Don't Ignore The Insider Selling In Resideo Technologies

Don't Ignore The Insider Selling In Resideo Technologies

We wouldn't blame Resideo Technologies, Inc. (NYSE:REZI) shareholders if they were a little worried about the fact that Jay Geldmacher, the CEO, President & Director recently netted about US$1.0m selling shares at an average price of US$25.33. However, that sale only accounted for 6.6% of their holding, so arguably it doesn't say much about their conviction.

我们不会责怪resideo technologies股东们对CEO、总裁兼董事Jay Geldmacher最近以每股25.33美元的均价卖出股票获得了约100万美元感到有些担忧。然而,这次卖出仅占他们持股的6.6%,因此可以说这并不能完全说明他们的信念。

The Last 12 Months Of Insider Transactions At Resideo Technologies

在Resideo Technologies的过去12个月内的内部交易中,最大的内部卖出是由高级副总裁兼执行顾问Phillip Theodore进行的,价值US$329,000,每股约US$16.45。这意味着内部人士对股票进行了轻微的低于当前股价(US$20.15)的出售。作为一般规则,我们认为当内部人士以低于当前价格出售股票时,这是令人不鼓舞的,因为这意味着他们对较低的估值感到满意。虽然内部卖出并非积极的迹象,但我们不能确定它是否意味着内部人士认为股票已经完全定价,所以这只是一个微弱的迹象。这次单一的出售仅占Phillip Theodore所持股份的13%。

Notably, that recent sale by Jay Geldmacher is the biggest insider sale of Resideo Technologies shares that we've seen in the last year. So it's clear an insider wanted to take some cash off the table, even slightly below the current price of US$25.78. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 6.6% of Jay Geldmacher's holding.

值得注意的是,Jay Geldmacher最近的这笔交易是resideo technologies股票内部人士在过去一年中进行的最大规模交易。因此,很明显有内部人士想要在股价略低于25.78美元的当下提取一些现金。一般来说,如果公司内部人士一直在出售股票,尤其是以低于当前价格的价格进行交易,我们会认为这是个负面信号,因为这意味着他们认为较低价格是合理的。然而,虽然内部人士的卖出行为有时会让人泄气,但这只是一个弱信号。 值得注意的是,这次交易仅占Jay Geldmacher持股的6.6%。

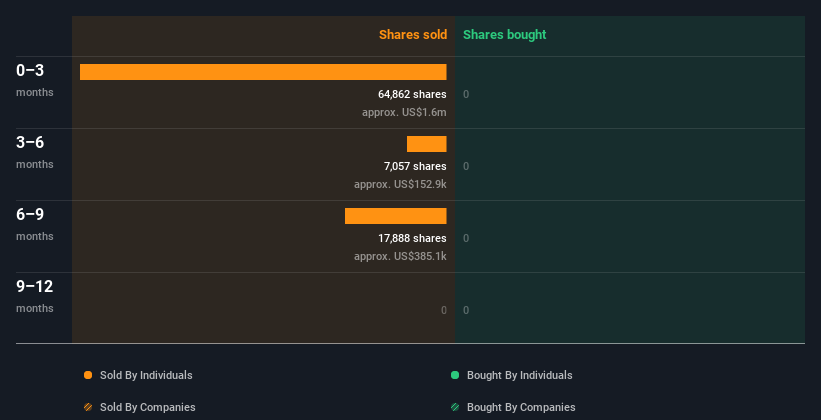

In the last year Resideo Technologies insiders didn't buy any company stock. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

在过去一年中,resideo technologies内部人士没有购买任何公司股票。您可以在下面的图表中查看过去一年内公司和个人的内部交易。如果您想准确了解谁以什么价格和何时出售了股票,只需点击下方的图表!

I will like Resideo Technologies better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

如果我看到一些大的内部买入,我会更喜欢resideo technologies。在等待的时候,看看这份免费的低估和小盘股票清单,其中包括相当多最近有内部人买入的股票。

Insider Ownership Of Resideo Technologies

Resideo Technologies内部股东所有权

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that Resideo Technologies insiders own 1.4% of the company, worth about US$54m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

许多投资者喜欢检查公司由内部人拥有多少股份。我认为如果内部人拥有该公司的显著数量股份是一个好迹象。看起来resideo technologies的内部人拥有公司的1.4%,价值约5400万美元。我们当然在其他地方看到更高水平的内部持股,但这些持股足以表明内部人和其他股东之间的一致性。

So What Do The Resideo Technologies Insider Transactions Indicate?

那么,Resideo Technologies内部交易究竟意味着什么?

Insiders haven't bought Resideo Technologies stock in the last three months, but there was some selling. Looking to the last twelve months, our data doesn't show any insider buying. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We're in no rush to buy! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To assist with this, we've discovered 3 warning signs that you should run your eye over to get a better picture of Resideo Technologies.

内部人在过去三个月内没有买入resideo technologies的股票,但有一些卖出。看过去十二个月,我们的数据没有显示任何内部买入。内部持股比例并不特别高,所以这份分析让我们对该公司感到谨慎。我们不急着买入!因此,这些内部交易可以帮助我们建立关于这支股票的论点,但了解这家公司面临的风险也很有必要。为了帮助您,我们发现了3个警示信号,您应该仔细研究,以更好地了解resideo technologies。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

当然,您可能会在其他地方找到一项出色的投资。因此,请查看此免费的有趣公司列表。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

对于本文而言,内部人是指向相关监管机构报告其交易的个人。我们目前仅考虑公开市场交易和直接利益的私人处置,但不包括衍生交易或间接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

译文内容由第三方软件翻译。

I will like Resideo Technologies better if I see some big insider buys. While we wait, check out this

I will like Resideo Technologies better if I see some big insider buys. While we wait, check out this