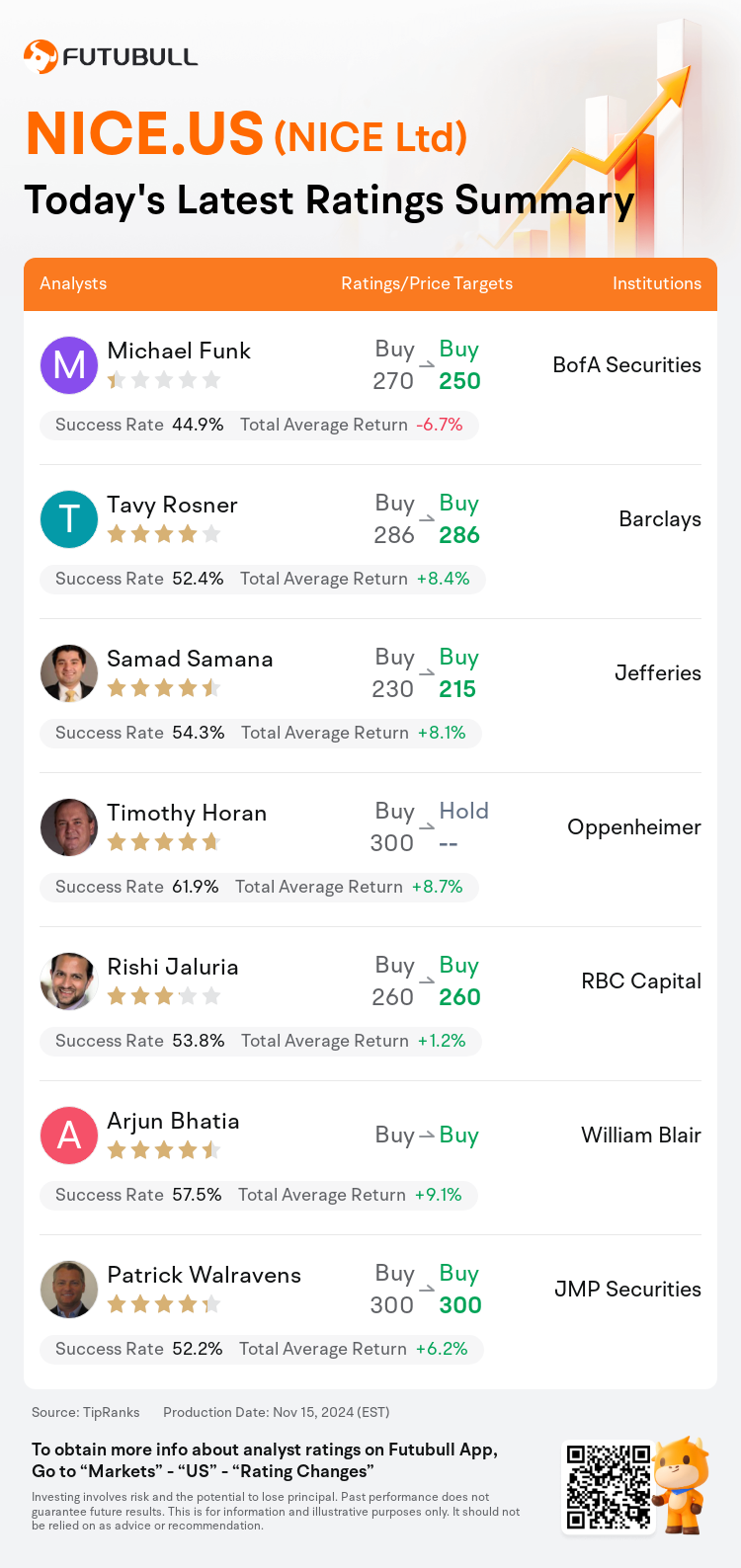

On Nov 15, major Wall Street analysts update their ratings for $NICE Ltd (NICE.US)$, with price targets ranging from $215 to $300.

BofA Securities analyst Michael Funk maintains with a buy rating, and adjusts the target price from $270 to $250.

Barclays analyst Tavy Rosner maintains with a buy rating, and maintains the target price at $286.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Oppenheimer analyst Timothy Horan downgrades to a hold rating.

RBC Capital analyst Rishi Jaluria maintains with a buy rating, and maintains the target price at $260.

