Great-West Lifeco Reports Record Base Earnings in the Third Quarter of 2024

Great-West Lifeco Reports Record Base Earnings in the Third Quarter of 2024

Great-West Lifeco Inc.'s Quarterly Report to Shareholders for the third quarter of 2024, including its Management's Discussion and Analysis (MD&A) and condensed consolidated interim unaudited financial statements, are available at greatwestlifeco.com/financial-reports and sedarplus.comOpens a new website in a new window. Readers are referred to the Basis of presentation, Cautionary note regarding Forward-Looking Information and Cautionary note regarding Non-GAAP Financial Measures and Ratios sections at the end of this release for additional information on disclosures. All figures are expressed in millions of Canadian dollars, unless otherwise noted.

Great-West Lifeco Inc. '向股东提交的2024年第三季度季度报告,包括其管理层的讨论与分析(MD&A)和简明的未经审计的中期合并财务报表,可在greatwestlifeco.com/financial-reports和Sedarplus.com在新窗口中打开新网站上查阅。有关披露的更多信息,请读者参阅本新闻稿末尾的陈述基础、关于前瞻性信息的警示说明以及有关非公认会计准则财务指标和比率的警示性说明部分。除非另有说明,所有数字均以百万加元表示。

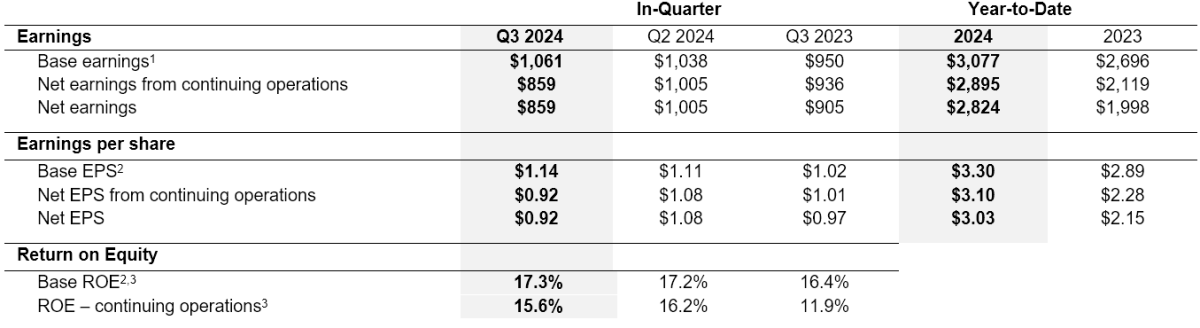

- Base earnings of $1,061 million, or $1.14 per share, up 12% from the third quarter of 2023

- Net earnings from continuing operations of $859 million or $0.92 per share, down 9% from a year ago

- Base ROE of 17.3% and ROE from continuing operations of 15.6%

- LICAT Ratio of 134%

- Book value per share of $25.78, up 7% year over year

- 基本收益为10.61亿美元,合每股收益1.14美元,较2023年第三季度增长12%

- 持续经营业务净收益为8.59亿美元,合每股收益0.92美元,较去年同期下降9%

- 基本投资回报率为17.3%,持续经营业务的投资回报率为15.6%

- LiCat 比率为 134%

- 每股账面价值为25.78美元,同比增长7%

Winnipeg, November 6, 2024 – Great-West Lifeco Inc. (Lifeco or the Company) today announced its third quarter 2024 results.

温尼伯,2024年11月6日——Great-West Lifeco Inc.(Lifeco或公司)今天公布了其2024年第三季度业绩。

"We continue to execute on our focused strategies to deliver sustainable and profitable growth for our shareholders. In our fifth consecutive quarter of record base earnings, we're delivering at the top end of our medium-term financial objectives," said Paul Mahon, President and CEO, Great-West Lifeco. "We have strong underlying momentum across all of our segments, and we have delivered on key actions to support and accelerate our growth strategies in both the U.S. and Canada. At the same time, the strength of our disciplined approach to managing our business is demonstrated through recent actuarial assumption reviews and their positive impact on our capital levels."

“我们将继续执行我们的重点战略,为股东带来可持续和盈利的增长。Great-West Lifeco总裁兼首席执行官保罗·马洪说,这是我们连续第五个季度创纪录的基本收益,实现了中期财务目标的最高水平。“我们在所有细分市场都有强劲的潜在势头,我们已经采取了关键行动,以支持和加快我们在美国和加拿大的增长战略。同时,最近的精算假设审查及其对我们资本水平的积极影响证明了我们严格的业务管理方法的力量。”

Key Financial Highlights

主要财务亮点

1 This is a non-GAAP financial measure. Refer to the "Non-GAAP Financial Measures and Ratios" section of this document for additional details.

