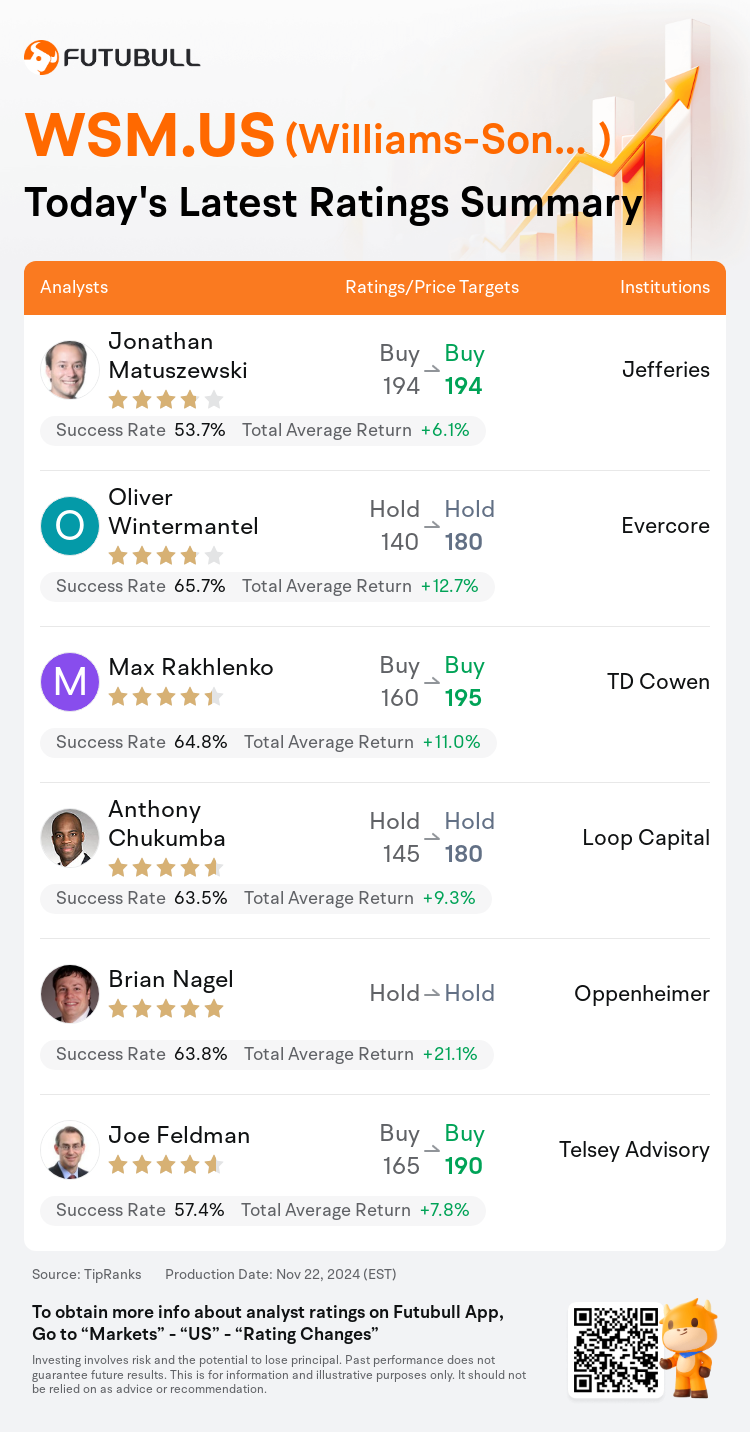

On Nov 22, major Wall Street analysts update their ratings for $Williams-Sonoma (WSM.US)$, with price targets ranging from $180 to $195.

Jefferies analyst Jonathan Matuszewski maintains with a buy rating, and maintains the target price at $194.

Evercore analyst Oliver Wintermantel maintains with a hold rating, and adjusts the target price from $140 to $180.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and adjusts the target price from $160 to $195.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and adjusts the target price from $160 to $195.

