Financial giants have made a conspicuous bullish move on Novo Nordisk. Our analysis of options history for Novo Nordisk (NYSE:NVO) revealed 23 unusual trades.

Delving into the details, we found 56% of traders were bullish, while 26% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $401,684, and 14 were calls, valued at $675,514.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $200.0 for Novo Nordisk over the recent three months.

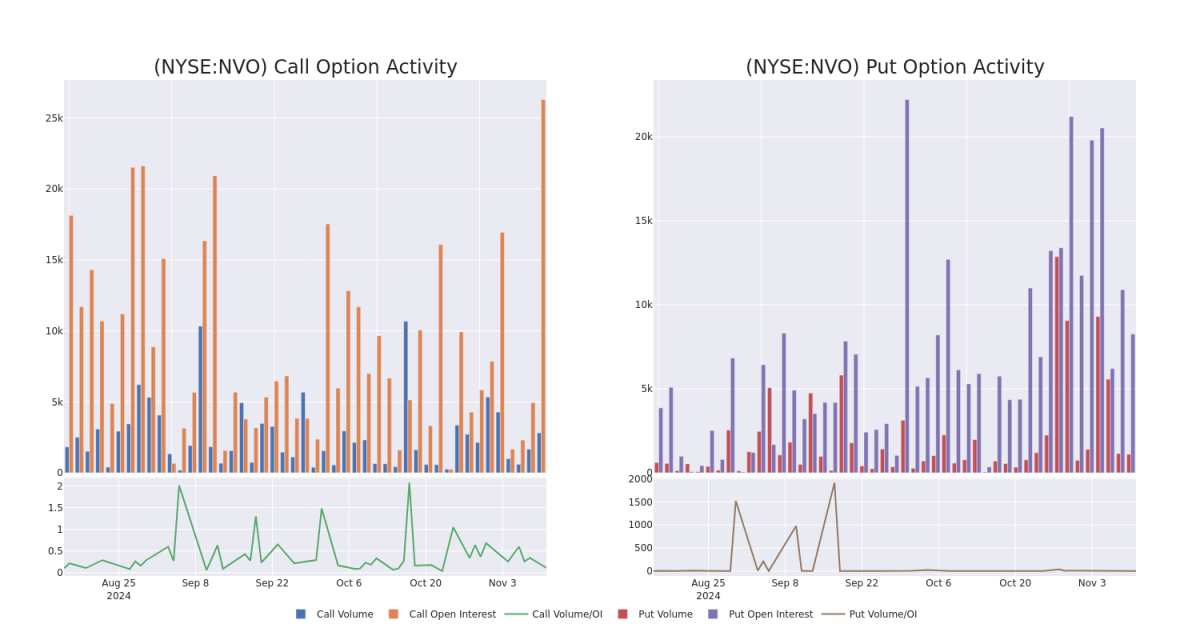

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| NVO | CALL | SWEEP | BULLISH | 01/17/25 | $2.28 | $2.19 | $2.25 | $125.00 | $112.3K | 6.6K | 702 |

| NVO | PUT | SWEEP | BULLISH | 03/21/25 | $10.7 | $10.65 | $10.65 | $115.00 | $93.7K | 1.1K | 100 |

| NVO | CALL | TRADE | BULLISH | 01/17/25 | $13.65 | $13.5 | $13.6 | $100.00 | $85.6K | 1.1K | 78 |

| NVO | PUT | TRADE | BULLISH | 03/21/25 | $36.25 | $35.95 | $35.95 | $145.00 | $71.9K | 11 | 20 |

| NVO | CALL | SWEEP | BULLISH | 12/20/24 | $2.37 | $2.26 | $2.37 | $120.00 | $70.6K | 9.7K | 632 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Having examined the options trading patterns of Novo Nordisk, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Novo Nordisk

- With a trading volume of 3,829,487, the price of NVO is up by 1.72%, reaching $109.05.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 79 days from now.

What The Experts Say On Novo Nordisk

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160. * An analyst from BMO Capital has decided to maintain their Outperform rating on Novo Nordisk, which currently sits at a price target of $156.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

金融巨頭對諾和諾德做出了明顯的看漲舉動。我們對紐交所的諾和諾德(NYSE:NVO)期權歷史進行分析後發現23筆異常交易。

深入細節,我們發現56%的交易者持看好態度,而26%顯示看淡傾向。在所有我們發現的交易中,有9筆看跌交易,價值401,684美元,有14筆看漲交易,價值675,514美元。

