Institutional Investors in Performant Financial Corporation (NASDAQ:PFMT) Lost 23% Last Week but Have Reaped the Benefits of Longer-term Growth

Institutional Investors in Performant Financial Corporation (NASDAQ:PFMT) Lost 23% Last Week but Have Reaped the Benefits of Longer-term Growth

Key Insights

主要見解

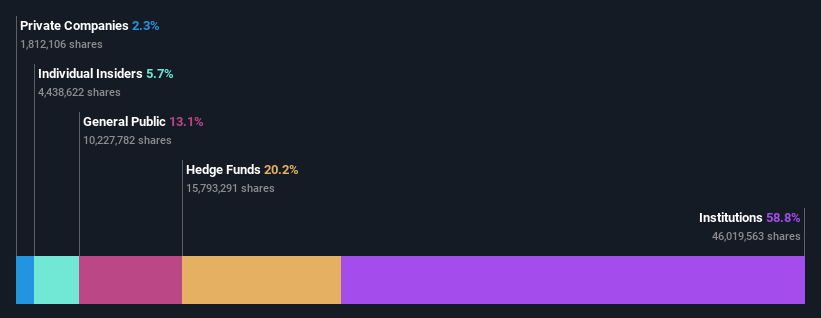

- Institutions' substantial holdings in Performant Financial implies that they have significant influence over the company's share price

- The top 6 shareholders own 53% of the company

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

- 機構在performant financial的重大持股意味着他們對公司股價有重要影響。

- 前6名股東擁有公司的53%股權。

- 通過分析師預測數據和所有權研究,您可以更好地評估公司未來的業績。

To get a sense of who is truly in control of Performant Financial Corporation (NASDAQ:PFMT), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are institutions with 59% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

要了解誰真正控制了performant financial公司(納斯達克:PFMT),了解業務的所有權結構非常重要。而持有最大份額的團體是機構,擁有59%的股份。換句話說,該團體從對公司的投資中獲得最多(或失去最多)。

No shareholder likes losing money on their investments, especially institutional investors who saw their holdings drop 23% in value last week. However, the 23% one-year return to shareholders may have helped lessen their pain. They should, however, be mindful of further losses in the future.

沒有股東喜歡在投資中虧損,尤其是上週看到其持股價值下跌23%的機構投資者。然而,23%的年度股東回報可能緩解了他們的痛苦。然而,他們應該對未來可能的進一步損失保持警惕。

Let's take a closer look to see what the different types of shareholders can tell us about Performant Financial.

讓我們更仔細地看看不同類型的股東可以告訴我們關於performant financial的什麼。

What Does The Institutional Ownership Tell Us About Performant Financial?

機構持股告訴我們關於performant financial的什麼?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

機構通常在向自己的投資者報告時會針對一個基準進行衡量,因此一旦某隻股票被納入主要指數,他們通常會更加熱衷於該股票。我們預計大多數公司都會有一些機構在登記簿上,尤其是那些正在增長的公司。

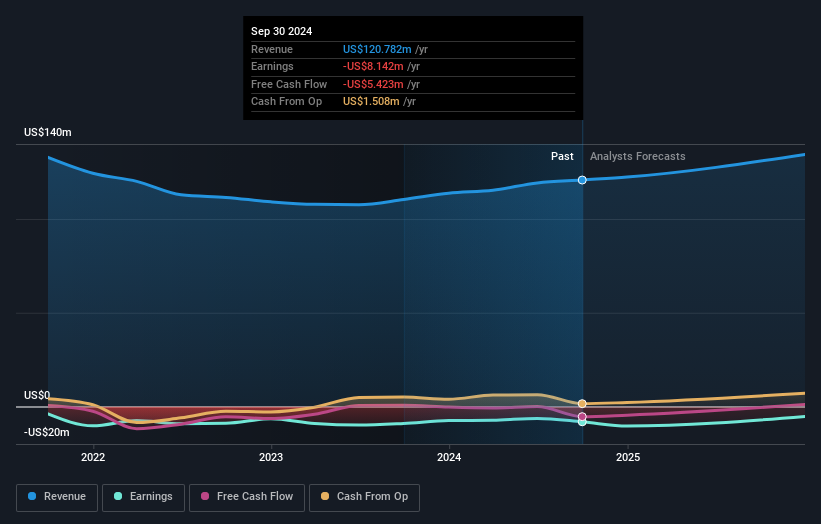

Performant Financial already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Performant Financial's earnings history below. Of course, the future is what really matters.