2 Base EPS and base return on equity are non-GAAP ratios. Refer to the "Non-GAAP Financial Measures and Ratios" section of this document for additional details.

3 Base return on equity and return on equity – continuing operations are calculated using the trailing four quarters of applicable earnings and common shareholders' equity.

1 这是一项非公认会计准则财务指标。有关其他详细信息,请参阅本文档的 “非公认会计准则财务指标和比率” 部分。

2 基本每股收益和基本股本回报率是非公认会计准则比率。有关其他详细信息,请参阅本文档的 “非公认会计准则财务指标和比率” 部分。

3 基本股本回报率和股本回报率——持续经营使用过去四个季度的适用收益和普通股股东权益来计算。

Record base earnings1 of $1,061 million or $1.14 per common share, up 12% from $950 million a year ago reflects continued pre-tax growth and higher earnings on surplus from all segments, partially offset by the impact of the Global Minimum Tax (GMT) in the Capital and Risk Solutions and Europe segments. Base earnings growth was driven by net fee and spread income growth from higher equity markets and the addition of Investment Planning Counsel (IPC) and Value Partners, higher investment earnings, as well as favourable experience in the U.S. life reinsurance business. These items were partially offset by unfavourable group mortality experience in the Europe segment.

创纪录的基本收益1为10.61亿美元,合每股普通股1.14美元,较去年同期的9.5亿美元增长12%,这反映了持续的税前增长以及所有板块盈余收益的增加,但资本和风险解决方案以及欧洲板块全球最低税(GMT)的影响部分抵消了这一影响。基础收益增长是由净费用和利差收入的增长推动的,股票市场走高,投资规划顾问(IPC)和惠普合伙人的加入,更高的投资收益以及美国人寿再保险业务的良好经验。欧洲细分市场不利的群体死亡率经历部分抵消了这些项目。

Net earnings from continuing operations of $859 million or $0.92 per common share, compared to $936 million a year ago reflects less favourable impacts of relative interest rate movements, including spread movements, and more unfavourable fair value impacts of assumption changes and management actions partially offset by higher base earnings. The third quarter of 2023 included reductions in commercial property values in the Europe segment.

与去年同期的9.36亿美元相比,持续经营业务的净收益为8.59亿美元,合每股普通股收益0.92美元,这反映了包括利差变动在内的相对利率变动的不利影响,以及假设变动和管理行动带来的更不利的公允价值影响被较高的基本收益部分抵消。2023年第三季度包括欧洲板块商业地产价值的下降。

In the third quarter of 2024, the Company completed certain actuarial assumption reviews and model refinements related to insurance contract liabilities which resulted in a positive economic impact. Within the Company's financial statements this is observed through an increase to contractual service margin on non-participating business of $305 million and a negative impact to net earnings of $203 million. These assumption changes improved the capital position of the Company, increasing the Canada Life LICAT ratio by two points. The assumption changes have a modest positive impact on base earnings from the beginning of third quarter of 2024 onwards.

2024年第三季度,公司完成了与保险合同负债相关的某些精算假设审查和模型完善,从而产生了积极的经济影响。在公司的财务报表中,通过将非参与业务的合同服务利润率提高3.05亿美元以及对2.03亿美元净收益的负面影响来观察到这一点。这些假设变更改善了公司的资本状况,使加拿大人寿的LiCat比率提高了两个百分点。从2024年第三季度初开始,假设变化对基本收益产生了适度的积极影响。

Highlights

亮点

- Record base earnings for the fifth consecutive quarter:

- Base EPS up 14% year-to-date and on track to exceed our medium-term objective in 2024.

- Base ROE at the top end of the range of our medium-term objective.

- Strong regulatory capital levels continue to provide substantial flexibility.

- Wealth and Retirement businesses continue to drive growth across the business with total Lifeco assets under administration (AUA)4 exceeding $3 trillion for the first time:

- Strong asset growth across each operating segment, with year-over-year average AUA4 growth of 43% in Canada5 and 21% in Europe; while at Empower, robust year-over-year average AUA growth in Defined Contribution (DC) of 16% and 25% in Personal Wealth.

