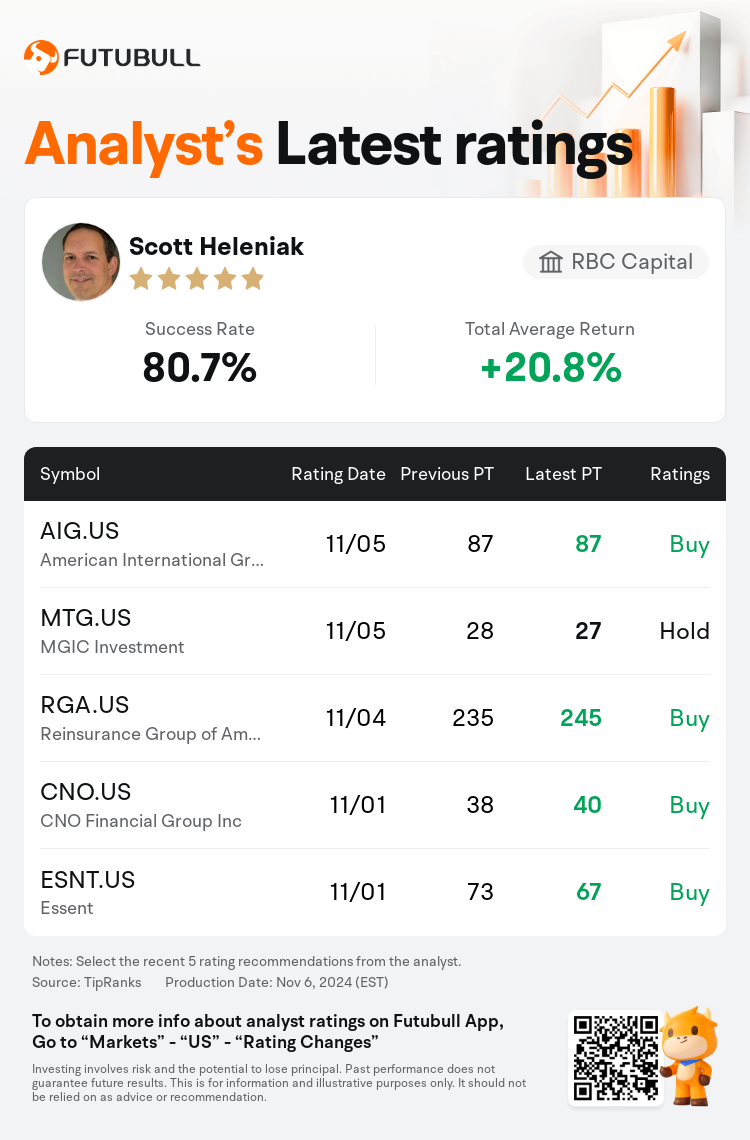

RBC Capital analyst Scott Heleniak maintains $American International Group (AIG.US)$ with a buy rating, and maintains the target price at $87.

According to TipRanks data, the analyst has a success rate of 80.7% and a total average return of 20.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $American International Group (AIG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $American International Group (AIG.US)$'s main analysts recently are as follows:

The shares of AIG witnessed a decline post-earnings as a result of the company's guidance indicating a decrease in net interest income for Q4 and projecting a 10% return on equity (ROE) by 2024. Although this forecast may contain a degree of caution, it is anticipated that the ROE will reach 10.3% in 2025 and further increase to 10.8% in 2026.

