Unpacking the Latest Options Trading Trends in Moderna

Unpacking the Latest Options Trading Trends in Moderna

Whales with a lot of money to spend have taken a noticeably bearish stance on Moderna.

擁有大量資金的鯨魚已在Moderna方面採取了明顯的看淡態度。

Looking at options history for Moderna (NASDAQ:MRNA) we detected 37 trades.

查看moderna(納斯達克:MRNA)的期權歷史,我們發現了37筆交易。

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 59% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,32%的投資者持有看漲期望,而59%持有看跌期望。

From the overall spotted trades, 19 are puts, for a total amount of $1,152,330 and 18, calls, for a total amount of $1,026,287.

在所有發現的交易中,有19個看跌期權,總金額爲$1,152,330,18個看漲期權,總金額爲$1,026,287。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $300.0 for Moderna over the recent three months.

根據交易活動情況,顯然重要的投資者的目標是moderna在最近三個月內價格範圍從$30.0到$300.0之間。

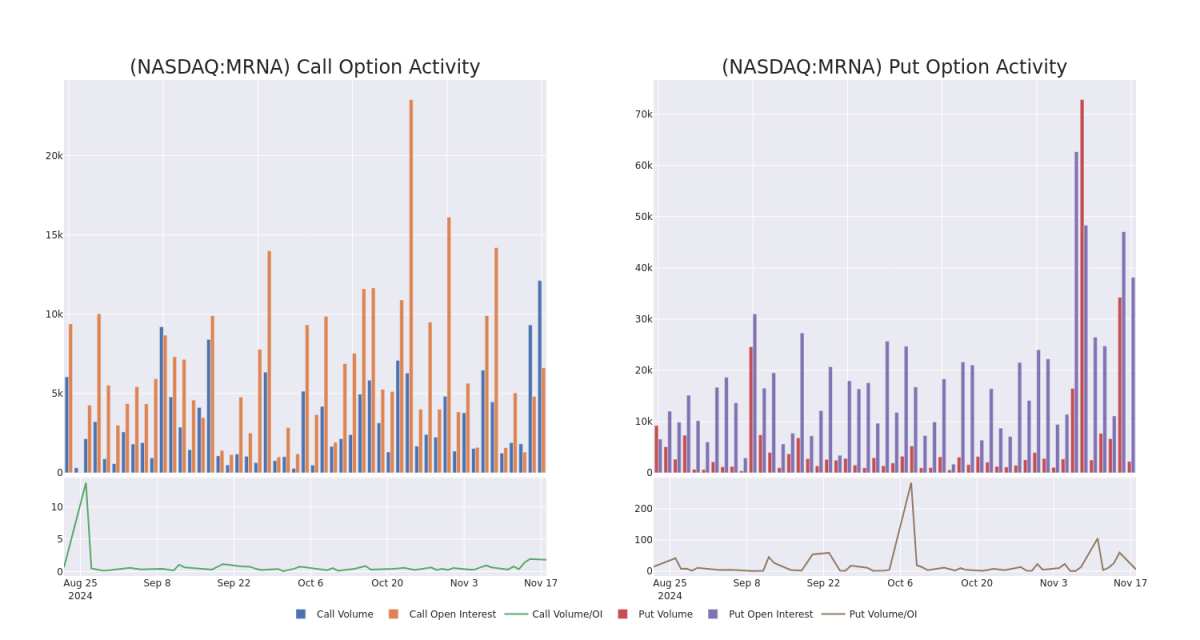

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Moderna's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Moderna's significant trades, within a strike price range of $30.0 to $300.0, over the past month.

檢查成交量和未平倉合約量對股票研究提供關鍵洞察。這些信息對評估特定行權價位下moderna期權的流動性和興趣水平至關重要。以下是我們針對過去一個月內moderna的重要交易的看漲期權和看跌期權在$30.0至$300.0行權價範圍內成交量和未平倉量趨勢的快照。

Moderna Option Volume And Open Interest Over Last 30 Days

Moderna過去30天內的期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.35 | $3.35 | $40.00 | $169.5K | 1.3K | 1.0K |

| MRNA | PUT | TRADE | BULLISH | 06/20/25 | $34.95 | $33.8 | $33.8 | $70.00 | $168.9K | 1.0K | 50 |

| MRNA | PUT | SWEEP | BULLISH | 04/17/25 | $24.05 | $24.0 | $24.05 | $60.00 | $137.0K | 1.1K | 59 |

| MRNA | CALL | SWEEP | BEARISH | 04/17/25 | $6.3 | $6.2 | $6.21 | $45.00 | $124.0K | 733 | 389 |

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.35 | $3.3 | $3.3 | $40.00 | $113.1K | 1.3K | 344 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| moderna | 看漲 | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.35 | $3.35 | $40.00 | $169.5千美元 | 1.3千 | 1.0千 |

| moderna | 看跌 | 交易 | BULLISH | 06/20/25 | $34.95 | $33.8 | $33.8 | $70.00 | 168.9K | 1.0千 | 50 |

| moderna | 看跌 | SWEEP | BULLISH | 04/17/25 | $24.05 | $24.0 | $24.05 | $60.00 | $137.0K | 1.1K | 59 |

| moderna | 看漲 | SWEEP | 看淡 | 04/17/25 | $6.3 | $6.2 | $6.21 | $45.00 | $124.0K | 733 | 389 |

| moderna | 看漲 | SWEEP | BULLISH | 12/20/24 | $3.35 | $3.3 | $3.3 | $40.00 | $113.1K | 1.3千 | 344 |

About Moderna

關於現代

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Moderna是一家創建於2010年的商業化生物科技公司,於2018年12月首次公開發行。該公司的mRNA技術通過其新冠疫苗得到快速驗證,該疫苗於2020年12月獲得美國授權。截至2024年9月,Moderna在臨床開發中有40個mRNA開發候選項目,涵蓋傳染病、腫瘤學、心血管疾病和罕見遺傳病等廣泛療法領域。

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了moderna的期權交易模式之後,我們的注意力現在直接轉向該公司。這種轉變使我們能夠深入了解其當前的市場地位和表現

Current Position of Moderna

Moderna現有狀態

- Trading volume stands at 5,807,278, with MRNA's price down by -4.83%, positioned at $37.6.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 93 days.

- 交易成交量爲5,807,278股,MRNA的價格下跌了-4.83%,定位在37.6美元。

- RSI指標顯示該股票可能已被超賣。

- 預計93天后公佈收益報告。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 19 are puts, for a total amount of $1,152,330 and 18, calls, for a total amount of $1,026,287.

From the overall spotted trades, 19 are puts, for a total amount of $1,152,330 and 18, calls, for a total amount of $1,026,287.