What the Options Market Tells Us About First Solar

What the Options Market Tells Us About First Solar

Investors with a lot of money to spend have taken a bullish stance on First Solar (NASDAQ:FSLR).

有很多資金的投資者對第一太陽能(納斯達克:FSLR)採取了看好的立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with FSLR, it often means somebody knows something is about to happen.

無論這些是機構還是富裕個人,我們並不清楚。但是當發生這麼大的事情時,通常意味着有人知道即將發生什麼。

Today, Benzinga's options scanner spotted 9 options trades for First Solar.

今天,Benzinga的期權掃描器發現了第一太陽能的9筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 77% bullish and 11%, bearish.

這些大手交易者的整體情緒分爲77%看漲和11%看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $41,340, and 8, calls, for a total amount of $548,992.

在我們發現的所有期權中,有1筆看跌,金額爲41,340美元,以及8筆看漲,金額共計548,992美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $180.0 to $300.0 for First Solar during the past quarter.

分析這些合約的成交量和持倉量,似乎大戶在過去一個季度一直關注第一太陽能的股價區間在$180.0到$300.0之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

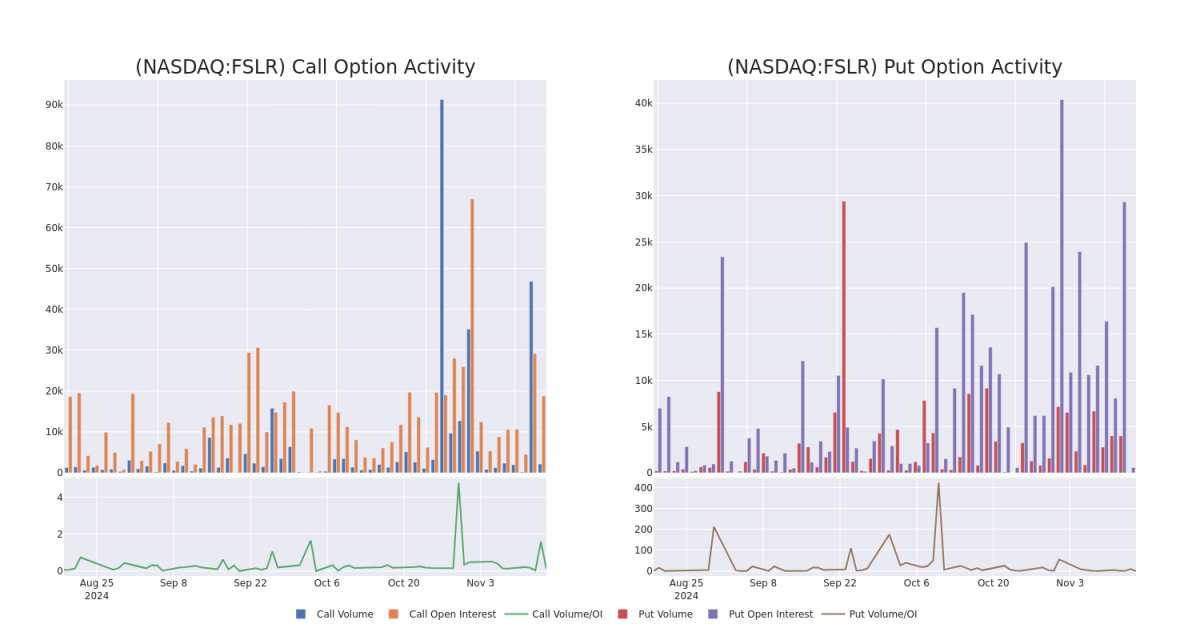

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for First Solar's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of First Solar's whale trades within a strike price range from $180.0 to $300.0 in the last 30 days.

在交易期權時,觀察成交量和持倉量是一個很有利的策略。這些數據可以幫助您追蹤第一太陽能期權在特定行權價格的流動性和利益。在下面,我們可以觀察過去30天內$180.0到$300.0這一行權價格區間內,對第一太陽能的看漲期權和看跌期權的成交量和持倉量的增長。

First Solar Option Volume And Open Interest Over Last 30 Days

第一太陽能期權成交量和持倉量過去30天的情況

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | CALL | TRADE | BULLISH | 06/20/25 | $9.4 | $6.7 | $8.4 | $300.00 | $126.0K | 3.7K | 158 |

| FSLR | CALL | TRADE | NEUTRAL | 06/20/25 | $9.35 | $7.65 | $8.4 | $300.00 | $124.3K | 3.7K | 306 |

| FSLR | CALL | SWEEP | BULLISH | 01/17/25 | $2.66 | $2.23 | $2.66 | $270.00 | $106.4K | 2.6K | 7 |

| FSLR | CALL | SWEEP | BULLISH | 11/29/24 | $6.7 | $6.5 | $6.7 | $207.50 | $80.9K | 400 | 187 |

| FSLR | PUT | SWEEP | BEARISH | 03/21/25 | $15.9 | $15.5 | $15.9 | $185.00 | $41.3K | 566 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 第一太陽能 | 看漲 | 交易 | BULLISH | 06/20/25 | $9.4 | $6.7 | $8.4 | $300.00 | $126.0K | 3.7千 | 158 |

| 第一太陽能 | 看漲 | 交易 | 中立 | 06/20/25 | $9.35 | $7.65 | $8.4 | $300.00 | 該成交筆數爲124.3K美元。 | 3.7千 | 306 |

| 第一太陽能 | 看漲 | SWEEP | BULLISH | 01/17/25 | $2.66 | $2.23 | $2.66 | $270.00 | $106.4K | 2.6千 | 7 |

| 第一太陽能 | 看漲 | SWEEP | BULLISH | 11/29/24 | $6.7 | $6.5 | $6.7 | $207.50 | $80.9K | 400 | 187 |

| 第一太陽能 | 看跌 | SWEEP | 看淡 | 03/21/25 | $15.9 | $15.5 | $15.9 | $185.00 | $41.3K | 566 | 30 |

About First Solar

關於第一太陽能

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company's solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world's largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

第一太陽能設計並製造用於大型電力開發項目的太陽能光伏板、模塊和系統。該公司的太陽能模塊採用鎘鎘硒將陽光轉換爲電力,這通常被稱爲薄膜技術。第一太陽能是世界上最大的薄膜太陽能模塊製造商,在越南、馬來西亞、美國和印度設有生產線。

After a thorough review of the options trading surrounding First Solar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對第一太陽能周圍期權交易的徹底審查,我們轉而更詳細地審查該公司。這包括對其當前市場地位和表現的評估。

Present Market Standing of First Solar

第一太陽能的現市場地位

- Trading volume stands at 1,148,637, with FSLR's price up by 2.1%, positioned at $199.23.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 102 days.

- 交易量爲1,148,637,FSLR的價格上漲2.1%,位於199.23美元。

- RSI指標顯示該股票可能接近超買。

- 預計在102天內發佈收入公告。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with FSLR, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with FSLR, it often means somebody knows something is about to happen.