Despite surpassing earnings expectations in the third quarter, concerns may arise due to a ULR miss and complexities regarding reserves, as observed with other stocks. Post-earnings report, estimates were modestly adjusted downwards by 1% to account for marginally higher GOE expenses, reduced share repurchases within the quarter, and buybacks that were somewhat below initial estimates, balanced by improved net interest income.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

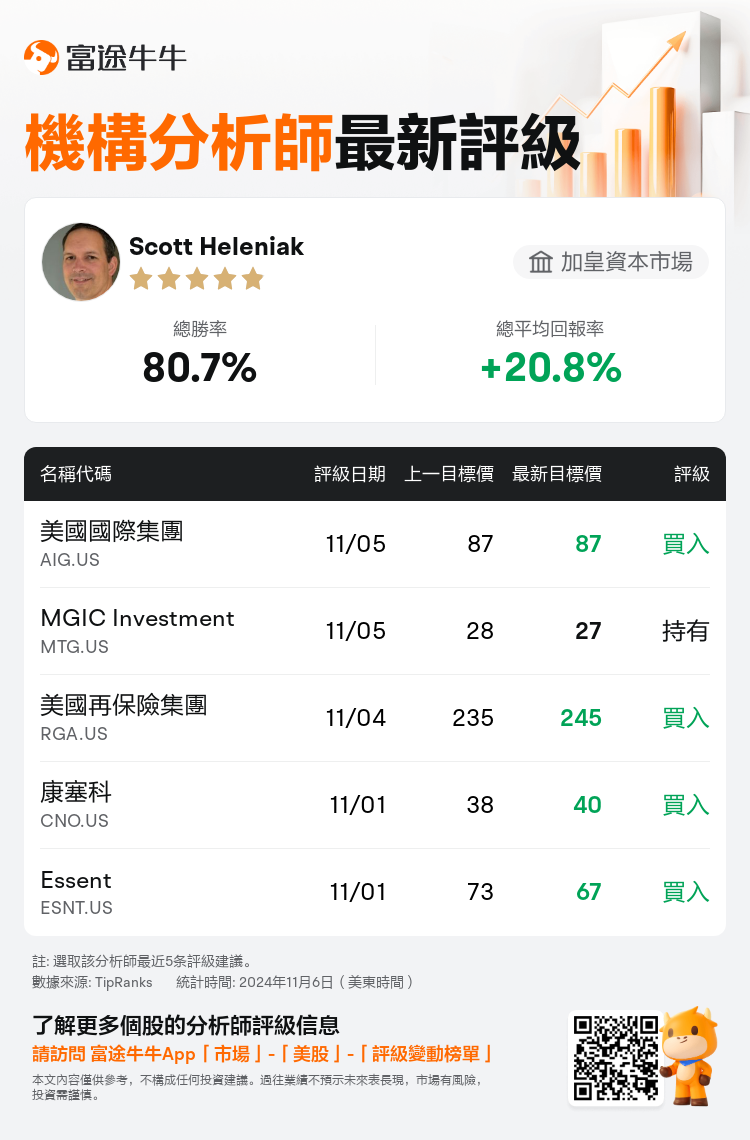

加皇資本市場分析師Scott Heleniak維持$美國國際集團 (AIG.US)$買入評級,維持目標價87美元。

根據TipRanks數據顯示,該分析師近一年總勝率為80.7%,總平均回報率為20.8%。

此外,綜合報道,$美國國際集團 (AIG.US)$近期主要分析師觀點如下:

此外,綜合報道,$美國國際集團 (AIG.US)$近期主要分析師觀點如下:

美國國際集團的股票在盈利發佈後出現下滑,因公司指引顯示第四季度淨利息收入減少,並預計2024年股本回報率爲10%。儘管這一預測可能帶有一定程度的謹慎,但預計ROE將在2025年達到10.3%,並在2026年進一步增至10.8%。

儘管在第三季度超過盈利預期,但可能因錯誤的ULR和其他股票存在的儲備複雜性而引發擔憂。在盈利報告後,預計會將利潤調整下調1%,以考慮較高的GOE費用、季內股票回購減少以及略低於最初預期的回購,而這一調整則由改善的淨利息收入相抵。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$美國國際集團 (AIG.US)$近期主要分析師觀點如下:

此外,綜合報道,$美國國際集團 (AIG.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of