Loop Capital analyst Anthony Chukumba maintains with a hold rating, and adjusts the target price from $145 to $180.

Oppenheimer analyst Brian Nagel maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Williams-Sonoma (WSM.US)$'s main analysts recently are as follows:

After announcing Q3 results that exceeded expectations on both revenue and earnings fronts and upgrading its forecast for FY25 revenue and operating margins, analysis suggests a balanced risk/reward scenario for Williams-Sonoma. This view is based on the offsetting forces of subdued housing turnover and macroeconomic uncertainties against the advantages of market share gains and operating margins that surpass those seen before the pandemic.

It has been noted that Williams-Sonoma's sales exhibited a modest sequential improvement, yet the multi-year growth rates are persistently decelerating. Combined with the uncertainties in the housing market, this trend makes it challenging to anticipate a positive shift in the near future.

Visibility into a category inflection remains limited, yet increased 'newness' is expected to maintain at least stable top-line performance. Although margin comparisons are becoming more challenging, management appears to have sufficient flexibility to maintain a mid-to-high teens operating margin.

Williams-Sonoma has seen its stock increase by over 70% year-to-date following continued improvements in sales trends, market share gains, and strong profitability. The stock's current market multiple exceeds its typical range, viewed as justified considering its elevated and stable margins and promising prospects for recovering comparative sales in 2025. The attractiveness of Williams-Sonoma could become even more apparent with the broader recovery in the big-ticket and discretionary Home Furnishing sectors.

Williams-Sonoma's recent third-quarter results surpassed expectations, highlighting the success of management's strategy to reduce promotions, which contributed to a robust market response.

Here are the latest investment ratings and price targets for $Williams-Sonoma (WSM.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