預測價格區間

根據交易活動,顯然一些重要投資者正在瞄準諾和諾德股價在過去三個月中從70.0到200.0美元的價位區間。

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

評估成交量和未平倉合約是期權交易中的戰略步驟。這些指標揭示了在指定行權價處諾和諾德期權的流動性和投資者興趣。即將到來的數據可視化展現了在過去30天內與諾和諾德的大手交易相關的看漲和看跌的成交量和未平倉合約的波動,這些涉及從70.0到200.0美元的行權價區間。

評估成交量和未平倉合約是期權交易中的戰略步驟。這些指標揭示了在指定行權價處諾和諾德期權的流動性和投資者興趣。即將到來的數據可視化展現了在過去30天內與諾和諾德的大手交易相關的看漲和看跌的成交量和未平倉合約的波動,這些涉及從70.0到200.0美元的行權價區間。

諾和諾德期權活動分析:最近30天

觀察到的最大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

NVO | CALL | SWEEP | BULLISH | 01/17/25 | $2.28 | $2.19 | $2.25 | $125.00 | $112.3K | 6.6K | 702 |

NVO | PUT | SWEEP | BULLISH | 03/21/25 | $10.7 | $10.65 | $10.65 | $115.00 | $93.7K | 1.1K | 100 |

NVO | CALL | TRADE | BULLISH | 01/17/25 | $13.65 | $13.5 | $13.6 | $100.00 | $85.6K | 1.1K | 78 |

NVO | PUT | TRADE | BULLISH | 03/21/25 | $36.25 | $35.95 | $35.95 | $145.00 | $71.9K | 11 | 20 |

NVO | CALL | SWEEP | BULLISH | 12/20/24 | $2.37 | $2.26 | $2.37 | $120.00 | $70.6K | | |

諾和諾德是一家領先的全球醫療保健公司,致力於研發創新藥品,幫助患糖尿病的患者過上更長壽、更健康的生活,這一傳統已有100多年。這種傳統爲我們提供了經驗和能力,使我們能夠推動變革,幫助人們戰勝其他嚴重的慢性疾病,如肥胖症、罕見的血液和內分泌紊亂。我們始終堅信,持久的成功公式是保持專注,長遠思考,並以財務、社會和環境負責任的方式做生意。諾和諾德在新澤西州設有美國總部,在7個州加上華盛頓特區擁有商業、生產和研究設施,在全國約有8000名員工。有關更多信息,訪問novonordisk-us.com,Facebook、Instagram和X。

作爲全球治療糖尿病品牌市場三分之一的領先者,丹麥的Novo Nordisk公司是世界上提供糖尿病護理產品的主要製造商和市場推廣者。該公司製造和銷售各種人體和現代胰島素、GLP-1療法等可注射糖尿病治療藥物、口服降糖藥以及肥胖症治療藥物。Novo Nordisk還有一個生物製藥部門(約佔營收的10%),專門從事血友病和其他疾病的蛋白質療法。

經過對Novo Nordisk的期權交易模式的分析,我們現在將關注點直接轉向公司本身。這個轉變使我們能夠深入探究其當前的市場地位和表現。

挪威諾德斯克的當前持倉情況

專家對諾和諾德的評價

過去30天內,共有2位專業分析師對這支股票發表了觀點,並設定了平均目標價爲$158.0。

檢測到期權異動:智慧資金在行動。

Benzinga Edge的期權異動板塊在市場變化發生之前發現潛在的市場波動者。看看大額資金在你喜愛的股票上的持倉情況。點擊這裏進行查看。* Cantor Fitzgerald的一位分析師將其評級下調爲增持,並設定了$160的目標價。* BMO Capital的一位分析師決定維持他們對諾和諾德斯克的跑贏市場評級,目前的目標價爲$156。

交易期權存在更大風險,但也有更高利潤的潛力。精明交易者通過持續教育、戰略交易調整、利用各種因子以及保持對市場動態的敏銳感來降低這些風險。使用Benzinga Pro實時警報,及時了解諾和諾德斯克的最新期權交易。

評估成交量和未平倉合約是期權交易中的戰略步驟。這些指標揭示了在指定行權價處諾和諾德期權的流動性和投資者興趣。即將到來的數據可視化展現了在過去30天內與諾和諾德的大手交易相關的看漲和看跌的成交量和未平倉合約的波動,這些涉及從70.0到200.0美元的行權價區間。

評估成交量和未平倉合約是期權交易中的戰略步驟。這些指標揭示了在指定行權價處諾和諾德期權的流動性和投資者興趣。即將到來的數據可視化展現了在過去30天內與諾和諾德的大手交易相關的看漲和看跌的成交量和未平倉合約的波動,這些涉及從70.0到200.0美元的行權價區間。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.