Looking At Workday's Recent Unusual Options Activity

Looking At Workday's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Workday (NASDAQ:WDAY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDAY usually suggests something big is about to happen.

有實力的投資者已經採取了看好的方式對待Workday(納斯達克:WDAY),這是市場參與者不應忽視的事情。我們在Benzinga跟蹤公開期權記錄揭示了今天這一重大舉措。這些投資者的身份仍然是未知的,但在WDAY發生如此重大的舉動通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Workday. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當時Benzinga的期權掃描儀突出了9項非凡的期權活動。這個活動水平非常不尋常。

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 33% bearish. Among these notable options, 2 are puts, totaling $244,664, and 7 are calls, amounting to $284,340.

這些重量級投資者的整體情緒是分裂的,其中66%看好,33%看淡。在這些顯著的期權中,有2個是看跌,總計爲244,664美元,7個是看漲,總計爲284,340美元。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $282.5 for Workday over the recent three months.

根據交易活動,看來這些重要投資者的目標價格區間是220.0美元到282.5美元,針對Workday在最近三個月的表現。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

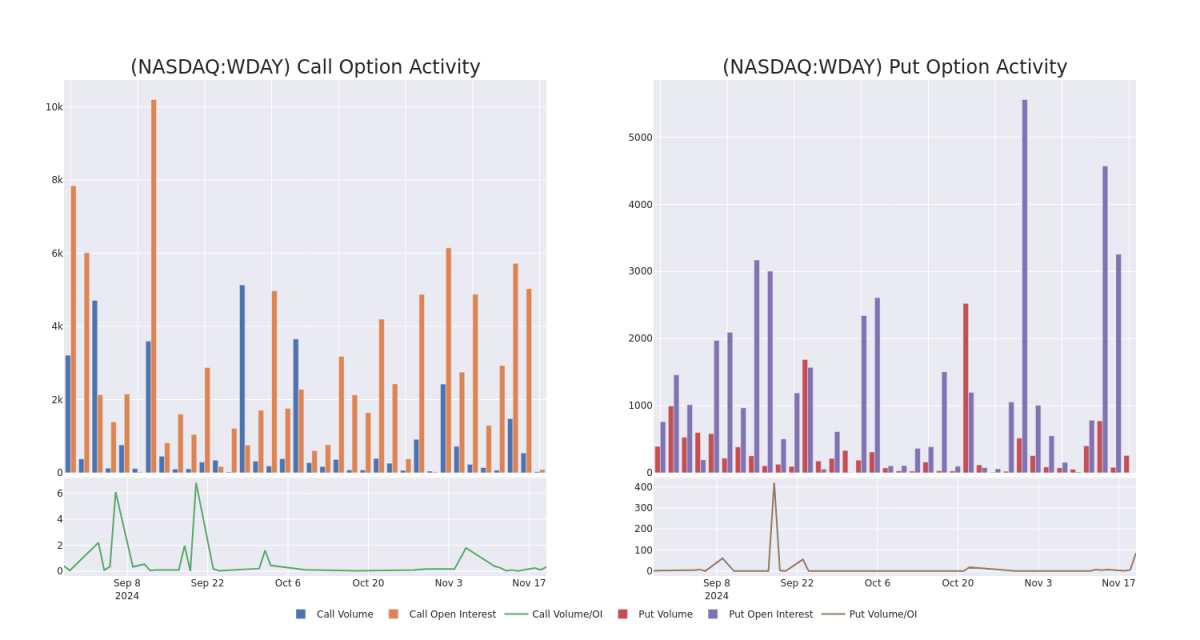

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Workday's options for a given strike price.

這些數據可以幫助您追蹤給定行權價格的Workday期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale activity within a strike price range from $220.0 to $282.5 in the last 30 days.

在下面,我們可以觀察到過去30天內,工作日的鯨魚活動中,所有看漲和看跌的成交量和未平倉合約的演變,行權價區間爲220.0美元到282.5美元。

Workday Call and Put Volume: 30-Day Overview

工作日看漲和看跌成交量:30天概述

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | PUT | SWEEP | BULLISH | 12/27/24 | $2.2 | $1.8 | $1.9 | $220.00 | $189.0K | 0 | 0 |

| WDAY | PUT | SWEEP | BULLISH | 12/20/24 | $1.75 | $1.7 | $1.7 | $220.00 | $55.6K | 587 | 275 |

| WDAY | CALL | TRADE | BULLISH | 12/20/24 | $10.3 | $9.9 | $10.2 | $280.00 | $50.9K | 751 | 101 |

| WDAY | CALL | TRADE | BEARISH | 12/20/24 | $9.4 | $9.1 | $9.1 | $280.00 | $45.5K | 751 | 51 |

| WDAY | CALL | TRADE | BULLISH | 12/20/24 | $8.0 | $7.7 | $7.9 | $282.50 | $42.6K | 1 | 54 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | 看跌 | SWEEP | BULLISH | 12/27/24 | $2.2 | $1.8 | $1.9 | $220.00 | 189,000美元 | 0 | 0 |

| WDAY | 看跌 | SWEEP | BULLISH | 12/20/24 | $1.75 | $1.7 | $1.7 | $220.00 | $55.6K | 587 | 275 |

| WDAY | 看漲 | 交易 | BULLISH | 12/20/24 | $10.3 | $9.9 | $10.2 | $280.00 | $50.9K | 751 | 101 |

| WDAY | 看漲 | 交易 | 看淡 | 12/20/24 | $9.4 | $9.1 | $9.1 | $280.00 | $45.5K | 751 | 51 |

| WDAY | 看漲 | 交易 | BULLISH | 12/20/24 | $8.0 | $7.7 | $7.9 | $282.50 | $42.6K | 1 | 54 |

About Workday

關於Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Workday是一家提供人力資本管理、財務管理和業務規劃解決方案的軟件公司。Workday以雲計算軟件提供商而聞名,總部位於加利福尼亞州普萊森頓。該公司成立於2005年,現有員工超過18,000人。

After a thorough review of the options trading surrounding Workday, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對Workday周圍的期權交易進行了全面審查,我們轉而對該公司進行更詳細的研究。這包括對其當前市場狀況和表現的評估。

Current Position of Workday

Workday的當前位置

- With a volume of 937,628, the price of WDAY is up 1.34% at $262.92.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 5 days.

- WDAY的成交量爲937,628,價格上漲1.34%,現爲$262.92。

- RSI指標暗示該股票可能要超買了。

- 下一次收益預計將在5天發佈。

What The Experts Say On Workday

關於Workday,專家怎麼說

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $305.0.

在過去30天內,2位專業分析師對這隻股票給出了他們的看法,設定了平均目標價爲$305.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Scotiabank lowers its rating to Sector Outperform with a new price target of $340.* An analyst from Loop Capital persists with their Hold rating on Workday, maintaining a target price of $270.

一位有20年經驗的期權交易員透露了他的單行圖技術,顯示何時買入和賣出。複製他的交易,這些交易在每20天內平均獲得27%的利潤。點擊這裏獲取訪問權限。* 反映出擔憂,一位來自斯科舍銀行的分析師將其評級下調至板塊表現優於市場,並設定新的目標價爲$340。* 來自Loop Capital的分析師繼續持有Workday的持有評級,維持目標價爲$270。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Workday options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。聰明的交易者通過不斷自我教育、調整策略、監控多個因子以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時提醒,保持對最新Workday期權交易的了解。

譯文內容由第三人軟體翻譯。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $282.5 for Workday over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $282.5 for Workday over the recent three months.