JD executives stated that the consumption potential stimulated by the national subsidy in Q3 has not been fully unleashed yet. The continuation of this policy is very helpful in boosting consumption, and they also hope that consumer confidence can continue to strengthen. Looking at the whole year, the Group is confident that profits will increase by double digits. Dada, Jinxuan, JD International, and other new business revenues decreased by 25.65% year-on-year, with net losses expanding from 0.192 billion yuan in Q3 2023 to 0.615 billion yuan.

"Science and Technology Innovation Board Daily" news on November 14th (Reporter: Huang Xinyi, Editor: Liang Youyun). JD Group's latest financial report for 2024 shows that in Q3, the company achieved a revenue of 260.389 billion yuan, a year-on-year increase of 5.1%; the net profit attributable to shareholders of the Company was 11.731 billion yuan, a year-on-year increase of 47.82%.

Divided by business attributes, television products and household appliance businesses contributed revenue of 122.56 billion yuan, a 2.7% year-on-year increase; general merchandise contributed revenue of 82.053 billion yuan, an 8% year-on-year increase; service businesses (including marketing, external logistics services, etc.) contributed revenue of 55.774 billion yuan, a 6.5% year-on-year increase.

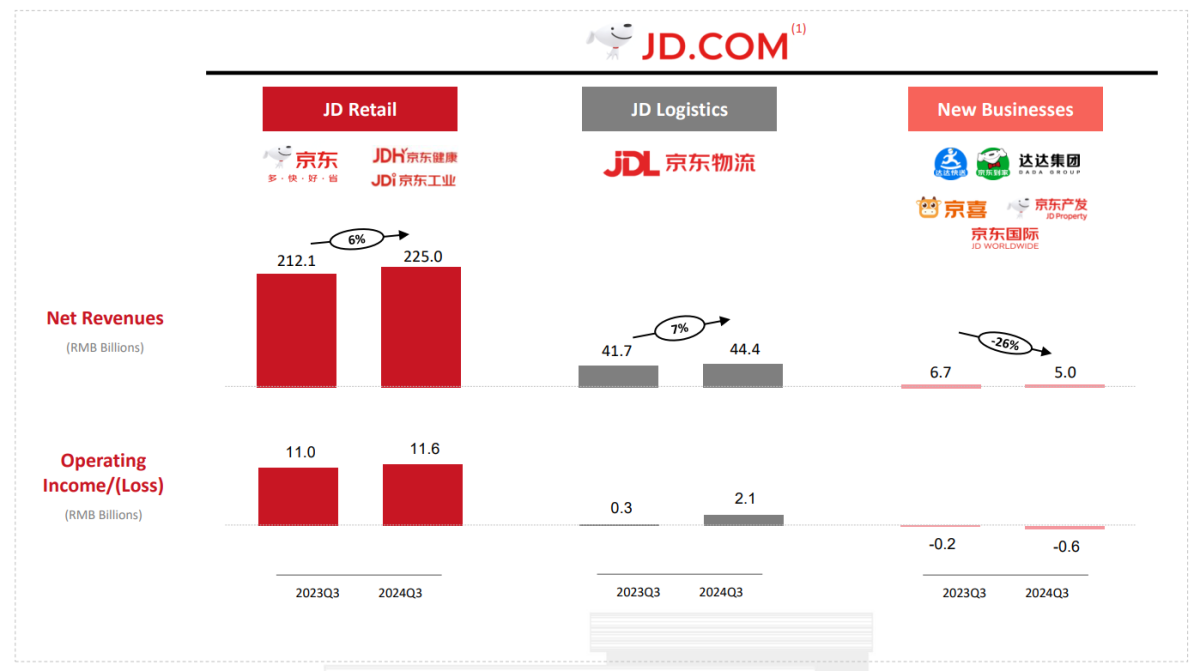

In terms of core business divisions, JD Retail contributed revenue of 224.986 billion yuan, a 6.1% year-on-year increase; JD Logistics contributed revenue of 44.396 billion yuan, a 6.56% year-on-year increase.