- In Canada, individual segregated fund sales have grown 26% from prior year and total Individual Wealth Management net asset flows6 (excluding IPC and Value Partners) are up $113 million from prior year and up $189 million from the second quarter of 2024. IPC and Value Partners have contributed $407 million of net asset inflows in 2024.

- Canada Life is extending its reach in the underserved Canadian mass market, with a distribution agreement signed in the third quarter of 2024 with managing general agent Primerica Life Insurance Company of Canada (Primerica) which provides Primerica's advisors with access to a curated segregated fund shelf.

- International product sales drove Wealth & Asset Management sales growth of 38% in the U.K. from the prior year and Wealth & Asset Management AUA is up 22% in Ireland from the prior year.

- Empower continues to execute on its strategy, strengthening confidence in delivering on the U.S. segment base earnings growth objective for 2024:

- U.S. delivered strong base earnings growth of 35% for the quarter.

- Base ROE has increased approximately 300 basis points in the past 12 months.

- Results at Empower are driven by market performance and positive net flows in Personal Wealth.

- Empower acquired Plan Management Corporation (PMC), the creator of OptionTrax, a digital equity plan administration and service provider, expanding Empower's retirement services to employers who offer equity compensation programs as well as enhancing financial planning services offered through the Empower Personal Wealth business.

- Disciplined approach to managing business remains a core attribute contributing to the strength and stability of the Company's long-term performance:

- Current preliminary estimates of insured losses arising from recent catastrophe events do not reach the level where any significant claims would be anticipated. The Company also monitors potential impacts of recent geopolitical conflicts, which are not expected to have a material effect on results.

- 连续第五个季度创纪录的基本收益:

- 迄今为止,基本每股收益增长了14%,有望在2024年超过我们的中期目标。

- 将投资回报率设定在我们中期目标区间的最高水平。

- 强劲的监管资本水平继续提供极大的灵活性。

- 财富和退休业务继续推动整个业务的增长,Lifeco管理的总资产(AUA)4首次超过3万亿美元:

- 每个运营板块的资产均实现强劲增长,加拿大AUA4的平均同比增长43%5,欧洲为21%;而在Empower,固定缴款(DC)的AUA平均同比增长强劲增长,为16%,个人财富为25%。

- 在加拿大,个人独立基金的销售额比上年增长了26%,个人财富管理净资产流量总额6(不包括IPC和惠理投资)比上年增长了1.13亿美元,比2024年第二季度增长了1.89亿美元。IPC和惠理伙伴在2024年贡献了4.07亿美元的净资产流入。

- 加拿大人寿正在扩大其在服务不足的加拿大大众市场的影响力,于2024年第三季度与管理总代理加拿大Primerica人寿保险公司(Primerica)签署了分销协议,该公司为Primerica的顾问提供了获得精心策划的隔离基金架的机会。

- 国际产品销售推动英国财富与资产管理的销售额比上年增长了38%,爱尔兰财富与资产管理AUA的销售额比上年增长了22%。

- Empower继续执行其战略,增强了人们对实现2024年美国细分市场基本收益增长目标的信心:

- 美国本季度实现了35%的强劲基本收益增长。

- 在过去的12个月中,基本投资回报率增加了约300个基点。

- Empower的业绩是由市场表现和个人财富的正净流量推动的。

- Empower收购了数字股权计划管理和服务提供商OptionTrax的创建者计划管理公司(PMC),将Empower的退休服务扩展到提供股权补偿计划的雇主,并加强了通过Empower个人财富业务提供的财务规划服务。

- 严谨的业务管理方法仍然是促进公司长期业绩强度和稳定性的核心特征:

- 目前对最近灾难事件造成的保险损失的初步估计没有达到任何重大索赔的预期水平。该公司还监测近期地缘政治冲突的潜在影响,预计这些冲突不会对业绩产生实质性影响。

4 This is a non-GAAP financial measure. Refer to the "Non-GAAP Financial Measures and Ratios" section of this document for additional details.

5 Includes Investment Planning Counsel (IPC) and Value Partners acquisitions.

6 An indicator of the Company's ability to attract and retain business and includes cash flows related to segregated funds and proprietary and non-proprietary mutual funds.

