Is Hut 8 (NASDAQ:HUT) Using Too Much Debt?

Is Hut 8 (NASDAQ:HUT) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Hut 8 Corp. (NASDAQ:HUT) does carry debt. But should shareholders be worried about its use of debt?

大衛·伊本說得很好,『波動性不是我們關心的風險。我們關心的是避免資本的永久性損失。』 所以看來,聰明的錢知道,債務——通常涉及破產——是評估一家公司的風險時一個非常重要的因素。重要的是,Hut 8 corp.(納斯達克:HUT)確實有債務。但是,股東應該擔心它的債務使用嗎?

When Is Debt Dangerous?

債務何時有危險?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

一般來說,只有在公司無法通過籌集資本或自己的現金流輕鬆償還債務時,債務才會成爲真正的問題。資本主義的本質是「創造性破壞」過程,即銀行家無情地清算失敗的企業。然而,一種更頻繁的(但仍然代價高昂)情況是,公司必須以低於市場價的價格發行股票,以永久性地稀釋股東,來支撐其資產負債表。當然,債務的好處在於,它通常代表廉價資本,特別是當它取代稀釋一個公司具有高回報能力的再投資時。當我們考慮債務水平時,我們首先考慮現金和債務水平。

How Much Debt Does Hut 8 Carry?

Hut 8的債務有多少?

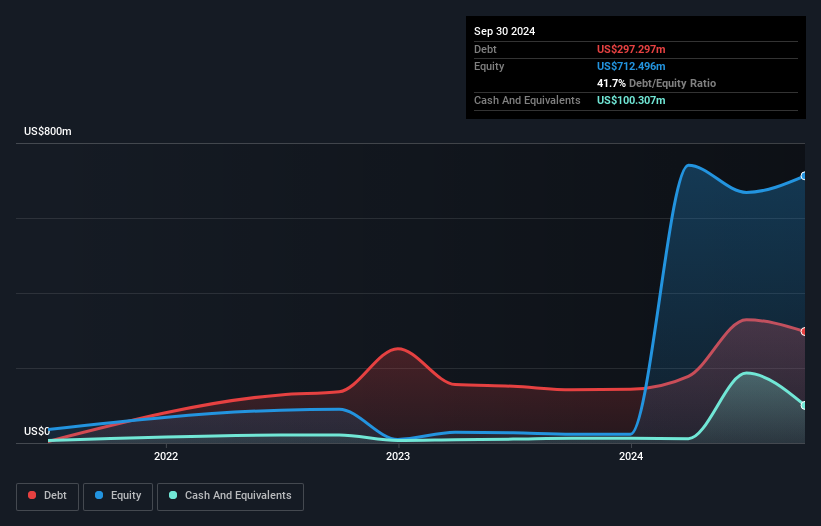

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Hut 8 had US$297.3m of debt, an increase on US$141.8m, over one year. However, because it has a cash reserve of US$100.3m, its net debt is less, at about US$197.0m.

您可以點擊下面的圖形查看歷史數據,但它顯示截至2024年9月,Hut 8的債務爲29730萬美元,比14180萬美元增加了一年。然而,由於它有10030萬美元的現金儲備,其淨債務更少,約爲19700萬美元。

A Look At Hut 8's Liabilities

Hut 8的負債情況概述

The latest balance sheet data shows that Hut 8 had liabilities of US$110.5m due within a year, and liabilities of US$276.2m falling due after that. On the other hand, it had cash of US$100.3m and US$8.01m worth of receivables due within a year. So its liabilities total US$278.4m more than the combination of its cash and short-term receivables.

最新的資產負債表數據顯示,Hut 8的負債爲11050萬美元,需在一年內償還,27620萬美元的負債將在那之後到期。另一方面,它有現金10030萬美元和應收賬款801萬美元,需在一年內償還。因此,它的負債總額27840萬美元,超過了現金和短期應收賬款的總和。

Given Hut 8 has a market capitalization of US$2.31b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

考慮到Hut 8的市值爲23.1億美元,很難相信這些負債構成什麼威脅。然而,我們確實認爲值得關注其資產負債表的強度,因爲這可能會隨着時間的推移而變化。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

爲了衡量公司相對於其收益的債務情況,我們計算其淨負債除以利息、稅項、折舊和攤銷前收益(EBITDA)和其利息支出除以利息前收益(EBIT)的比例(其利息覆蓋率)。這種方法的優點是,我們既考慮了債務的絕對量(淨負債與 EBITDA),又考慮到了與該債務相關的實際利息支出(其利息覆蓋率)。

Hut 8 has net debt of just 0.78 times EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.5 times the interest expense over the last year. It was also good to see that despite losing money on the EBIT line last year, Hut 8 turned things around in the last 12 months, delivering and EBIT of US$209m. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hut 8's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Hut 8的淨債務僅爲EBITDA的0.78倍,表明它顯然不是一個不負責任的借款人。這個觀點得到了穩健的利息覆蓋率的支持,最近一年EBIT爲利息費用的8.5倍。儘管去年EBIT出現虧損,但Hut 8在過去12個月中扭轉了局面,實現了20900萬美元的EBIT。在分析債務水平時,資產負債表是顯而易見的起點。但未來的收益,勝過一切,將決定Hut 8在未來維持健康資產負債表的能力。因此,如果您關注未來,可以查看此份免費報告,顯示分析師的利潤預測。

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Hut 8 burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

最後,儘管稅務部門可能喜歡會計利潤,但放貸人只接受冷硬現金。因此,檢查息稅前利潤(EBIT)中有多少是由自由現金流支撐的非常重要。在過去的一年中,Hut 8消耗了大量現金。雖然投資者無疑期望這種情況會在適當的時候逆轉,但這顯然意味着它的債務使用更具風險。

Our View

我們的觀點

Hut 8's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. In particular, its net debt to EBITDA was re-invigorating. We think that Hut 8's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Hut 8 you should be aware of, and 2 of them don't sit too well with us.

Hut 8將EBIT轉換爲自由現金流的表現對該分析來說是一個真正的負面因素,雖然我們考慮的其他因素使其處於一個明顯更好的狀態。特別是,它的淨債務與EBITDA的比率令人振奮。我們認爲,考慮到上述數據點後,Hut 8的債務確實使其有點風險。並不是所有風險都是壞事,如果它獲得成功,可能會提升分享價格回報,但這種債務風險是值得記住的。在分析債務時,資產負債表顯然是需要關注的領域。然而,並不是所有的投資風險都存在於資產負債表上——遠非如此。案例:我們發現Hut 8存在3個警告信號,你應該注意,其中2個我們並不太滿意。

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

如果您有興趣投資能夠在不負債的情況下增長利潤的企業,請查看這份免費列表,其中列出了在資產負債表上擁有淨現金的成長型企業。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

The latest balance sheet data shows that Hut 8 had liabilities of US$110.5m due within a year, and liabilities of US$276.2m falling due after that. On the other hand, it had cash of US$100.3m and US$8.01m worth of receivables due within a year. So its liabilities total US$278.4m more than the combination of its cash and short-term receivables.

The latest balance sheet data shows that Hut 8 had liabilities of US$110.5m due within a year, and liabilities of US$276.2m falling due after that. On the other hand, it had cash of US$100.3m and US$8.01m worth of receivables due within a year. So its liabilities total US$278.4m more than the combination of its cash and short-term receivables.