Snap (NYSE:SNAP Shareholders Incur Further Losses as Stock Declines 12% This Week, Taking Three-year Losses to 79%

Snap (NYSE:SNAP Shareholders Incur Further Losses as Stock Declines 12% This Week, Taking Three-year Losses to 79%

While not a mind-blowing move, it is good to see that the Snap Inc. (NYSE:SNAP) share price has gained 12% in the last three months. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 79% in the last three years. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

雖然這並不是一個令人驚歎的舉動,但看到snap inc(紐交所:SNAP)股價在過去三個月上漲了12%還是令人高興的。 但在面對過去三年令人震驚的下跌時,這顯得微不足道。 實際上,股價在過去三年中暴跌了79%。 可以說,在如此巨大的下跌後,最近的反彈是意料之中的。 需要考慮的是這項業務是否真的好轉。

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

股票在過去一週內下跌了12%,值得關注業務表現,以便查看是否存在任何紅旗信號。

Snap wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

在過去十二個月中,snap並沒有實現盈利,因此我們不太可能看到其股價與每股收益(EPS)之間有強烈的關聯性。 可以說,營業收入是我們下一個最佳選擇。 一般來說,未盈利的公司每年都被期望能實現營業收入的增長,並且增長幅度相當可觀。 這是因爲快速的營業收入增長可以很容易地推測出盈利,往往規模可觀。

In the last three years, Snap saw its revenue grow by 7.0% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 21%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

在過去三年中,snap的營業收入每年複合增長7.0%。 鑑於其在追求增長的過程中虧損,我們對此並不太滿意。 儘管如此,可以公正地說,迅速下跌的股價(在三年內下降21%,複合)表明市場對這個增長水平非常失望。 雖然我們對這隻股票的表現確實感到謹慎,但經歷過這種表現後,可能是過度反應。 當然,營業收入的增長是不錯的,但一般來說,利潤越低,業務的風險越大——而這項業務並沒有產生穩定的利潤。

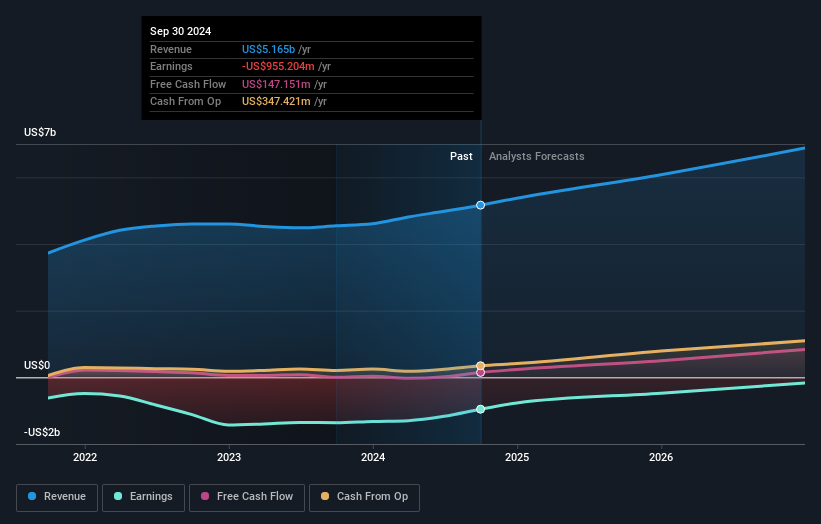

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

以下圖片顯示了收益和營收隨時間的變化(如果你點擊圖片,可以看到更詳細的信息)。

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Snap in this interactive graph of future profit estimates.

我們高興地報告,CEO的薪酬比大多數同類資本公司的CEO更爲適中。關注CEO薪酬始終是值得的,但一個更重要的問題是公司是否會在未來幾年中增長營業收入。您可以在這個互動圖表中查看分析師對snap inc未來利潤預估的預測。

A Different Perspective

另一種看法

While the broader market gained around 32% in the last year, Snap shareholders lost 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Snap you should be aware of.

雖然大盤在過去一年中上漲了約32%,但snap inc的股東卻損失了11%。即便是好的股票,有時股價也會下跌,但在我們過於關注之前,我們希望看到業務的基本指標改善。不幸的是,去年的表現可能表明仍然存在未解決的挑戰,因爲它比過去五年的年化損失5%還要糟糕。一般來說,長期股價疲軟可能是個壞兆頭,不過逆向投資者可能希望研究這隻股票,以期待反彈。我發現從長期來看觀察股價作爲業務表現的一個代理指標非常有趣。但要真正獲得洞見,我們還需要考慮其他的信息。值得注意的是:我們發現了1個您應該注意的snap inc的警告信號。

But note: Snap may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

但請注意:snap inc可能不是最好的買入股票。因此,看看這個免費的有過去盈利增長(以及進一步增長預測)的有趣公司的列表。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文所引述的市場回報反映了目前在美國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

In the last three years, Snap saw its revenue grow by 7.0% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 21%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

In the last three years, Snap saw its revenue grow by 7.0% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 21%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.