On Nov 08, major Wall Street analysts update their ratings for $HubSpot (HUBS.US)$, with price targets ranging from $610 to $750.

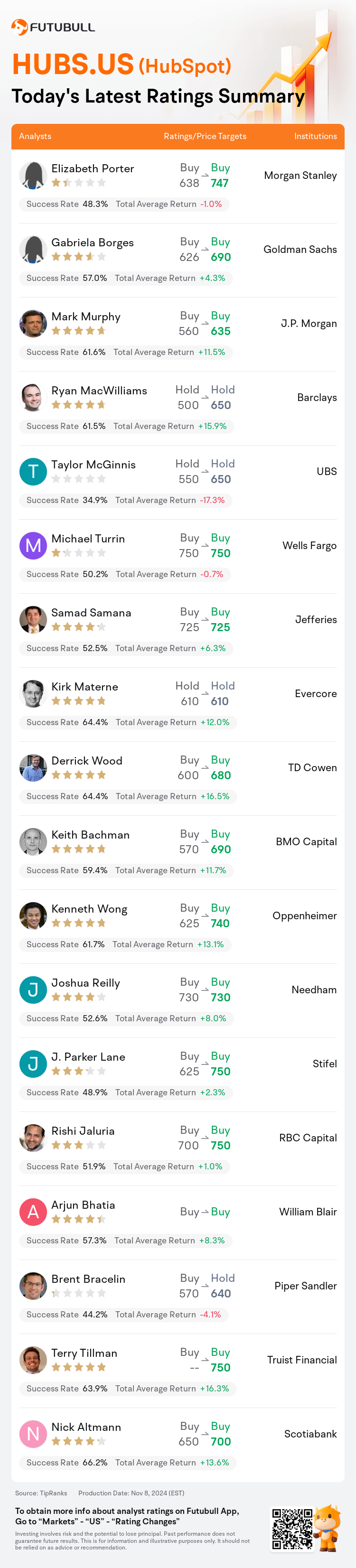

Morgan Stanley analyst Elizabeth Porter maintains with a buy rating, and adjusts the target price from $638 to $747.

Goldman Sachs analyst Gabriela Borges maintains with a buy rating, and adjusts the target price from $626 to $690.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $560 to $635.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $560 to $635.

Barclays analyst Ryan MacWilliams maintains with a hold rating, and adjusts the target price from $500 to $650.

UBS analyst Taylor McGinnis maintains with a hold rating, and adjusts the target price from $550 to $650.

Furthermore, according to the comprehensive report, the opinions of $HubSpot (HUBS.US)$'s main analysts recently are as follows:

The demand climate for HubSpot seems incrementally positive, with expectations leaning towards a favorable reception of the seat-based pricing model.

HubSpot demonstrated robust execution in their core growth strategies, which translated into strong third-quarter performance across various growth measures. Insights indicate that strength was observed in both up-market and down-market segments, contributing to the positive outcome.

HubSpot demonstrated a solid performance in Q3, meeting investor expectations with a 20% increase in revenue and billings. This growth represents only a slight slowdown from the low-20s percentage growth observed in the first half of 2024.

HubSpot reported a strong quarter that exceeded expectations, showcasing an increase in revenue, billings, and operating margin that align with recent trends, amidst an unchanged macroeconomic environment. The company also experienced an acceleration in upmarket momentum.

HubSpot's Q3 billings and revenue surpassed consensus and investor expectations, according to an analyst. The management pointed to significant deals and momentum across multiple hubs, indicating the platform's enhanced alignment with upmarket needs. This performance reflects the exceedingly positive reactions from partners and customers following a recent event.

Here are the latest investment ratings and price targets for $HubSpot (HUBS.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月8日,多家华尔街大行更新了$HubSpot (HUBS.US)$的评级,目标价介于610美元至750美元。

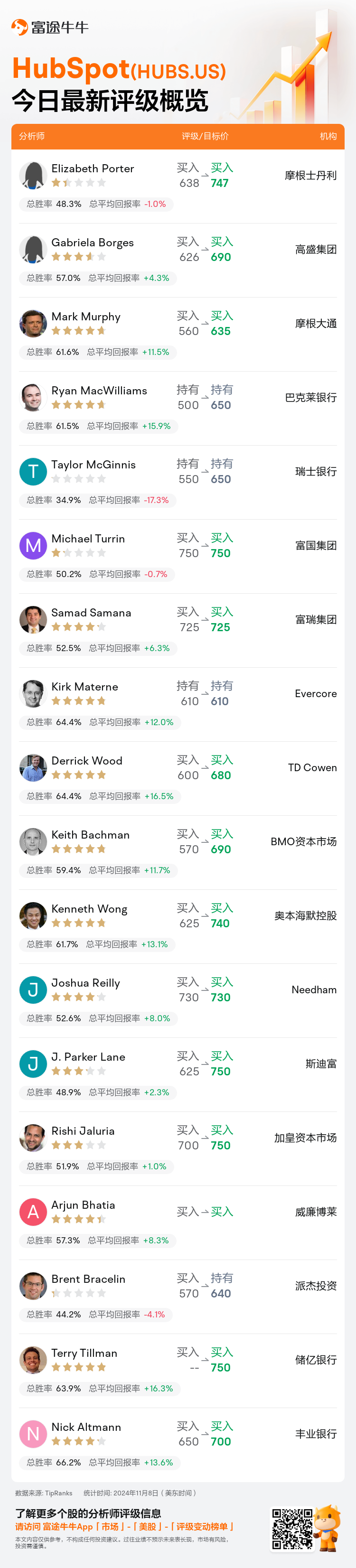

摩根士丹利分析师Elizabeth Porter维持买入评级,并将目标价从638美元上调至747美元。

高盛集团分析师Gabriela Borges维持买入评级,并将目标价从626美元上调至690美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从560美元上调至635美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从560美元上调至635美元。

巴克莱银行分析师Ryan MacWilliams维持持有评级,并将目标价从500美元上调至650美元。

瑞士银行分析师Taylor McGinnis维持持有评级,并将目标价从550美元上调至650美元。

此外,综合报道,$HubSpot (HUBS.US)$近期主要分析师观点如下:

HubSpot的需求氛围似乎呈逐步积极增长,预期偏向对基于座位的定价模型的良好接受。

hubspot在其核心增长策略中展示了强劲的执行力,这转化为第三季度在各种增长指标上表现强劲。洞察显示,强势表现同时出现在上市场和下市场领域,对正面结果产生贡献。

HubSpot在第三季度表现出色,符合投资者预期,营业收入和账单增长率增长20%。这种增长仅比2024年上半年观察到的20%左右的增长略微放缓。

HubSpot报告了一个强劲的季度,超出预期,展示出营收、账单和营业利润率的增长与最近趋势一致,尽管宏观经济环境未变。公司还在上市场动能方面经历了加速。

一位分析师表示,HubSpot的第三季度账单和营业收入超过了共识和投资者的预期。管理层指向了跨多个hub的重大交易和动力,表明该平台与上市场需求的协调得到了增强。这一表现反映出最近活动后合作伙伴和客户的极其积极反应。

以下为今日18位分析师对$HubSpot (HUBS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从560美元上调至635美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从560美元上调至635美元。

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $560 to $635.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $560 to $635.