Spotlight on Visa: Analyzing the Surge in Options Activity

Spotlight on Visa: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Visa. Our analysis of options history for Visa (NYSE:V) revealed 36 unusual trades.

金融巨頭在Visa股票上做出了明顯的看好舉動。我們對紐交所Visa股票(NYSE:V)的期權歷史進行分析,發現了36起異常交易。

Delving into the details, we found 36% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $193,024, and 32 were calls, valued at $2,087,431.

深入細節後,我們發現36%的交易員持看好態度,而30%顯示了看淡傾向。在我們發現的所有交易中,有4起看跌交易,價值爲193,024美元,而32起看漲交易,價值爲2,087,431美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $230.0 and $355.0 for Visa, spanning the last three months.

在評估交易量和持倉量後,顯而易見的是主要的市場搬弄是專注於Visa股票價格範圍在230.0到355.0美元之間,延續了過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

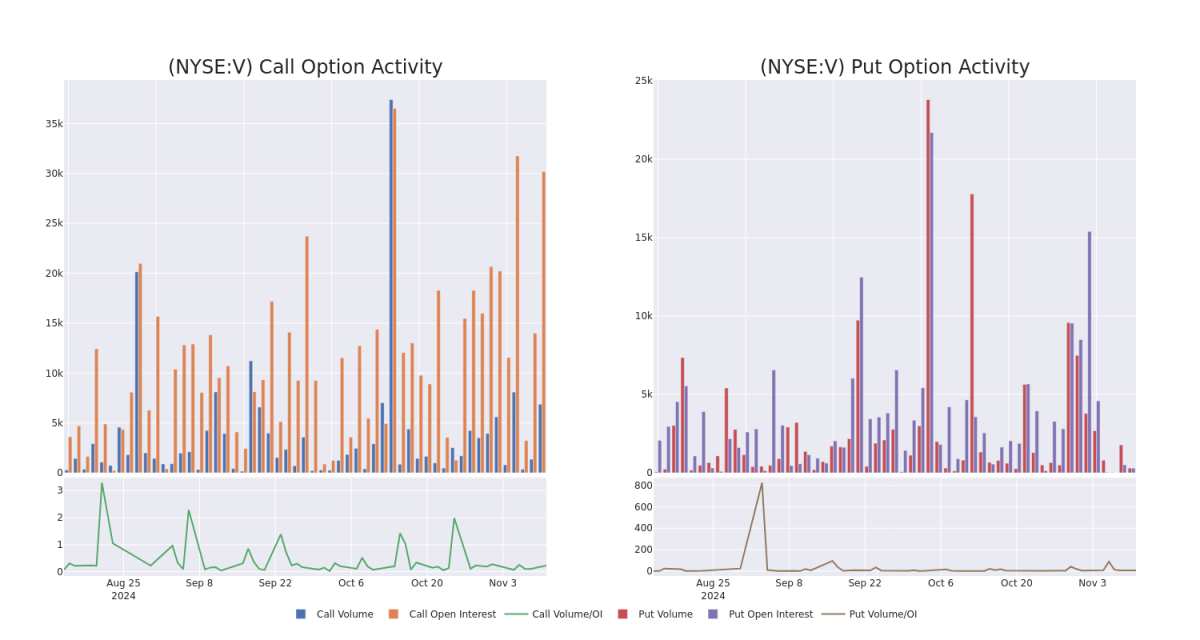

In today's trading context, the average open interest for options of Visa stands at 1451.52, with a total volume reaching 7,175.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $355.0, throughout the last 30 days.