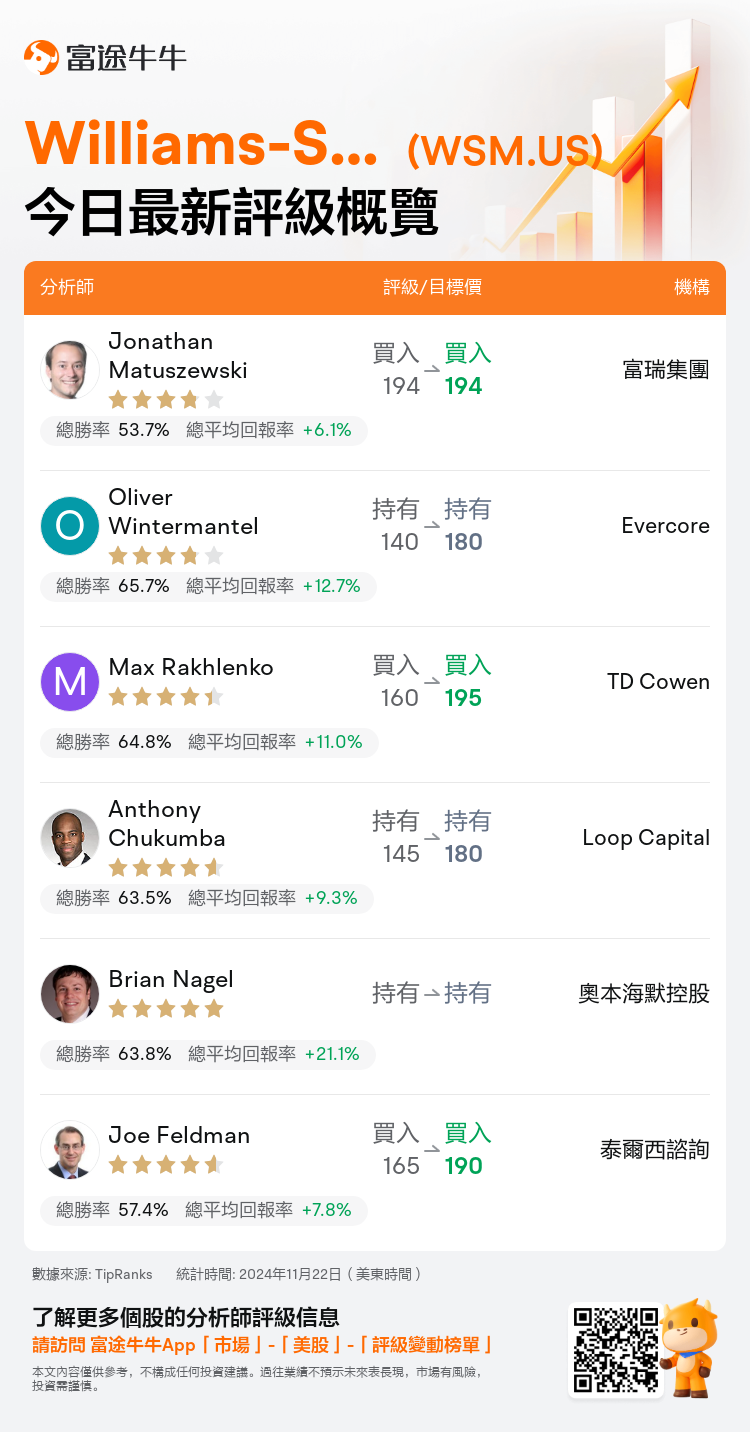

美東時間11月22日,多家華爾街大行更新了$Williams-Sonoma (WSM.US)$的評級,目標價介於180美元至195美元。

富瑞集團分析師Jonathan Matuszewski維持買入評級,維持目標價194美元。

Evercore分析師Oliver Wintermantel維持持有評級,並將目標價從140美元上調至180美元。

TD Cowen分析師Max Rakhlenko維持買入評級,並將目標價從160美元上調至195美元。

TD Cowen分析師Max Rakhlenko維持買入評級,並將目標價從160美元上調至195美元。

Loop Capital分析師Anthony Chukumba維持持有評級,並將目標價從145美元上調至180美元。

奧本海默控股分析師Brian Nagel維持持有評級。

此外,綜合報道,$Williams-Sonoma (WSM.US)$近期主要分析師觀點如下:

在宣佈第三季度超過預期的營收和盈利數據,並提升FY25年度營業收入和營業利潤率預測後,分析表明williams-sonoma面臨着平衡風險/回報的情景。這一觀點是基於房屋交易疲軟和宏觀經濟不確定性的抵消力量,對比市場份額增長和超過疫情前水平的營業利潤率的優勢。

據指出,williams-sonoma的銷售呈現出逐步改善的跡象,但多年增長率持續放緩。加上房地產市場的不確定性,這一趨勢使得難以預料在不久的將來會有積極的變化。

對類別拐點的可見性仍然有限,但預計'新穎性'的增加將至少維持穩定的營收表現。儘管邊際比較越來越具有挑戰性,管理層似乎有足夠的靈活性來維持一箇中到高青少年的營業利潤率。

williams-sonoma的股價在今年以來已經增長超過70%,這源於銷售趨勢持續改善、市場份額增長和強勁的盈利能力。股票目前的市場倍數超過了其典型的區間,被認爲是合理的,考慮到其提升且穩定的利潤率及2025年恢復比較銷售的前景。williams-sonoma的吸引力可能隨着大件和自由選購家居裝飾板塊的更廣泛復甦變得更爲明顯。

williams-sonoma最近的第三季度業績超出預期,突顯了管理層減少促銷活動的策略取得成功,這有助於引發了市場的積極反應。

以下爲今日6位分析師對$Williams-Sonoma (WSM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Max Rakhlenko維持買入評級,並將目標價從160美元上調至195美元。

TD Cowen分析師Max Rakhlenko維持買入評級,並將目標價從160美元上調至195美元。

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and adjusts the target price from $160 to $195.

TD Cowen analyst Max Rakhlenko maintains with a buy rating, and adjusts the target price from $160 to $195.