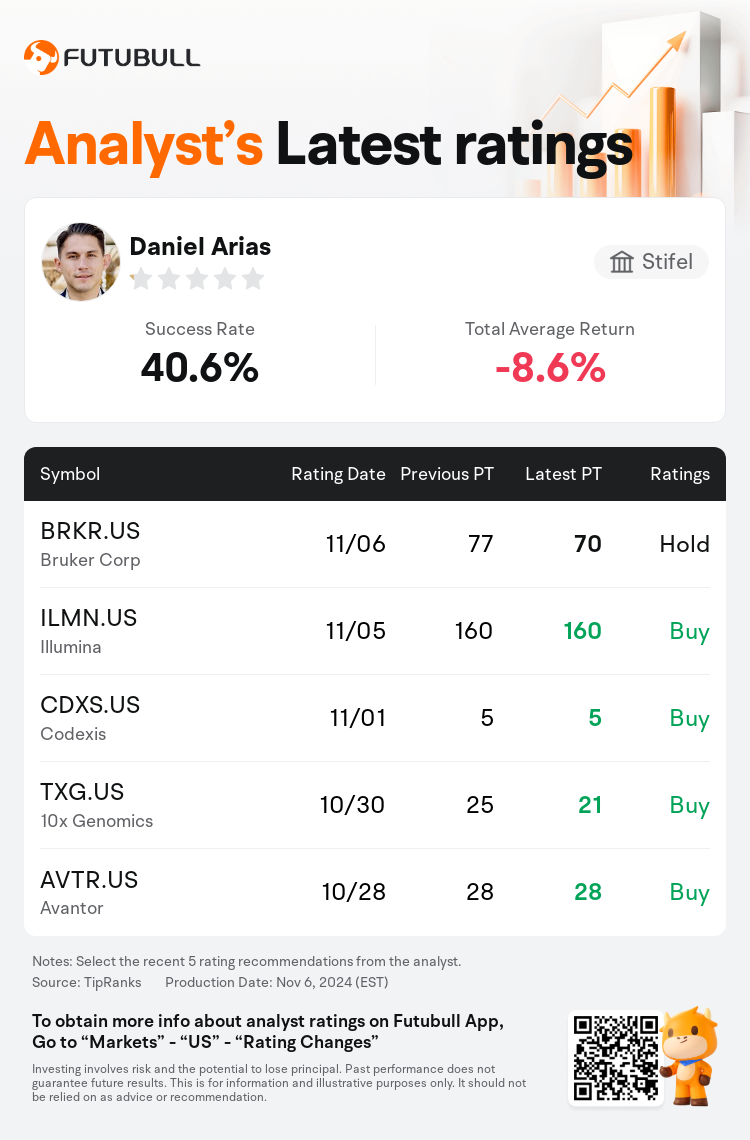

Stifel analyst Daniel Arias maintains $Bruker Corp (BRKR.US)$ with a hold rating, and adjusts the target price from $77 to $70.

According to TipRanks data, the analyst has a success rate of 40.6% and a total average return of -8.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Bruker Corp (BRKR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Bruker Corp (BRKR.US)$'s main analysts recently are as follows:

Bruker experienced continued softness in China and in the biopharmaceutical sector during the quarter, as observed by the analyst.

The company experienced challenging results within a difficult macroeconomic context, according to an analyst. Adjustments to estimates have been made reflecting reduced fiscal 2024 targets. Nonetheless, it is believed that the company's strong positioning in multi-omics and materials sciences will allow it to capitalize on the anticipated demand resurgence in biopharma and China.

