Adobe Options Trading: A Deep Dive Into Market Sentiment

Adobe Options Trading: A Deep Dive Into Market Sentiment

High-rolling investors have positioned themselves bearish on Adobe (NASDAQ:ADBE), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ADBE often signals that someone has privileged information.

大額投資者在adobe(納斯達克:ADBE)上採取了看淡的立場,零售交易者需對此引起注意。\今天,我們通過Benzinga對公開可用期權數據的跟蹤注意到了這一活動。這些投資者的身份尚不明確,但ADBE的如此重大舉動通常意味着有些人掌握了內部信息。

Today, Benzinga's options scanner spotted 9 options trades for Adobe. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現了9筆adobe的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 22% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $109,500, and 8 calls, totaling $702,999.

這些主要交易者的情緒呈現分歧,其中22%看好,55%看淡。在我們確定的所有期權中,有一筆看跌期權,金額爲109,500美元,還有8筆看漲期權,總計702,999美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $440.0 and $570.0 for Adobe, spanning the last three months.

通過評估交易成交量和未平倉合約,我們可以明顯看到主要市場參與者關注adobe的價格區間在440.0美元到570.0美元之間,持續了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

In terms of liquidity and interest, the mean open interest for Adobe options trades today is 407.38 with a total volume of 771.00.

在流動性和興趣方面,今天adobe期權交易的平均未平倉合約爲407.38,總成交量爲771.00。

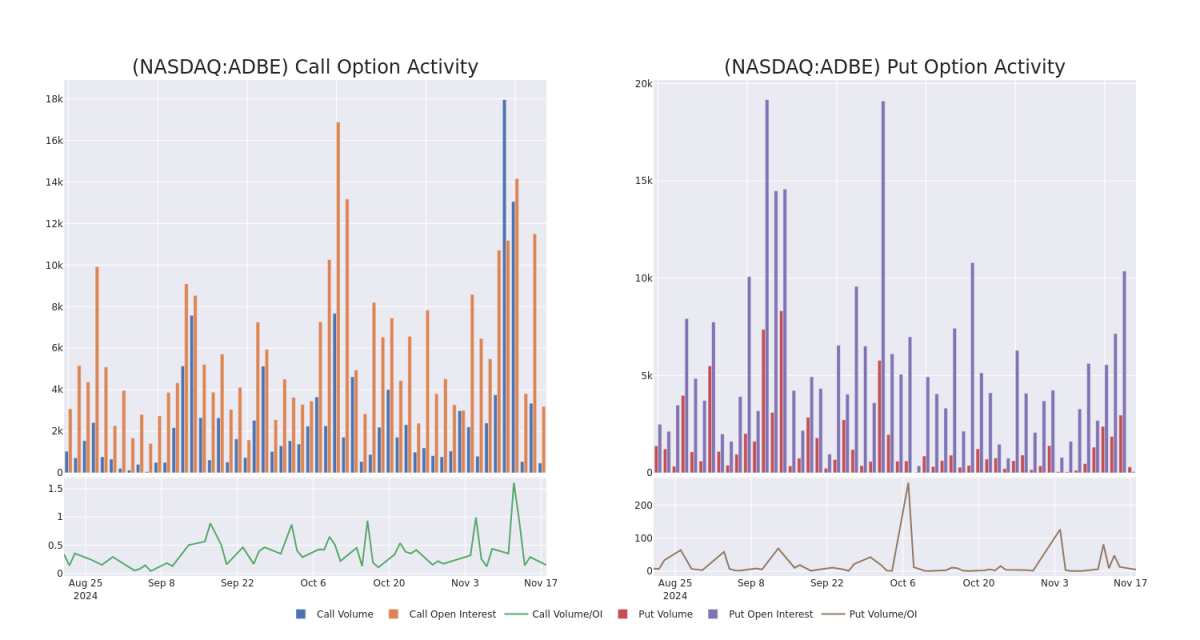

In the following chart, we are able to follow the development of volume and open interest of call and put options for Adobe's big money trades within a strike price range of $440.0 to $570.0 over the last 30 days.

在下圖中,我們能夠跟蹤過去30天內adobe大手交易的看漲和看跌期權的成交量和未平倉合約的發展,行使價格區間爲440.0美元到570.0美元。

Adobe Option Volume And Open Interest Over Last 30 Days

adobe 期權成交量和未平倉合約在過去30天內的情況

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | CALL | SWEEP | BULLISH | 01/17/25 | $22.0 | $21.75 | $22.0 | $525.00 | $244.2K | 359 | 0 |

| ADBE | CALL | TRADE | BEARISH | 12/20/24 | $21.85 | $17.35 | $17.4 | $520.00 | $173.9K | 547 | 100 |

| ADBE | PUT | TRADE | NEUTRAL | 11/22/24 | $4.25 | $2.83 | $3.65 | $492.50 | $109.5K | 63 | 300 |

| ADBE | CALL | TRADE | NEUTRAL | 06/18/26 | $141.4 | $133.0 | $137.17 | $440.00 | $68.5K | 435 | 2 |

| ADBE | CALL | SWEEP | BEARISH | 12/20/24 | $28.3 | $27.5 | $27.5 | $500.00 | $55.0K | 932 | 22 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| adobe | 看漲 | SWEEP | BULLISH | 01/17/25 | $22.0 | $21.75 | $22.0 | 525.00美元 | 244.2K美元 | 359 | 0 |

| adobe | 看漲 | 交易 | 看淡 | 12/20/24 | $21.85 | $17.35 | $17.4 | $520.00 | $173.9K | 547 | 100 |

| adobe | 看跌 | 交易 | 中立 | 11/22/24 | $4.25 | 2.83美元 | $3.65 | $492.50 | $109.5K | 63 | 300 |

| adobe | 看漲 | 交易 | 中立 | 06/18/26 | $141.4 | $84.8K | $137.17 | $440.00 | $68.5K | 435 | 2 |

| adobe | 看漲 | SWEEP | 看淡 | 12/20/24 | $28.3 | $27.5 | $27.5 | $500.00 | $55.0K | 932 | 22 |

About Adobe

關於Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe 提供內容創作、文檔管理和數字營銷和廣告軟件及服務,爲創意專業人士和營銷人員創建、管理、交付、衡量、優化和參與多種操作系統、設備和媒體的引人入勝的內容。公司有三個板塊:數字媒體內容創作、數字營銷解決方案的數字體驗和出版的傳統產品(營業收入不到 5%)。

After a thorough review of the options trading surrounding Adobe, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對Adobe周圍的期權交易進行全面審查之後,我們開始仔細研究該公司。這包括評估其當前的市場地位和業績。

Adobe's Current Market Status

Adobe當前市場狀況

- With a volume of 163,482, the price of ADBE is down -0.41% at $501.31.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 23 days.

- ADBE的成交量爲163,482,價格下跌了-0.41%,爲$501.31。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一次收益預計在23天內公佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $440.0 and $570.0 for Adobe, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $440.0 and $570.0 for Adobe, spanning the last three months.