在今日的交易背景中,Visa期權的平均持倉量爲1451.52,總成交量達到7,175.00。隨附的圖表描述了過去30天內Visa高價值交易的看漲和看跌期權成交量和持倉量的發展情況,這些交易集中在230.0到355.0美元的行權價格帶內。

Visa Option Activity Analysis: Last 30 Days

維薩期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | TRADE | BULLISH | 12/20/24 | $3.55 | $3.45 | $3.52 | $320.00 | $598.4K | 1.4K | 1.7K |

| V | CALL | SWEEP | BEARISH | 12/20/24 | $8.25 | $8.1 | $8.1 | $310.00 | $126.3K | 1.9K | 193 |

| V | CALL | TRADE | BEARISH | 03/21/25 | $11.25 | $10.6 | $10.6 | $320.00 | $106.0K | 368 | 100 |

| V | CALL | TRADE | BULLISH | 12/20/24 | $10.55 | $9.05 | $10.05 | $305.00 | $100.5K | 1.8K | 100 |

| V | CALL | TRADE | BEARISH | 11/15/24 | $7.65 | $7.6 | $7.6 | $305.00 | $67.6K | 2.4K | 166 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | 看漲 | 交易 | 看好 | 12/20/24 | $3.55 | $3.45 | $3.52 | $320.00 | 598.4千美元 | 1.4K | 1.7千 |

| V | 看漲 | Sweep | BEARISH | 12/20/24 | $8.25 | $8.1 | $8.1 | $310.00 | $126.3K | 1.9K | 193 |

| V | 看漲 | 交易 | BEARISH | 03/21/25 | $11.25 | $10.6 | $10.6 | $320.00 | $106.0K | 368 | 100 |

| V | 看漲 | 交易 | 看好 | 12/20/24 | $10.55 | $9.05 | $10.05 | $305.00 | $100.5K | 1.8千 | 100 |

| V | 看漲 | 交易 | BEARISH | 11/15/24 | $7.65 | $7.6 | $7.6 | $305.00 | $67.6K | 2.4K | 166 |

About Visa

關於Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是世界上最大的支付處理器。在2023財年,它的總成交量接近15萬億美元。Visa在200多個國家和地區開展業務,並可以處理來自160多種貨幣的交易。其系統每秒可處理超過65000筆交易。

Visa's Current Market Status

維薩的當前市場狀況

- Currently trading with a volume of 2,135,630, the V's price is up by 0.78%, now at $310.27.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 73 days.

- 目前成交量爲2,135,630,V的價格上漲了0.78%,目前爲$310.27。

- RSI讀數表明股票目前可能超買。

- 預計發佈收益還有73天。

What Analysts Are Saying About Visa

關於Visa的分析師觀點

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $326.2.

過去30天內,共有5位專業分析師對這支股票進行了評估,設定了平均目標價格爲$326.2。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Macquarie persists with their Outperform rating on Visa, maintaining a target price of $335. * In a cautious move, an analyst from Oppenheimer downgraded its rating to Outperform, setting a price target of $321. * An analyst from TD Cowen persists with their Buy rating on Visa, maintaining a target price of $325. * An analyst from Jefferies persists with their Buy rating on Visa, maintaining a target price of $330. * An analyst from BMO Capital has decided to maintain their Outperform rating on Visa, which currently sits at a price target of $320.

20年期權交易老手揭示其一行圖表技術,可顯示何時買入和賣出。複製他的交易,這些交易平均每20天獲利27%。點擊這裏獲取訪問。*摩根士丹利(Macquarie)的分析師堅持對Visa給予超越市場評級,並維持335美元的目標價。*Oppenheimer的分析師謹慎行事,將其評級下調至超越市場,並設定了321美元的目標價。*TD Cowen的分析師堅持給予Visa買入評級,並維持325美元的目標價。*Jefferies的分析師堅持給予Visa買入評級,並維持330美元的目標價。*BMO Capital的分析師決定維持對Visa的超越市場評級,目前的目標價爲320美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

In today's trading context, the average open interest for options of Visa stands at 1451.52, with a total volume reaching 7,175.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $355.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Visa stands at 1451.52, with a total volume reaching 7,175.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $355.0, throughout the last 30 days.