Bruker's third-quarter results did not meet expectations, and the company has revised its organic sales growth forecast for fiscal 2024 downward, attributing this adjustment to a more gradual recovery in China and early-stage growth in the biopharma sector. The revision in guidance is explained not by a significant downturn in Q3 markets but by previous forecasts that were perhaps too optimistic. Nevertheless, the company's management conveyed an optimistic outlook for 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

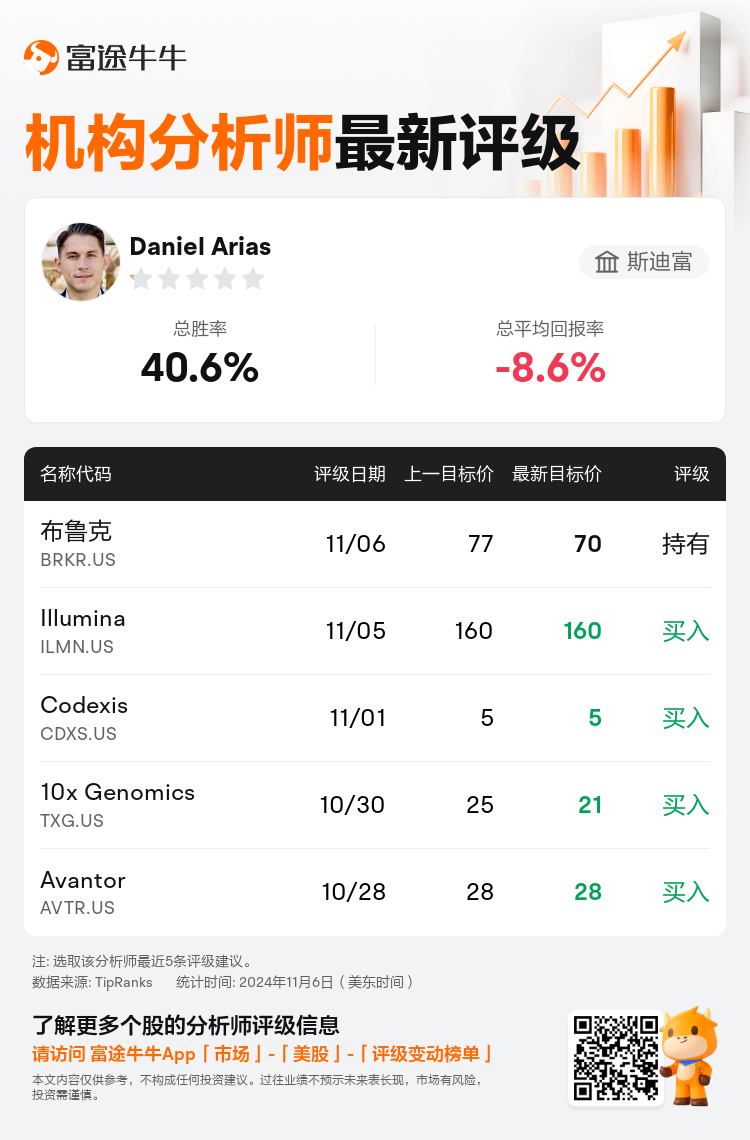

斯迪富分析师Daniel Arias维持$布鲁克 (BRKR.US)$持有评级,并将目标价从77美元下调至70美元。

根据TipRanks数据显示,该分析师近一年总胜率为40.6%,总平均回报率为-8.6%。

此外,综合报道,$布鲁克 (BRKR.US)$近期主要分析师观点如下:

此外,综合报道,$布鲁克 (BRKR.US)$近期主要分析师观点如下:

Bruker在本季度中国和生物制药板块持续疲软,正如分析师所观察到的。

根据分析师的说法,该公司在艰难的宏观经济背景下遇到了挑战性的业绩,已调整估算以反映降低的2024财政目标。尽管如此,人们认为该公司在多组学和材料科学领域的强势定位将使其能够充分利用生物制药和中国预期需求复苏。

Bruker第三季度的业绩未达预期,并已下调其2024财年有机销售增长预测,将这一调整归因于中国需求恢复缓慢和生物制药板块的早期增长。对2025年的展望并不是因为Q3市场出现了明显下滑,而是因为先前的预测可能过于乐观。尽管如此,公司管理层对2025年表达了乐观的展望。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$布鲁克 (BRKR.US)$近期主要分析师观点如下:

此外,综合报道,$布鲁克 (BRKR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of