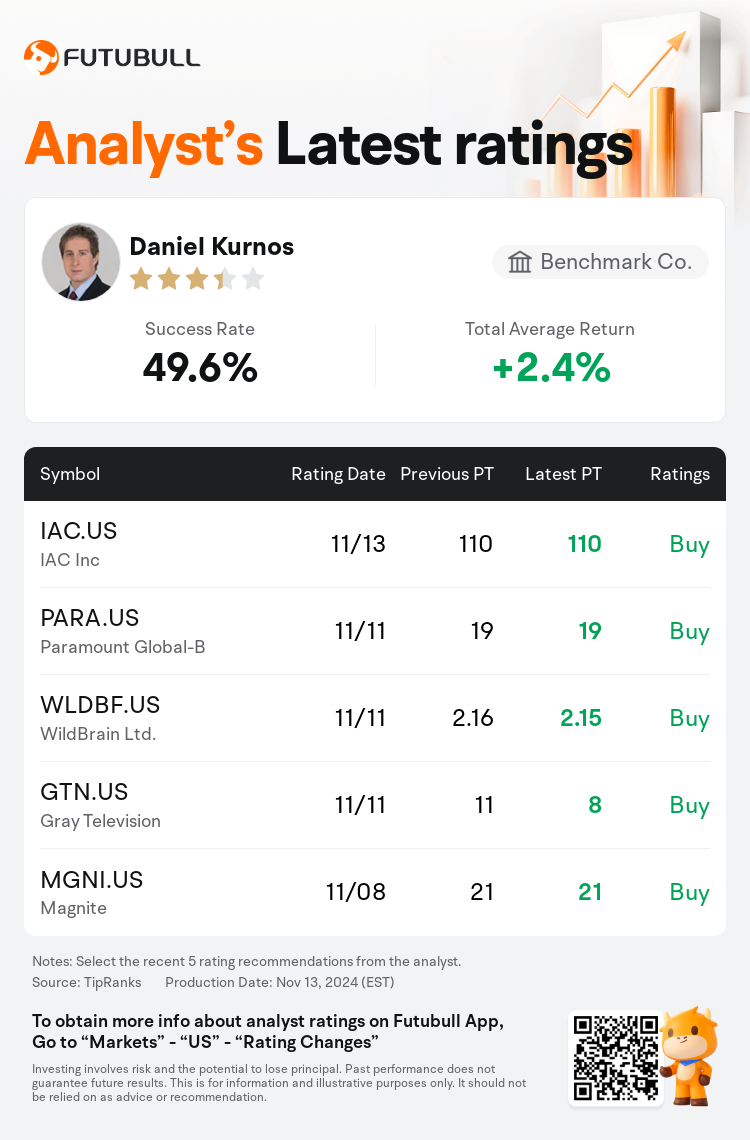

Benchmark Co. analyst Daniel Kurnos maintains $IAC Inc (IAC.US)$ with a buy rating, and maintains the target price at $110.

According to TipRanks data, the analyst has a success rate of 49.6% and a total average return of 2.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $IAC Inc (IAC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $IAC Inc (IAC.US)$'s main analysts recently are as follows:

Following the Q3 report, there is an anticipation of headwinds for Angi in early 2025, but management exudes confidence for the period following that. Additionally, a prospective spin could mitigate the seven-year overhang risk associated with IAC equity.

IAC is contemplating a distribution of its 85% ownership in Angi to its shareholders. Angi is currently in the midst of an operational overhaul, as evidenced by a revenue decrease of over 15% year-over-year in the third quarter.