4 这是一项非公认会计准则财务指标。有关其他详细信息,请参阅本文档的 “非公认会计准则财务指标和比率” 部分。

5 包括投资规划顾问(IPC)和惠理合伙人的收购。

6 衡量公司吸引和保留业务能力的指标,包括与隔离基金以及专有和非专有共同基金相关的现金流。

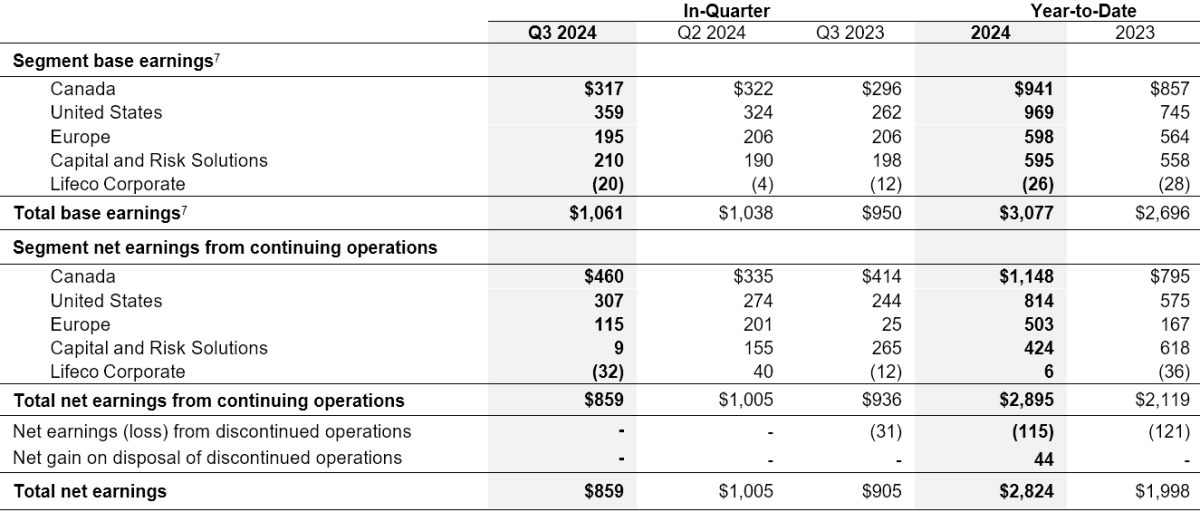

SEGMENTED OPERATING RESULTS

分段经营业绩

For reporting purposes, Lifeco's consolidated operating results are grouped into five reportable segments – Canada, United States, Europe, Capital and Risk Solutions and Lifeco Corporate – reflecting the management and corporate structure of the Company. For more information, refer to the Company's third quarter 2024 interim Management's Discussion and Analysis (MD&A).

出于报告目的,Lifeco的合并经营业绩分为五个可报告的部门——加拿大、美国、欧洲、资本和风险解决方案以及Lifeco Corporate——反映了公司的管理和公司结构。欲了解更多信息,请参阅公司2024年第三季度中期管理层的讨论与分析(MD&A)。

7 This is a non-GAAP financial measure. Refer to the "Non-GAAP Financial Measures and Ratios" section of this document for additional details.

7 这是一项非公认会计准则财务指标。有关其他详细信息,请参阅本文档的 “非公认会计准则财务指标和比率” 部分。

CANADA

加拿大

- Q3 Canada segment base earnings of $317 million and net earnings of $460 million – Base earnings of $317 million increased by $21 million, or 7%, compared to the same quarter last year, reflecting higher net fee and spread income from the addition of IPC and Value Partners and higher equity markets, as well as improved credit experience and higher earnings on surplus. These items were partially offset by lower CSM recognized for services provided in Insurance and Annuities driven by actuarial assumption changes.

- 加拿大第三季度分部基本收益为3.17亿美元,净收益为4.6亿美元——与去年同期相比,3.17亿美元的基本收益增长了2100万美元,增长了7%,这反映了IPC和Value Partners的加入以及股票市场的增加所带来的净费用和利差收入的增加,以及信贷体验的改善和盈余收益的增加。由于精算假设的变化,保险和年金中提供的服务确认的CsM减少,部分抵消了这些项目。

UNITED STATES

美国

- Q3 United States segment base earnings of US$264 million ($359 million) and net earnings from continuing operations of US$225 million ($307 million) – Base earnings of US$264 million increased by US$69 million, or 35%, compared to the third quarter of 2023, primarily due to an increase in fee income driven by growth in the business and higher equity markets, as well as higher earnings on surplus assets, partially offset by higher crediting rates and higher growth-related operating expenses.

