Looking At Snowflake's Recent Unusual Options Activity

Looking At Snowflake's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Snowflake (NYSE:SNOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNOW usually suggests something big is about to happen.

資金充裕的投資者對Snowflake(NYSE:SNOW)採取了看淡的態度,市場參與者不應忽視這一點。我們在Benzinga跟蹤公開期權記錄時發現了這一重大舉動。這些投資者的身份仍然是未知的,但是在SNOW發生如此大的變動通常意味着即將發生一些重要的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 86 extraordinary options activities for Snowflake. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當Benzinga的期權掃描器強調了Snowflake的86項非同尋常的期權活動。這種活動水平超出了尋常。

The general mood among these heavyweight investors is divided, with 39% leaning bullish and 52% bearish. Among these notable options, 62 are puts, totaling $2,880,105, and 24 are calls, amounting to $1,076,331.

這些重量級投資者中的普遍情緒存在分歧,39%傾向於看好,52%看淡。在這些顯著的期權中,有62個看跌,總額爲$2,880,105,有24個看漲,總額爲$1,076,331。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $200.0 for Snowflake, spanning the last three months.

經過評估交易量和未平倉合約量,很明顯主要市場搬弄是專注於Snowflake的股價區間在$80.0和$200.0之間,跨越了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

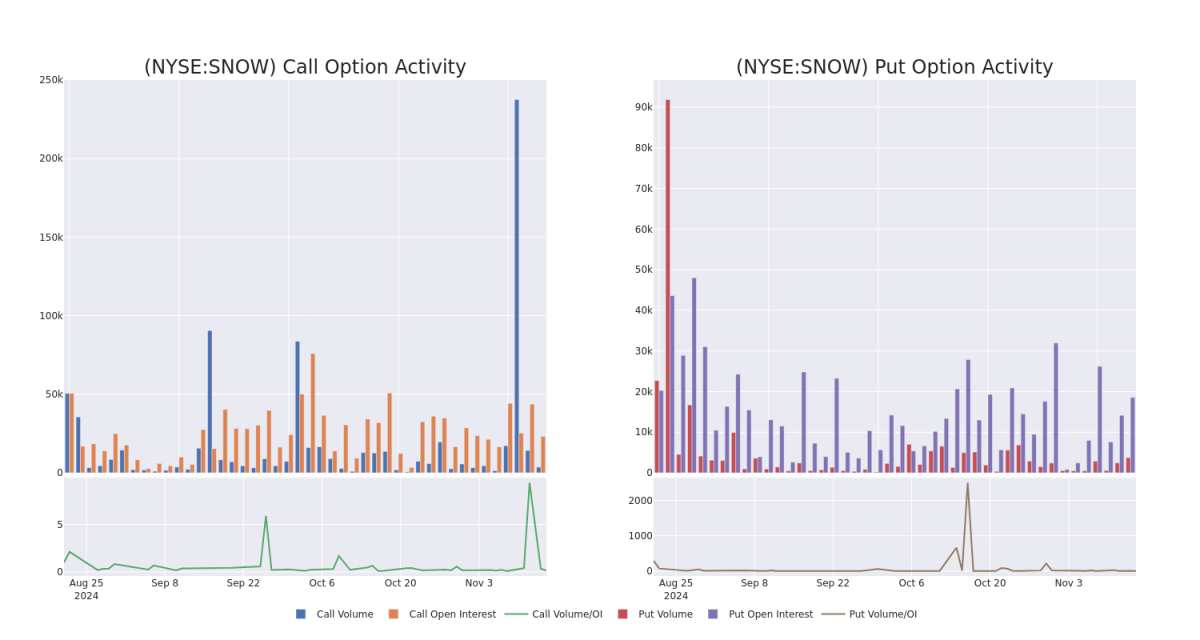

In today's trading context, the average open interest for options of Snowflake stands at 930.06, with a total volume reaching 10,549.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $80.0 to $200.0, throughout the last 30 days.

在今天的交易情境中,Snowflake期權的平均未平倉合約量爲930.06,總成交量達到10,549.00。隨附的圖表描述了Snowflake的高價值交易的看漲和看跌期權成交量和未平倉合約量的發展,位於從$80.0到$200.0的行權價走廊中,貫穿了過去30天。

Snowflake Option Activity Analysis: Last 30 Days

Snowflake期權活動分析:最近30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | PUT | TRADE | BEARISH | 12/20/24 | $43.95 | $43.8 | $43.95 | $170.00 | $127.4K | 5 | 29 |

| SNOW | PUT | TRADE | BULLISH | 02/21/25 | $14.05 | $14.0 | $14.0 | $130.00 | $106.4K | 509 | 164 |

| SNOW | CALL | SWEEP | BULLISH | 01/17/25 | $2.56 | $2.5 | $2.56 | $160.00 | $102.4K | 3.2K | 533 |

| SNOW | PUT | SWEEP | NEUTRAL | 01/17/25 | $19.3 | $19.25 | $19.25 | $140.00 | $88.6K | 1.8K | 98 |

| SNOW | PUT | SWEEP | BEARISH | 11/22/24 | $4.9 | $4.85 | $4.9 | $122.00 | $79.3K | 211 | 197 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| snowflake | 看跌 | 交易 | 看淡 | 12/20/24 | $43.95 | $43.8 | $43.95 | $170.00 | $127.4K | 5 | 29 |

| snowflake | 看跌 | 交易 | BULLISH | 02/21/25 | 14.05美元 | $14.0 | $14.0 | $130.00 | $106.4K | 509 | 164 |

| snowflake | 看漲 | SWEEP | BULLISH | 01/17/25 | $2.56 | $2.5 | $2.56 | $160.00 | $102.4K | 3.2千 | 533 |

| snowflake | 看跌 | SWEEP | 中立 | 01/17/25 | $19.3 | $19.25 | $19.25 | $140.00 | $88.6K | 1.8K | 98 |

| snowflake | 看跌 | SWEEP | 看淡 | 11/22/24 | $4.9 | $4.85 | $4.9 | $122.00 | $79.3K | 211 | 197 |

About Snowflake

關於Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Snowflake成立於2012年,是一家數據湖,數據倉庫和共享公司,於2020年上市。到目前爲止,該公司擁有超過3000個客戶,其中近30%是財富500強客戶。Snowflake的數據湖存儲非結構化和半結構化數據,然後可用於分析,創建存儲在其數據倉庫中的見解。Snowflake的數據共享功能使企業可以輕鬆購買和攝取數據,而傳統方式需要數月時間。總的來說,該公司以其數據解決方案可以託管在各種公共雲中而聞名。

Having examined the options trading patterns of Snowflake, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對Snowflake期權交易模式的研究,我們現在將重點轉向該公司。這個轉變讓我們深入了解它的現有市場地位和業績。

Where Is Snowflake Standing Right Now?

雪花現在的情況如何?

- Trading volume stands at 3,071,577, with SNOW's price up by 0.63%, positioned at $126.75.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 2 days.

- 交易量爲3,071,577,SNOW的價格上漲了0.63%,位於126.75美元。

- RSI指標顯示該股票可能接近超買。

- 預計在2天內公佈收益報告。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.

期權交易帶來了更高的風險和潛在回報。聰明的交易者通過不斷學習、調整策略、監控多種因子和密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報了解最新的Snowflake期權交易情況。

譯文內容由第三人軟體翻譯。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $200.0 for Snowflake, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $200.0 for Snowflake, spanning the last three months.