Furthermore, according to the comprehensive report, the opinions of $NICE Ltd (NICE.US)$'s main analysts recently are as follows:

The company's third-quarter results slightly surpassed expectations on revenue but did not meet the anticipated growth in cloud revenue, which is a primary focus for investors. Moreover, the company's management has revised its forecast for organic cloud growth down to 16%-17% from the previous expectation of 18% for the year 2024. Despite these developments, the stock is still considered appealing due to its competitive stance, the expected uptick in Contact Center as a Service demand, and its current valuation.

Upon evaluating the Q3 results and anticipating a return to accelerated growth in Q4, it appears that there are more robust underlying business trends and pipeline narratives for Nice as compared to Zoom Video. The more positive outlook for Nice is based on research that has revealed a strong momentum in large-deal closures and an increase in competitive victories.

The company has experienced a slowdown in organic cloud growth, which has decelerated to 16% from 21% in the previous year. Despite strong bookings for new digital and artificial intelligence services, the implementation process has been lengthier than anticipated, as is common with most AI applications. The situation suggests there may be more opportune moments for entry and a potential future uptick in cloud growth.

Following the company's recent quarterly results, it was noted that total revenue and earnings per share surpassed consensus estimates, with the increase in revenue being attributed to product sales, despite Cloud revenue not meeting expectations. Analysts highlight that while management has a positive outlook on future momentum and anticipates an uptick in Cloud growth in the upcoming quarter, concerns linger due to another underwhelming performance in Cloud revenue, the absence of a long-term Cloud forecast, and a CEO transition, which collectively contribute to a period of uncertainty for the company.

Here are the latest investment ratings and price targets for $NICE Ltd (NICE.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