- 第三季度美国分部基本收益为2.64亿美元(3.59亿美元),持续经营净收益为2.25亿美元(3.07亿美元)——与2023年第三季度相比,基础收益为2.64亿美元,增长了6,900万美元,增长了35%,这主要是由于业务增长和股票市场上涨推动的费用收入增加,以及剩余资产收益的增加,但被更高的信贷利率和更高的更高所部分抵消与增长相关的运营费用。

EUROPE

欧洲

- Q3 Europe segment base earnings of $195 million and net earnings of $115 million – Base earnings of $195 million decreased by $11 million, or 5%, compared to the same quarter last year, primarily due to unfavourable group mortality experience in the U.K., tax impacts from the prior year in Germany that did not repeat and a higher effective tax rate due to the implementation of the GMT. These items were partially offset by higher fee income in the U.K. and Ireland as well as favourable impacts from trading activity in the U.K. On a pre-tax, constant currency basis, base earnings have increased 10% compared to the same quarter last year.

- 第三季度欧洲分部基本收益为1.95亿美元,净收益为1.15亿美元——与去年同期相比,基本收益为1.95亿美元,下降了5%,这主要是由于英国不利的群体死亡率、德国上一年度的税收影响没有重演,以及格林威治标准的实施导致的有效税率提高。英国和爱尔兰费用收入的增加以及英国贸易活动的有利影响部分抵消了这些项目。按税前固定货币计算,基本收益与去年同期相比增长了10%。

CAPITAL AND RISK SOLUTIONS

资本和风险解决方案

- Q3 Capital and Risk Solutions segment base earnings of $210 million and net earnings of $9 million – Base earnings of $210 million increased by $12 million, or 6%, compared to the same quarter last year, as favourable claims experience in the U.S. life business and higher earnings on surplus were partially offset by the impact of the GMT. Excluding the $26 million impact of the GMT, base earnings were up 19% compared to the third quarter of 2023.

- 第三季度资本和风险解决方案板块基本收益为2.1亿美元,净收益为900万美元——与去年同期相比,2.1亿美元的基本收益增长了1200万美元,增长了6%,原因是美国人寿业务良好的理赔经验和盈余收益的增加被格林威治标准时间的影响。不包括格林威治标准时间对2600万美元的影响,与2023年第三季度相比,基本收益增长了19%。

QUARTERLY DIVIDENDS

季度分红

The Board of Directors approved a quarterly dividend of $0.555 per share on the common shares of Lifeco payable December 31, 2024 to shareholders of record at the close of business December 3, 2024.

董事会批准了Lifeco普通股每股0.555美元的季度股息,股息将于2024年12月31日支付给2024年12月3日营业结束时的登记股东。

In addition, the Directors approved quarterly dividends on Lifeco's preferred shares, as follows:

此外,董事们批准了Lifeco优先股的季度分红,如下所示:

First Preferred Shares |

Amount, per share |

Series G |

$0.3250 |

Series H |

$0.30313 |

Series I |

$0.28125 |

Series L |

$0.353125 |

Series M |

$0.3625 |

Series N |

$0.109313 |

Series P |

$0.3375 |

Series Q |

$0.321875 |

Series R |

$0.3000 |

Series S |

$0.328125 |

Series T |

$0.321875 |

Series Y |

$0.28125 |

第一股优先股 |

每股金额 |

G 系列 |

0.3250 美元 |

H 系列 |

0.30313 美元 |

第一辑 |

0.28125 美元 |

L 系列 |

0.353125 美元 |

M 系列 |

0.3625 美元 |

N 系列 |

0.109313 美元 |

P 系列 |

0.3375 美元 |

Q 系列 |

0.321875 美元 |

R 系列 |

0.3000 美元 |

S 系列 |

0.328125 美元 |

T 系列 |

0.321875 美元 |

Y 系列 |

0.28125 美元 |

For purposes of the Income Tax Act (Canada), and any similar provincial legislation, the dividends referred to above are eligible dividends.

就《所得税法》(加拿大)和任何类似的省级立法而言,上述股息是合格股息。

Third Quarter Conference Call

第三季度电话会议

Lifeco's third quarter conference call and audio webcast will be held on Thursday November 7, 2024 at 10 a.m. ET.

Lifeco的第三季度电话会议和网络音频直播将于美国东部时间2024年11月7日星期四上午10点举行。

The live webcast of the call will be available at 3rd Quarter 2024 – Conference Call and Webcast (greatwestlifeco.com) or by calling 1-844-763-8274 (toll-free) or 1-647-484-8814 for International participants.

电话会议的网络直播将于2024年第三季度播出——电话会议和网络直播(greatwestlifeco.com),或致电1-844-763-8274(免费电话)或1-647-484-8814供国际参与者观看。

A replay of the call will be available following the event on our website or by calling 1-855-669-9658 (Canada toll-free) or 1-877-344-7529 (U.S. toll-free) and using the access code 6085380.

