Spotlight on JPMorgan Chase: Analyzing the Surge in Options Activity

Spotlight on JPMorgan Chase: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on JPMorgan Chase.

資金雄厚的大鱷對摩根大通採取了明顯看好的立場。

Looking at options history for JPMorgan Chase (NYSE:JPM) we detected 44 trades.

查看摩根大通(紐交所:JPM)的期權歷史,我們發現有44筆交易。

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 36% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說38%的投資者以看好的預期進行交易,而36%則是看淡的。

From the overall spotted trades, 18 are puts, for a total amount of $1,479,655 and 26, calls, for a total amount of $4,497,476.

從所有發現的交易中,有18個看跌期權,總金額爲1,479,655美元,26個看漲期權,總金額爲4,497,476美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $300.0 for JPMorgan Chase during the past quarter.

分析這些合約的成交量和未平倉合約,似乎大資金玩家在過去一個季度內密切關注摩根大通的價格區間在130.0美元到300.0美元之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

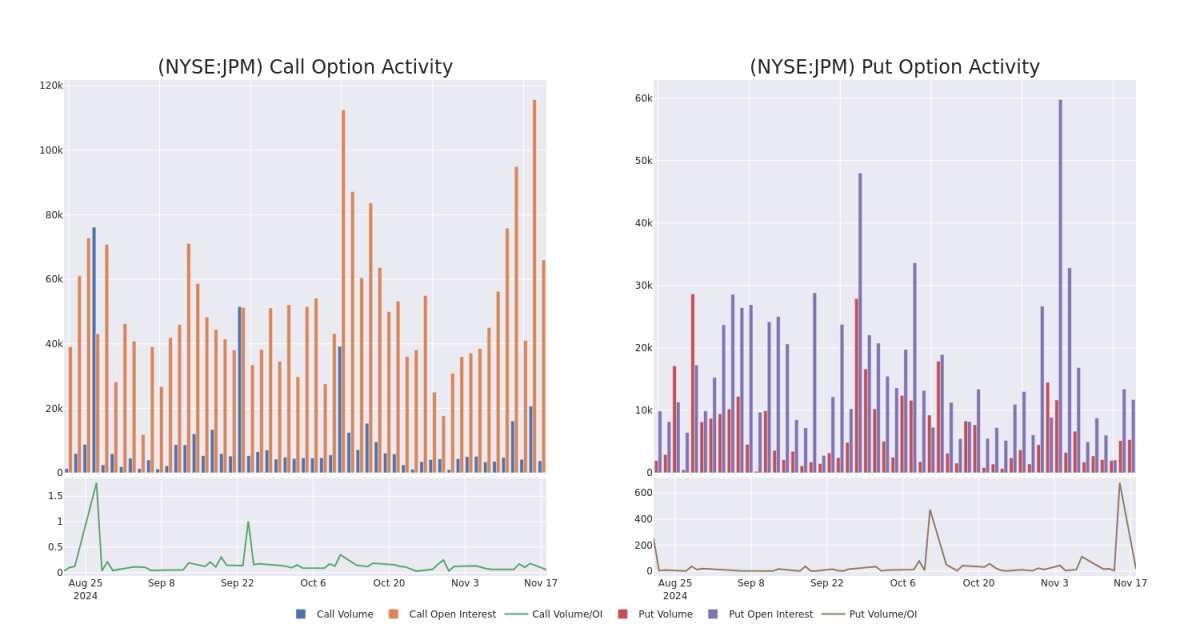

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for JPMorgan Chase's options for a given strike price.

這些數據可以幫助您在給定的行權價上跟蹤摩根大通期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JPMorgan Chase's whale activity within a strike price range from $130.0 to $300.0 in the last 30 days.

以下,我們可以觀察到過去30天內,摩根大通的鯨魚活動在$130.0到$300.0的行使價區間內,看漲期權和看跌期權的成交量和未平倉合約的變化。

JPMorgan Chase Option Volume And Open Interest Over Last 30 Days

摩根大通在過去30天內的期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | BULLISH | 01/16/26 | $57.25 | $56.45 | $57.6 | $200.00 | $2.8M | 4.2K | 502 |

| JPM | PUT | TRADE | BEARISH | 01/16/26 | $7.9 | $7.65 | $7.9 | $200.00 | $395.0K | 5.5K | 500 |

| JPM | PUT | TRADE | BEARISH | 01/16/26 | $6.1 | $5.9 | $6.1 | $190.00 | $305.0K | 3.8K | 500 |

| JPM | CALL | TRADE | BEARISH | 12/20/24 | $4.25 | $4.15 | $4.15 | $250.00 | $207.5K | 6.8K | 1.1K |

| JPM | CALL | SWEEP | NEUTRAL | 01/17/25 | $22.85 | $22.6 | $22.67 | $225.00 | $188.3K | 2.5K | 86 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 摩根大通 | 看漲 | 交易 | BULLISH | 01/16/26 | $57.25 | $56.45 | 5760萬美元 | $200.00 | 2.8百萬美元 | 4.2千 | 502 |

| 摩根大通 | 看跌 | 交易 | 看淡 | 01/16/26 | $7.9 | $7.65 | $7.9 | $200.00 | $395.0K | 5.5K | 500 |

| 摩根大通 | 看跌 | 交易 | 看淡 | 01/16/26 | $6.1 | $5.9 | $6.1 | $190.00 | $305.0K | 3.8K | 500 |

| 摩根大通 | 看漲 | 交易 | 看淡 | 12/20/24 | $4.25 | $4.15 | $4.15 | $250.00 | $207.5K | 6.8K | 1.1K |

| 摩根大通 | 看漲 | SWEEP | 中立 | 01/17/25 | $22.85 | $22.6 | $22.67 | $225.00 | 188.3千美元 | 2.5K | 86 |

About JPMorgan Chase

關於摩根大通

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

摩根大通是美國最大、最複雜的金融機構之一,擁有近4.1萬億美元的資產。它分爲四個主要板塊——消費和社區銀行業務、公司和投資銀行業務、商業銀行業務和資產和财富管理。摩根大通在多個國家運營並受到監管。

Present Market Standing of JPMorgan Chase

JP摩根大通的現在市場狀況

- Trading volume stands at 4,827,830, with JPM's price down by -0.05%, positioned at $245.2.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 58 days.

- 交易成交量爲4,827,830,摩根大通的價格下跌了-0.05%,當前價格爲$245.2。

- RSI指標顯示該股票可能接近超買。

- 預計在58天內公佈收益報告。

Professional Analyst Ratings for JPMorgan Chase

摩根大通的專業分析師評級

In the last month, 2 experts released ratings on this stock with an average target price of $255.5.

在上個月,有2位專家對該股票發佈了評級,平均目標價爲$255.5。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for JPMorgan Chase, targeting a price of $241. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for JPMorgan Chase, targeting a price of $270.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取訪問權限。* 持有看好評級的分析師來自Oppenheimer,繼續對摩根大通保持看好,目標價爲$241。* 持有超配評級的分析師來自Wells Fargo,繼續對摩根大通保持超配,目標價爲$270。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JPMorgan Chase with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續的教育、戰略性交易調整、利用各種因子,並保持對市場動態的關注來減輕這些風險。通過Benzinga Pro及時警報,了解摩根大通的最新期權交易。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 18 are puts, for a total amount of $1,479,655 and 26, calls, for a total amount of $4,497,476.

From the overall spotted trades, 18 are puts, for a total amount of $1,479,655 and 26, calls, for a total amount of $4,497,476.