Q3 outcomes were largely eclipsed by IAC's strategic choice to divest its Angi Inc. holdings, which account for around 28% of IAC's market value. This move is perceived as an effort by IAC to liberate capital to foster additional value generation. Considering the current negligible valuation of IAC's remaining interests excluding Angi and MGM, the decision to spin off is seen as a chance to reveal shareholder value from prospering profitable entities such as Dotdash-Meredith.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

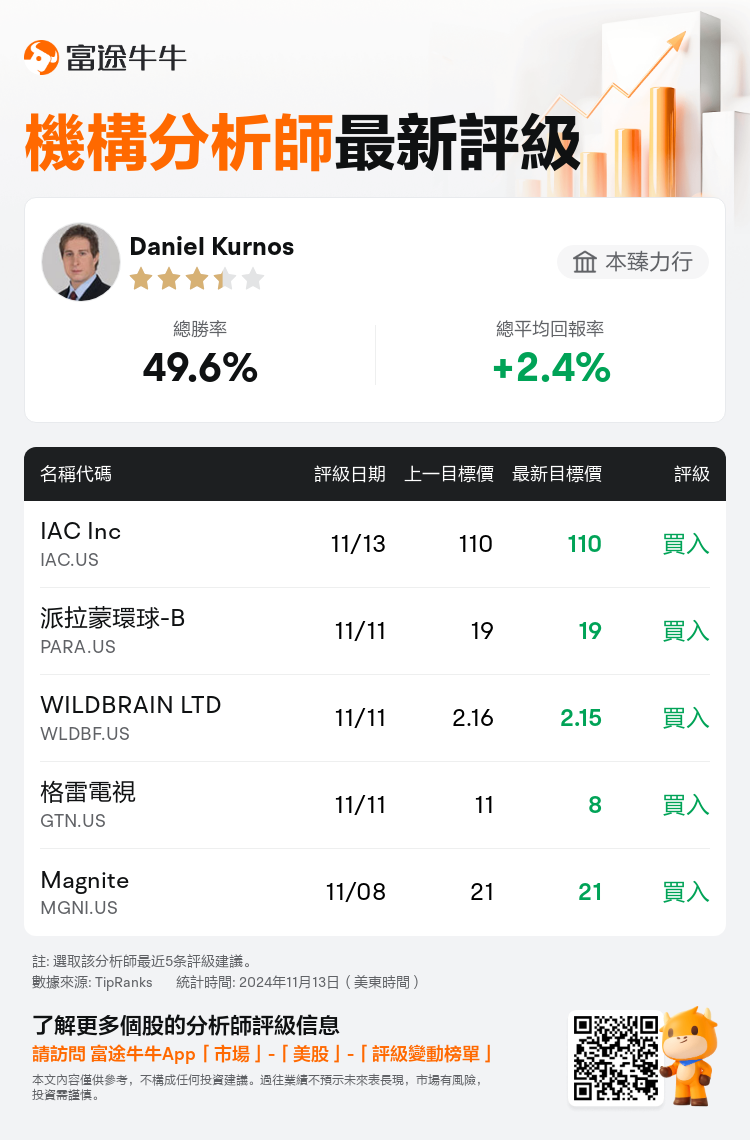

本臻力行分析師Daniel Kurnos維持$IAC Inc (IAC.US)$買入評級,維持目標價110美元。

根據TipRanks數據顯示,該分析師近一年總勝率為49.6%,總平均回報率為2.4%。

此外,綜合報道,$IAC Inc (IAC.US)$近期主要分析師觀點如下:

此外,綜合報道,$IAC Inc (IAC.US)$近期主要分析師觀點如下:

根據第三季度報告,有人預期 angi inc 在2025年初將面臨一些困難,但管理層對隨後的時期充滿信心。此外,一個潛在的分拆可能會緩解與 IAC 股權相關的七年懸掛風險。

IAC 正在考慮將其對 angi inc 的85%所有權分配給其股東。現階段,angi inc 正處於一場運營改組當中,第三季度營業收入同比下降超過15%。

第三季度的業績在很大程度上被 IAC 的戰略選擇掩蓋,即剝離其 angi inc 股份,這些股份約佔 IAC 市值的28%。這一舉措被視爲 IAC 爲解放資本以促進附加價值創生所做的努力。考慮到除 angi inc 和 MGm 外,IAC 剩餘利益的當前可忽略估值,決定進行分拆被視爲一個機會,以從像 Dotdash-Meredith 這樣的繁榮盈利實體中揭示股東價值。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$IAC Inc (IAC.US)$近期主要分析師觀點如下:

此外,綜合報道,$IAC Inc (IAC.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of