活动结束后,将在我们的网站上重播电话会议,也可以拨打1-855-669-9658(加拿大免费电话)或1-877-344-7529(美国免费电话)并使用接入码6085380。

Selected financial information is attached.

随函附上选定的财务信息。

GREAT-WEST LIFECO INC.

Great-West LIFECO INC.

Great-West Lifeco is a Canadian headquartered, international financial services holding company with interests in life insurance, health insurance, retirement and investment services, asset management and reinsurance businesses. We operate in Canada, the United States and Europe under the brands Canada Life, Empower, and Irish Life. At the start of 2024, our companies had over 32,250 employees, 106,000 advisor relationships, and thousands of distribution partners – serving approximately 40 million customer relationships.

Great-West Lifeco是一家总部位于加拿大的国际金融服务控股公司,在人寿保险、健康保险、退休和投资服务、资产管理和再保险业务方面拥有权益。我们以加拿大人寿、Empower和爱尔兰人寿品牌在加拿大、美国和欧洲开展业务。2024年初,我们的公司拥有超过32,250名员工,10.6万名顾问关系和数千名分销合作伙伴,为大约4000万名客户关系提供服务。

Great-West Lifeco trades on the Toronto Stock Exchange (TSX) under the ticker symbol GWO and is a member of the Power Corporation group of companies. To learn more, visit greatwestlifeco.com.

Great-West Lifeco在多伦多证券交易所(TSX)上市,股票代码为GWO,是电力公司集团的成员。要了解更多信息,请访问 greatwestlifeco.com。

Basis of presentation

列报依据

The condensed consolidated interim unaudited financial statements for the periods ended September 30, 2024 of Lifeco, have been prepared in accordance with International Financial Reporting Standards (IFRS) unless otherwise noted and are the basis for the figures presented in this release, unless otherwise noted.

除非另有说明,否则Lifeco截至2024年9月30日的简明合并中期未经审计的财务报表是根据国际财务报告准则(IFRS)编制的,除非另有说明,否则这些报表是本新闻稿中列出的数据的基础。

Cautionary note regarding Forward-Looking Information

关于前瞻性信息的警示说明

This release contains forward-looking information. Forward-looking information includes statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "will", "may", "expects", "anticipates", "intends", "plans", "believes", "estimates", "objective", "target", "potential" and other similar expressions or negative versions thereof. Forward-looking information includes, without limitation, statements about the Company and its operations, business (including business mix), financial condition, expected financial performance (including revenues, earnings or growth rates, medium-term financial objectives and base earnings objectives for the Empower business), expected earnings contribution of the Company's U.S. segment, strategies and prospects, expected costs and benefits of acquisitions and divestitures (including timing of integration activities and timing and extent of revenue and expense synergies), expected expenditures or investments (including but not limited to investment in technology infrastructure and digital capabilities and solutions and investments in strategic partnerships), value creation and realization of growth opportunities, expected dividend levels, expected cost reductions and savings, expected capital management activities and use of capital, estimates of risk sensitivities affecting capital adequacy ratios, anticipated global economic conditions, potential impacts of catastrophe events, potential impacts of geopolitical conflicts, and the impact of regulatory developments on the Company's business strategy and growth objectives.

本新闻稿包含前瞻性信息。前瞻性信息包括本质上具有预测性、取决于或提及未来事件或条件的陈述,或包含 “将”、“可能”、“期望”、“预期”、“打算”、“计划”、“相信”、“估计”、“目标”、“潜在” 等词语以及其他类似的表述或否定版本。前瞻性信息包括但不限于有关公司及其运营、业务(包括业务组合)、财务状况、预期财务业绩(包括收入、收益或增长率、Empower业务的中期财务目标和基本收益目标)、公司美国分部的预期收益贡献、战略和前景、收购和剥离的预期成本和收益(包括整合活动的时间以及收入和支出的时间和范围)的陈述协同效应)、预期支出或投资(包括但不限于对技术基础设施和数字能力和解决方案的投资以及对战略伙伴关系的投资)、价值创造和增长机会的实现、预期的股息水平、预期的成本削减和节省、预期的资本管理活动和资本使用、影响资本充足率的风险敏感度估计、预期的全球经济状况、灾难事件的潜在影响、地缘政治的潜在影响冲突,以及监管发展对公司业务战略和增长目标的影响。