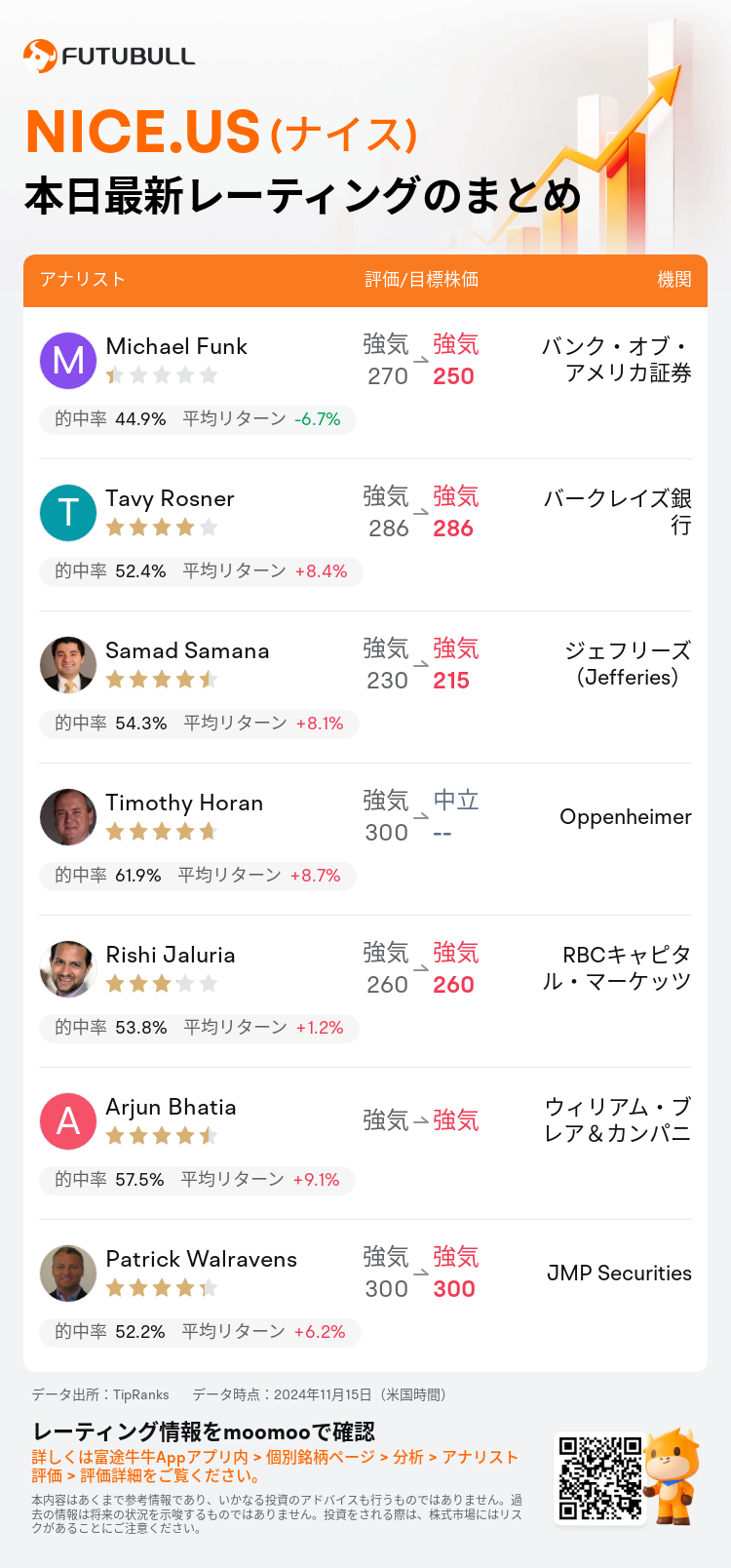

11月15日(米国時間)、ウォール街主要機関のアナリストが$ナイス (NICE.US)$のレーティングを更新し、目標株価は215ドルから300ドル。

バンク・オブ・アメリカ証券のアナリストMichael Funkはレーティングを強気に据え置き、目標株価を270ドルから250ドルに引き下げた。

バークレイズ銀行のアナリストTavy Rosnerはレーティングを強気に据え置き、目標株価を286ドルに据え置いた。

ジェフリーズ(Jefferies)のアナリストSamad Samanaはレーティングを強気に据え置き、目標株価を230ドルから215ドルに引き下げた。

ジェフリーズ(Jefferies)のアナリストSamad Samanaはレーティングを強気に据え置き、目標株価を230ドルから215ドルに引き下げた。

OppenheimerのアナリストTimothy Horanはレーティングを中立に引き下げ。

RBCキャピタル・マーケッツのアナリストRishi Jaluriaはレーティングを強気に据え置き、目標株価を260ドルに据え置いた。

また、$ナイス (NICE.US)$の最近の主なアナリストの観点は以下の通りである:

企業の第三四半期の結果は、売上高で期待をわずかに上回りましたが、主要な焦点であるクラウド売上高の成長は予想に達しませんでした。さらに、企業の経営陣は、2024年についての前回の予想である18%から有機クラウド成長の予測を16%〜17%に引き下げました。これらの進展にもかかわらず、株は競争力のある立場、連絡センターサービスの需要の見込まれる増加、および現在の評価額により、引き続き魅力的と見なされています。

Q3の結果を評価し、Q4での成長の加速に期待すると、ナイスに関しては、ズームビデオと比較してより堅調なビジネストレンドやパイプラインの物語があるようです。ナイスに対するよりポジティブな展望は、大型取引のクロージャーでの強力な勢いと競争に勝利する機会の増加を示す調査に基づいています。

企業は、前年の21%から16%に減速した有機クラウド成長の減速を経験しています。新しいデジタルおよび人工知能サービスの強力なブッキングにもかかわらず、実装プロセスは、大部分の人工知能アプリケーションと同様に、予想よりも長引いています。この状況から判断すると、参入のより適した瞬間やクラウド成長の将来の上昇が考えられます。

企業の最近の四半期の結果に続き、総売上高と1株当たりの利益がコンセンサス予想を上回り、売上高の増加は製品売上高に起因していますが、クラウド売上高が期待に達していませんでした。経営陣が将来の勢いに前向きな見通しを持ち、次の四半期でのクラウド成長の増加を予期しているにもかかわらず、クラウド売上高の再び期待を下回るパフォーマンス、長期クラウド予測の欠如、およびCEOの交代による不確実な時期に対する懸念が根強くあります。

以下の表は今日7名アナリストの$ナイス (NICE.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

ジェフリーズ(Jefferies)のアナリストSamad Samanaはレーティングを強気に据え置き、目標株価を230ドルから215ドルに引き下げた。

ジェフリーズ(Jefferies)のアナリストSamad Samanaはレーティングを強気に据え置き、目標株価を230ドルから215ドルに引き下げた。

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.