ADTRAN Holdings, Inc. (NASDAQ:ADTN) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

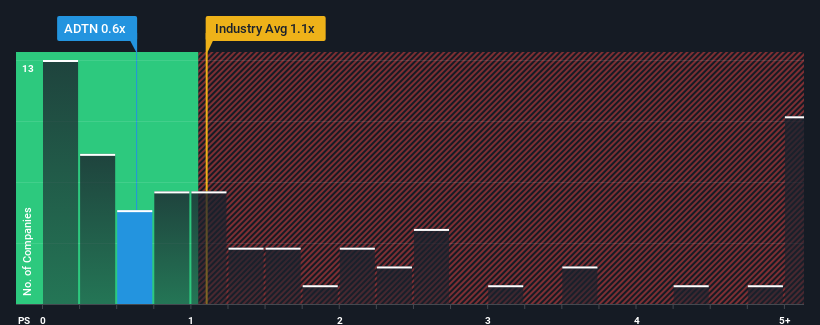

Although its price has surged higher, there still wouldn't be many who think ADTRAN Holdings' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Communications industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has ADTRAN Holdings Performed Recently?

While the industry has experienced revenue growth lately, ADTRAN Holdings' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ADTRAN Holdings will help you uncover what's on the horizon.How Is ADTRAN Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like ADTRAN Holdings' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like ADTRAN Holdings' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. Even so, admirably revenue has lifted 78% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 11% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 9.6% per year, which is not materially different.

In light of this, it's understandable that ADTRAN Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

ADTRAN Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A ADTRAN Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Communications industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 1 warning sign for ADTRAN Holdings that you need to take into consideration.

If you're unsure about the strength of ADTRAN Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.