Market Whales and Their Recent Bets on ORCL Options

Market Whales and Their Recent Bets on ORCL Options

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle (NYSE:ORCL) revealed 38 unusual trades.

金融巨頭在甲骨文上進行了顯著的看好舉動。我們對甲骨文(NYSE:ORCL)的期權歷史分析顯示,有38筆異常交易。

Delving into the details, we found 39% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $249,098, and 33 were calls, valued at $2,196,370.

深入細節後,我們發現39%的交易者持有看好看漲的態度,而39%顯示出看淡的傾向。我們發現的所有交易中,有5筆看跌交易,價值249,098美元,而有33筆看漲交易,價值2,196,370美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $90.0 and $195.0 for Oracle, spanning the last three months.

在評估交易量和未平倉量之後,明顯可以看出,主要市場搬動者正專注於甲骨文的價格區間,介於90.0美元和195.0美元之間,跨越過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

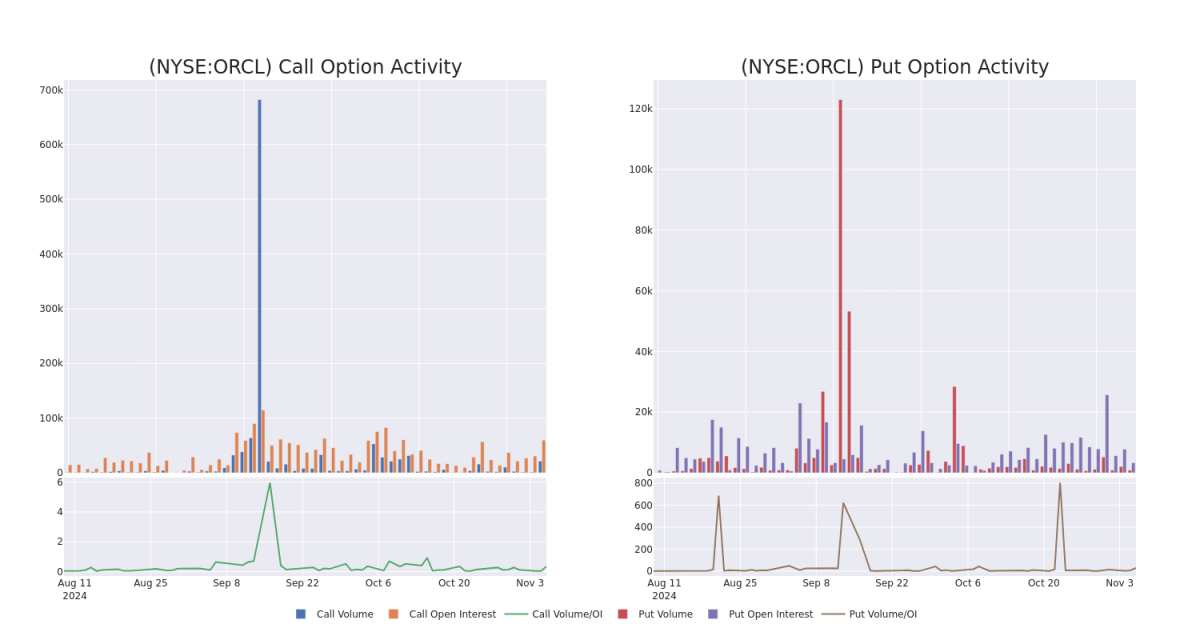

In today's trading context, the average open interest for options of Oracle stands at 2623.67, with a total volume reaching 22,202.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $90.0 to $195.0, throughout the last 30 days.

在今天的交易背景下,甲骨文期權的平均未平倉量爲2623.67,總交易量達到22,202.00。附圖描述了過去30天內,甲骨文區間爲90.0美元至195.0美元的大手交易的看漲看跌期權成交量和未平倉量的變化。

Oracle Option Activity Analysis: Last 30 Days

甲骨文期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BEARISH | 01/16/26 | $95.65 | $92.3 | $93.13 | $90.00 | $186.0K | 238 | 0 |

| ORCL | CALL | TRADE | BULLISH | 11/08/24 | $10.55 | $9.9 | $10.55 | $170.00 | $183.5K | 2.8K | 291 |

| ORCL | CALL | TRADE | NEUTRAL | 01/16/26 | $28.65 | $26.75 | $27.53 | $180.00 | $165.1K | 490 | 61 |

| ORCL | CALL | TRADE | BULLISH | 01/16/26 | $71.8 | $71.3 | $71.8 | $115.00 | $143.6K | 207 | 20 |

| ORCL | CALL | TRADE | BULLISH | 01/17/25 | $24.75 | $24.45 | $24.67 | $160.00 | $123.3K | 3.3K | 57 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看漲 | SWEEP | 看淡 | 01/16/26 | $95.65 | $92.3 | $93.13 | $90.00 | $186.0K | 238 | 0 |

| ORCL | 看漲 | 交易 | 看好 | 11/08/24 | $10.55 | $9.9 | $10.55 | $170.00 | $183.5K | 2.8K | 291 |

| ORCL | 看漲 | 交易 | 中立 | 01/16/26 | $28.65 | 26.75美元 | $27.53 | $180.00 | $165.1K | 490 | 61 |

| ORCL | 看漲 | 交易 | 看好 | 01/16/26 | $71.8 | 71.3美元 | $71.8 | $115.00 | 143.6千美元 | 207 | 20 |

| ORCL | 看漲 | 交易 | 看好 | 01/17/25 | $24.75 | $24.45 | $24.67 | $160.00 | $123.3K | 3.3千 | 57 |

About Oracle

關於Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企業提供數據庫技術和企業資源規劃(ERP)軟件。Oracle成立於1977年,是第一個商用SQL數據庫管理系統的創始人。如今,Oracle在175個國家擁有430,000個客戶,由136,000名員工支持。

In light of the recent options history for Oracle, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Oracle最近的期權歷史,現在適合專注於公司本身。我們旨在探索其當前的表現。

Where Is Oracle Standing Right Now?

Oracle現狀如何?

- Currently trading with a volume of 6,784,472, the ORCL's price is up by 4.77%, now at $179.97.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 33 days.

- ORCL的交易量爲6,784,472,價格上漲了4.77%,目前爲179.97美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計業績發佈還有33天。

What The Experts Say On Oracle

專家對Oracle的看法

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $185.0.

過去一個月,有2位行業分析師分享了他們對這支股票的見解,提出了平均目標價185.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $165. * Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for Oracle, targeting a price of $205.

20年期期權交易專家揭示了他的一行圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取.* RBC Capital的分析師已經將評級調降至板塊表現,將目標價調整至165美元。* 保持他們立場的JMP Securities的分析師繼續持有Oracle的市場跑贏評級,目標價爲205美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和回報潛力。精明的交易員通過不斷學習、調整策略、監控多個指標並密切關注市場動向來管理這些風險。通過Benzinga Pro的實時提醒了解最新的Oracle期權交易情況。

譯文內容由第三人軟體翻譯。

In today's trading context, the average open interest for options of Oracle stands at 2623.67, with a total volume reaching 22,202.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $90.0 to $195.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Oracle stands at 2623.67, with a total volume reaching 22,202.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $90.0 to $195.0, throughout the last 30 days.