In terms of core business divisions, JD Retail contributed revenue of 224.986 billion yuan, a 6.1% year-on-year increase; JD Logistics contributed revenue of 44.396 billion yuan, a 6.56% year-on-year increase.

Overall, in the first three quarters of 2024, JD Group accumulated revenue of 811.833 billion yuan, a 4.3% year-on-year increase; achieving a net profit attributable to shareholders of the Company of 31.505 billion yuan, a 51.63% year-on-year increase.

During the earnings conference, JD executives expressed that the consumption potential stimulated by the national subsidy in Q3 has not been fully unleashed yet. The continuation of this policy is very helpful in boosting consumption, and they also hope that consumer confidence can continue to strengthen. "The November 11 shopping festival exceeded expectations, with a very good growth in active users and order volume. The number of users and purchase frequency both maintained a double-digit growth. Looking at the whole year, the Group is confident that profits will increase by double digits."

For trade-ins and private label retailing, they have made significant contributions.

Compared to the slowdown in growth rates of multiple business sectors in the first half and Q2, JD's various indicators in Q3 showed a significant improvement in growth rates. JD Group's Chief Financial Officer, Sun Su, bluntly stated in the financial report: "In Q3, our total revenue growth benefited from the rebound in electronics and home appliance sales, as well as the continued growth momentum in daily commodities."

Starting from August 26 this year, the nationwide home appliance trade-in plan led by the government and followed up by provinces and cities across the country is gradually being implemented. Currently, it has been launched in more than 20 provinces and cities nationwide, including economically developed and high-consumption areas such as Beijing, Guangzhou, Shanghai, Zhejiang, etc.

As an important subsidy consumption channel for home appliance trade-ins, JD.com has continued to grow its active user base and transaction volume since the launch of the trade-in subsidy activity. Data shows that JD's e-commerce platform has seen double-digit growth in quarterly active users and shopping frequency for three consecutive quarters year-on-year. Thanks to the increase in user activity, orders and users from third-party merchants have also maintained rapid growth.

Although JD.com has not disclosed the specific hot-selling categories of home appliances in the third quarter, the trade-in consumption has surged in the recent closure report of the November 11 shopping festival-related, becoming an important source of active consumption on the platform. JD.com revealed that during the November 11 promotion period, the number of users shopping on the platform increased by over 20% year-on-year, large-screen televisions became the top choice for trade-ins, and the transaction volume of 519 home appliance and household product categories including robotic vacuum cleaners and dryers increased by 200% year-on-year. The transaction volume of various AI hardware categories such as AI computers and AI smartphones increased by over 100%.

JD.com CEO Xu Ran stated at the earnings conference that the consumption potential stimulated by the national subsidy in the third quarter has not been fully unleashed yet, and short-term categories will also be restricted by inadequate production capacity, which will require a certain period to expand production capacity. If this policy continues, it will be very helpful in boosting consumption.

Xu Ran believes that the national subsidy policies like trade-ins are not just to stimulate short-term consumption, but more importantly, they act as leverage to drive employment and increase household income, thereby enhancing consumer confidence. "I am cautiously optimistic about next year."

In addition to home appliance subsidies, JD.com's focus on investments in apparel and daily white-label commodities has also brought significant growth. The revenue growth rate of general merchandise in the third quarter was the highest among all business growth rates in the same period. It is reported that JD's platform's daily department store category revenue has maintained high single-digit year-on-year growth for three consecutive quarters, exceeding the industry average growth rate, with revenues from supermarkets and apparel categories achieving double-digit year-on-year growth.

Xu Ran stated that they will continue to create a series of long-term activities centered around apparel and beauty. Specifically in the beauty category, they will strengthen cooperation with domestic beauty brands and expand billion-yuan subsidies to cover all beauty product categories.

In terms of operational models, the current focus in the fashion category is on 3P, but self-operated capabilities are also being strengthened. Xu Ran mentioned that the specific mode choice depends on the users' preferences. "A series of operational activities around apparel and beauty will continue in the subsequent fourth quarter."