Forward-looking statements are based on expectations, forecasts, estimates, predictions, projections and conclusions about future events that were current at the time of the statements and are inherently subject to, among other things, risks, uncertainties and assumptions about the Company, economic factors and the financial services industry generally, including the insurance, mutual fund and retirement solutions industries. They are not guarantees of future performance, and the reader is cautioned that actual events and results could differ materially from those expressed or implied by forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance that they will prove to be correct. In particular, in setting its objective to achieve base earnings growth in the Empower business of 15-20% in 2024, management has assumed pre-tax revenue synergies related to the Prudential acquisition of US$20 million by the end of 2024 and that the performance of equity, interest rate and credit markets during the relevant period is consistent with management's expectations, which take into account current market information and assume no credit impairments. In arriving at our assessment of the Company's potential exposure to Pillar Two income taxes and our expectation regarding the impact on our effective income tax rate and base earnings, management has relied on its interpretation of the relevant legislation.

前瞻性陈述基于对未来事件的预期、预测、估计、预测、预测和结论,这些事件在声明发表时是当前的,本质上受有关公司、经济因素和整个金融服务行业(包括保险、共同基金和退休解决方案行业)的风险、不确定性和假设的影响。它们不能保证未来的表现,请读者注意,实际事件和结果可能与前瞻性陈述所表达或暗示的事件和结果存在重大差异。这些假设中有许多是基于公司无法控制的因素和事件,因此无法保证这些因素和事件会被证明是正确的。特别是,在设定2024年实现Empower业务基本收益增长15-20%的目标时,管理层假设与保诚收购2,000万美元相关的税前收入协同效应,相关时期股票、利率和信贷市场的表现与管理层的预期一致,管理层的预期考虑了当前的市场信息,不假设信用减值。在评估公司潜在的第二支柱所得税敞口以及我们对有效所得税率和基本收益影响的预期时,管理层依赖于其对相关立法的解释。

It has also assumed a starting point of its current mix of business and base earnings growth consistent with management's base earnings objectives disclosed in the Company's 2023 Annual MD&A. In all cases, whether or not actual results differ from forward-looking information may depend on numerous factors, developments and assumptions, including, without limitation, the ability to integrate and leverage acquisitions and achieve anticipated benefits and synergies, the achievement of expense synergies and client retention targets from the acquisition of the Prudential retirement business, the Company's ability to execute strategic plans and adapt or recalibrate these plans as needed, the Company's reputation, business competition, assumptions around sales, pricing, fee rates, customer behaviour (including contributions, redemptions, withdrawals and lapse rates), mortality and morbidity experience, expense levels, reinsurance arrangements, global equity and capital markets (including continued access to equity and debt markets and credit instruments on economically feasible terms), geopolitical tensions and related economic impacts, interest and foreign exchange rates, inflation levels, liquidity requirements, investment values and asset breakdowns, hedging activities, financial condition of industry sectors and individual issuers that comprise part of the Company's investment portfolio, credit ratings, taxes, impairments of goodwill and other intangible assets, technological changes, breaches or failure of information systems and security (including cyber attacks), assumptions around third-party suppliers, changes in local and international laws and regulations, changes in accounting policies and the effect of applying future accounting policy changes, changes in actuarial standards, unexpected judicial or regulatory proceedings, catastrophic events, continuity and availability of personnel and third party service providers, unplanned material changes to the Company's facilities, customer and employee relations, levels of administrative and operational efficiencies, and other general economic, political and market factors in North America and internationally.

该公司还假设其当前业务和基础收益增长组合的起点与管理层在公司2023年年度管理分析和分析中披露的基本收益目标一致。在所有情况下,实际业绩是否与前瞻性信息不同可能取决于许多因素、发展和假设,包括但不限于整合和利用收购以及实现预期收益和协同效应的能力、收购后实现支出协同效应和客户留存目标的能力保诚退休业务、公司执行战略计划以及根据需要调整或调整这些计划的能力、公司的声誉、商业竞争、围绕销售、定价、费率、客户行为(包括缴款、赎回、提款和失效率)、死亡率和发病率、支出水平、再保险安排、全球股票和资本市场(包括继续以经济可行的条件进入股票和债务市场以及信贷工具),政治紧张局势及相关问题经济影响、利率和外汇汇率、通货膨胀水平、流动性要求、投资价值和资产明细、套期保值活动、构成公司投资组合一部分的行业部门和个人发行人的财务状况、信用评级、税收、商誉和其他无形资产减值、技术变革、信息系统和安全的泄露或故障(包括网络攻击)、围绕第三方供应商的假设、当地和国际法律法规的变化、法规的变化会计政策以及应用未来会计政策变更的影响、精算标准的变化、意外的司法或监管程序、灾难性事件、人员和第三方服务提供商的连续性和可用性、公司设施、客户和员工关系、行政和运营效率水平的计划外重大变化,以及北美和国际上的其他总体经济、政治和市场因素。

