Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

High-rolling investors have positioned themselves bullish on GameStop (NYSE:GME), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GME often signals that someone has privileged information.

高風險投資者看好GameStop(紐交所:GME),對零售交易者來說至關重要。 通過Benzinga跟蹤公開可獲取的期權數據,我們今天關注到了這一活動。這些投資者的身份尚不明確,但GME出現如此重大變動往往意味着某人掌握着內幕消息。

Today, Benzinga's options scanner spotted 16 options trades for GameStop. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現了16筆關於遊戲驛站的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 50% bullish and 31% bearish. Among all the options we identified, there was one put, amounting to $41,334, and 15 calls, totaling $842,586.

這些主要交易者的情緒呈現分裂,50%看好,31%看淡。在我們識別的所有期權中,有一筆看跌期權,金額爲$41,334,還有15筆看漲期權,總計$842,586。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.

評估交易量和未平倉合約後,很明顯,主要市場操縱者正在關注遊戲驛站在$20.0到$50.0的價格區間,這一切發生在過去三個月中。

Volume & Open Interest Trends

成交量和未平倉量趨勢

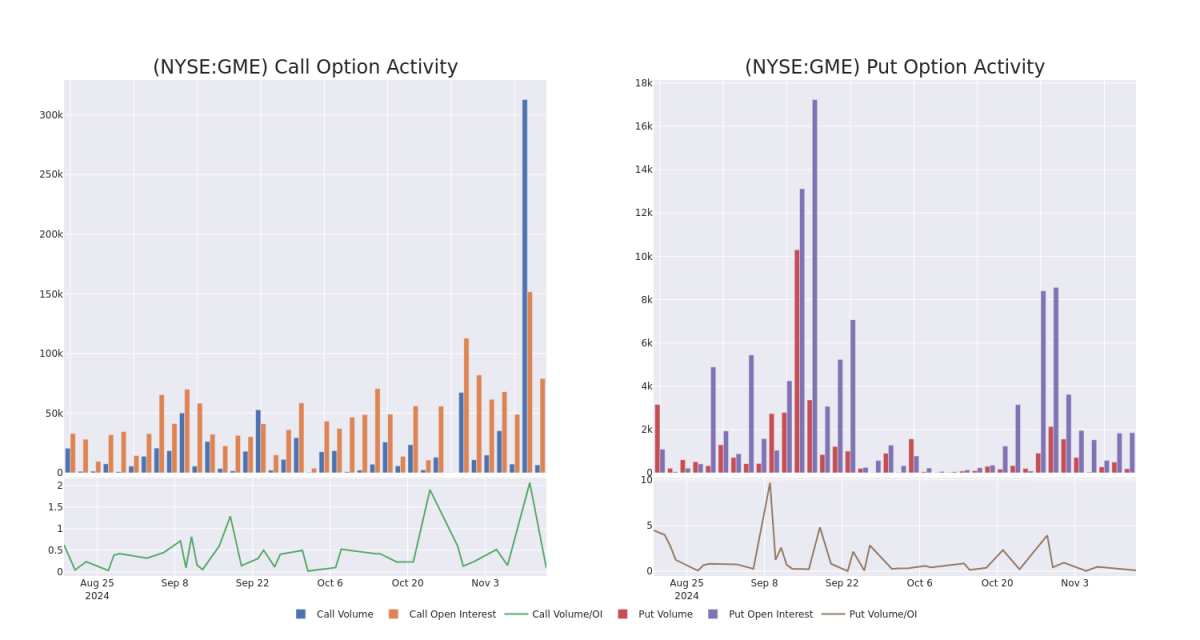

In terms of liquidity and interest, the mean open interest for GameStop options trades today is 6745.75 with a total volume of 6,843.00.

在流動性和興趣方面,今天遊戲驛站期權交易的平均未平倉合約爲6745.75,成交量爲6,843.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for GameStop's big money trades within a strike price range of $20.0 to $50.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天中游戲驛站的大手交易的看漲和看跌期權的成交量和未平倉合約的發展,行使價格區間爲$20.0到$50.0。

GameStop 30-Day Option Volume & Interest Snapshot

遊戲驛站30天期權成交量和持倉量快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | NEUTRAL | 11/29/24 | $1.05 | $0.72 | $0.88 | $47.00 | $178.0K | 35 | 2.0K |

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $4.65 | $4.55 | $4.55 | $40.00 | $91.1K | 27.9K | 766 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $5.65 | $5.6 | $5.6 | $22.00 | $86.2K | 9.0K | 283 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $6.75 | $6.3 | $6.64 | $21.00 | $66.4K | 6.8K | 289 |

| GME | CALL | SWEEP | BULLISH | 11/15/24 | $6.75 | $6.45 | $6.64 | $21.00 | $49.8K | 6.8K | 185 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看漲 | 掃單 | 中立 | 11/29/24 | $1.05 | 0.72美元 | $0.88 | $47.00 | $178.0K | 35 | 2.0K |

| 遊戲驛站 | 看漲 | 掃單 | 看淡 | 01/17/25 | $4.65 | $4.55 | $4.55 | $40.00 | $91.1K | 27.9千 | 766 |

| 遊戲驛站 | 看漲 | 掃單 | 看好 | 11/15/24 | $5.65 | $5.6 | $5.6 | $22.00 | $86.2K | 9.0K | 283 |

| 遊戲驛站 | 看漲 | 掃單 | 看好 | 11/15/24 | 其股票的收盤價格昨天爲$5.75。 | $6.3 | 6.64美元 | $21.00 | $66.4K | 6.8K | 289 |

| 遊戲驛站 | 看漲 | 掃單 | 看好 | 11/15/24 | $6.75 | $6.45 | $6.64 | $21.00 | $49.8K | 6.8K | 185 |

About GameStop

關於遊戲驛站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美國的一家多渠道視頻遊戲、消費電子和服務零售商。該公司在歐洲、加拿大、澳洲和美國等地區運營。GameStop主要通過GameStop、Eb Games和Micromania商店以及國際電子商務網站銷售新和二手視頻遊戲硬件、實體和數字視頻遊戲軟件和視頻遊戲配件。銷售收入的大部分來自美國。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於遊戲驛站最近的期權歷史,現在應該專注於公司本身。我們的目標是探索其當前的表現。

GameStop's Current Market Status

GameStop的當前市場狀態

- Currently trading with a volume of 7,460,340, the GME's price is up by 3.51%, now at $27.39.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 20 days.

- 目前交易量爲7,460,340,遊戲驛站的價格上漲了3.51%,現在爲27.39美元。

- RSI讀數表明股票目前可能超買。

- 預期的盈利發佈將在20天內進行。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $50.0 for GameStop, spanning the last three months.