In September this year, JD.com also announced the launch of the "Factory Hundred Billion Subsidy" plan, providing exclusive traffic subsidies, price subsidies, and logistics subsidies for white-label products and factory direct supply products, thereby helping industrial belt merchants create explosive products and increase daily sales. At the same time, JD.com also uses the "fully managed" and "quasi-self-operated" model to reduce the operating burden of industrial belt merchants, coordinate the low cost of industrial belts, and the advantages of factory direct supply.

During JD.com's November 11 shopping festival-related promotion, the number of cheap and postage-free items doubled year-on-year, with cleaning paper products, household cleaning products, kitchen and water utensils, daily groceries, and other factory goods becoming the preferred categories for consumers.

JD.com's logistics operation continues to be optimized, while the group faces pressures from new businesses.

It is worth noting that the revenue of the new business section (including Dada, JDX, JD Worldwide, etc.) was 4.97 billion yuan, a year-on-year decrease of 25.65%, still showing a significant decline trend. At the same time, the net loss of this section has also increased from 0.192 billion yuan in the third quarter of 2023 to 0.615 billion yuan.

In the third quarter report of 2024, Dada announced that the company achieved a revenue of 2.4294 billion yuan, a year-on-year decrease of 7.34%; operating losses were 0.227 billion yuan, expanding from 0.211 billion yuan in the same period of 2023.

In Dada's two major business sectors, the Dada Instant Delivery business maintained rapid growth, achieving a revenue of 1.499 billion yuan, a year-on-year increase of 38.6%. However, in the Dada JD.com delivery business, third-quarter revenue decreased by 39.6% year-on-year to 0.93 billion yuan. It was disclosed that the main reasons for the significant decline in this business segment were the decrease in online advertising and marketing service revenue, as well as JD.com's implementation of free shipping for orders over 29 yuan since February this year.

According to data, after implementing a series of preferential strategies, the "JD Instant Delivery" service launched by Dada in May of this year continued to maintain high-speed growth momentum in the JD.com App, with monthly average orders and order volumes both growing by over 100% year-on-year. As of the end of September, the overall number of JD Instant Delivery business outlets on JD.com exceeded 0.6 million, a year-on-year increase of over 70%.

For JD.com's logistics, on the eve of this year's November 11, its logistics system successfully connected with Taobao and Tmall, which was also eye-catching.

During this year's november 11 shopping festival-related promotions, jd.com logistics integrated supply chain solutions, JD Express, JD Express and many other businesses, involving warehousing, express delivery, express delivery and other supply chain full-process services, have all been opened to Taobao Tmall merchants. At this point, JD Logistics has basically connected to mainstream domestic e-commerce platforms.

In addition, JD Logistics recently proposed to initially invest 1.5 billion yuan to layout the Hong Kong logistics market, further deepening logistics outflow services. In terms of other overseas distribution businesses, JD Logistics mentioned in the third quarter report that the company has opened new warehouses in Malaysia, USA, and provided cross-border logistics services to a leading e-commerce platform in South Korea.

JD Logistics financial report data shows that the company's revenue in the third quarter was 44.396 billion yuan, a year-on-year increase of 6.6%; during the period, the EBITDA under non-international financial reporting standards was 5.726 billion yuan, a year-on-year increase of 49.3%. Among them, revenue contributed by external customers was 31.608 billion yuan, a year-on-year increase of 5.94%.

The significant growth of JD Logistics' net income is mainly due to the decrease in the proportion of cost of goods sold, dropping from 92.1% in the third quarter of 2023 to 88.8% in this year's third quarter. In this process, JD Logistics has achieved "open source and cost control" through product and network structure optimization, technology-driven operational efficiency improvement, and refined management to enhance resource utilization efficiency.

核心业务划分上,京东零售贡献营收2249.86亿元,同比增长6.1%;京东物流贡献营收443.96亿元,同比增长6.56%。

核心业务划分上,京东零售贡献营收2249.86亿元,同比增长6.1%;京东物流贡献营收443.96亿元,同比增长6.56%。