The reader is cautioned that the foregoing list of assumptions and factors is not exhaustive, and there may be other factors listed in other filings with securities regulators, including factors set out in the Company's 2023 Annual MD&A under "Risk Management and Control Practices" and "Summary of Critical Accounting Estimates" and in the Company's annual information form dated February 14, 2024 under "Risk Factors", which, along with other filings, is available for review at . The reader is also cautioned to consider these and other factors, uncertainties and potential events carefully and not to place undue reliance on forward-looking information.

读者请注意,上述假设和因素清单并不详尽,向证券监管机构提交的其他文件中可能还列出了其他因素,包括公司2023年度管理与控制惯例” 和 “关键会计估计摘要” 下列出的因素,以及公司2024年2月14日在 “风险因素” 下的年度信息表中列出的因素,该表与其他文件一起可在以下网址查阅。还提醒读者仔细考虑这些因素和其他因素、不确定性和潜在事件,不要过分依赖前瞻性信息。

Other than as specifically required by applicable law, the Company does not intend to update any forward-looking information whether as a result of new information, future events or otherwise.

除适用法律的特别要求外,公司无意更新任何前瞻性信息,无论是由于新信息、未来事件还是其他原因。

Cautionary note regarding Non-GAAP Financial Measures and Ratios

关于非公认会计准则财务指标和比率的警示说明

This release contains some non-Generally Accepted Accounting Principles (GAAP) financial measures and non-GAAP ratios as defined in National Instrument 52-112 "Non-GAAP and Other Financial Measures Disclosure". Terms by which non-GAAP financial measures are identified include, but are not limited to, "base earnings (loss)", "base earnings (loss) (US$)", "base earnings: insurance service result", "base earnings: net investment result", "assets under management" and "assets under administration". Terms by which non-GAAP ratios are identified include, but are not limited to, "base earnings per common share (EPS)", "base return on equity (ROE)", "base dividend payout ratio" and "effective income tax rate – base earnings – common shareholders". Non-GAAP financial measures and ratios are used to provide management and investors with additional measures of performance to help assess results where no comparable GAAP (IFRS) measure exists. However, non-GAAP financial measures and ratios do not have standard meanings prescribed by GAAP (IFRS) and are not directly comparable to similar measures used by other companies. Refer to the "Non-GAAP Financial Measures and Ratios" section in this release for the appropriate reconciliations of these non-GAAP financial measures to measures prescribed by GAAP as well as additional details on each measure and ratio.

本新闻稿包含一些非公认会计原则(GAAP)财务指标和非公认会计准则比率,定义见国家仪器52-112 “非公认会计准则和其他财务指标披露”。确定非公认会计准则财务指标的术语包括但不限于 “基本收益(亏损)”、“基本收益(亏损)(美元)”、“基本收益:保险服务业绩”、“基本收益:净投资业绩”、“管理的资产” 和 “管理的资产”。确定非公认会计准则比率的术语包括但不限于 “普通股基本收益(EPS)”、“基本股本回报率(ROE)”、“基本股息支付率” 和 “有效所得税税率——基本收益——普通股股东”。非公认会计准则财务指标和比率用于为管理层和投资者提供额外的业绩衡量标准,以帮助评估没有可比公认会计准则(IFRS)指标的情况。但是,非公认会计准则财务指标和比率没有GAAP(IFRS)规定的标准含义,也不能与其他公司使用的类似指标直接比较。请参阅本新闻稿中的 “非公认会计准则财务指标和比率” 部分,了解这些非公认会计准则财务指标与公认会计准则规定的指标的适当对账以及每种衡量标准和比率的更多详细信息。

For more information:

欲了解更多信息:

Media Relations

Leezann Freed-Lobchuk

204-946-4576

media.relations@canadalife.com

媒体关系

Leezann Freed-Lobchuk

204-946-4576

media.relations@canadalife.com

Investor Relations

Shubha Khan

416-552-5951

shubha.khan@canadalife.com

投资者关系

舒巴汗

416-552-5951

shubha.khan@canadalife.com

译文内容由第三方软件翻译。