performant financial已經在股東名冊上有機構投資者。事實上,他們在公司中擁有可觀的股份。這可以表明該公司在投資社區中具有一定的可信度。然而,最好還是對依賴於機構投資者帶來的所謂驗證保持警惕。他們有時也會出錯。如果多個機構同時改變對某隻股票的看法,你可能會看到股價迅速下跌。因此,值得查看下面performant financial的盈利歷史。當然,未來才是最重要的。

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. It looks like hedge funds own 20% of Performant Financial shares. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. Our data shows that Prescott Group Capital Management L.L.C. is the largest shareholder with 20% of shares outstanding. In comparison, the second and third largest shareholders hold about 13% and 5.9% of the stock. Furthermore, CEO Simeon Kohl is the owner of 0.5% of the company's shares.

機構投資者擁有超過50%的股份,因此他們一起可能會強烈影響董事會決策。看起來對沖基金擁有20%的performant financial 股票。這引起了我的注意,因爲對沖基金有時會試圖影響管理層,或者帶來變革,以便爲股東創造短期價值。我們的數據顯示,Prescott Group Capital Management L.L.C.是最大的股東,持有20%的流通股。相比之下,第二和第三大股東分別持有約13%和5.9%的股票。此外,首席執行官Simeon Kohl擁有公司0.5%的股份。

We did some more digging and found that 6 of the top shareholders account for roughly 53% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

我們進行了更深入的研究,並發現前6名股東佔公司股份的大約53%,這意味着除大股東外,還有一些小股東,因此在一定程度上平衡了彼此的利益。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

研究機構持股比例是衡量和篩選股票預期表現的好方法。同樣可以通過研究分析師情緒來實現。由於相當多的分析師都關注着該股票,因此你可以很容易地研究預測的增長。

Insider Ownership Of Performant Financial

performant financial 的內部持股情況

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

公司內部人員的定義可能是主觀的,並且在不同的司法管轄區之間是不同的。我們的數據反映了個別內部人員,至少捕捉到了董事會成員。公司管理業務,但首席執行官即使是董事會成員也必須向董事會負責。

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

當內部人持股情況表明領導層思考和公司真正所有者一樣時,內部所有權是積極的。然而,高達內部人士所有權也可能爲公司內的小團體帶來巨大的權力。在某些情況下,這可能是負面的。

Shareholders would probably be interested to learn that insiders own shares in Performant Financial Corporation. It has a market capitalization of just US$263m, and insiders have US$15m worth of shares, in their own names. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

股東們可能會對此感興趣,即內部人士持有Performant Financial Corporation的股份。公司市值僅爲26300萬美元,內部人士名下持有價值1500萬美元的股份。有人會說這顯示了股東與董事會之間的利益一致。但檢查這些內部人士是否有在賣出股份可能也是值得的。

General Public Ownership

一般大衆所有權

With a 13% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Performant Financial. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

擁有13%股份的公衆,主要由個人投資者組成,對Performant Financial有一定的影響力。雖然這個群體不一定能做出決定,但他們確實可以對公司運作產生真實影響。

Next Steps:

下一步:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For example, we've discovered 1 warning sign for Performant Financial that you should be aware of before investing here.

雖然考慮持有公司股份的不同群體非常重要,但還有其他因素更加重要。 例如,我們發現了一個警告信號,關於performant financial,你在這裏投資前應該注意。

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

如果您像我一樣,可能希望考慮這家公司是否會增長或縮小。幸運的是,您可以查看此免費報告,顯示分析師對其未來的預測。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的數據是使用最後一個財務報表日期結束的爲期12個月的數據計算的。這可能與全年年度報告數據不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.