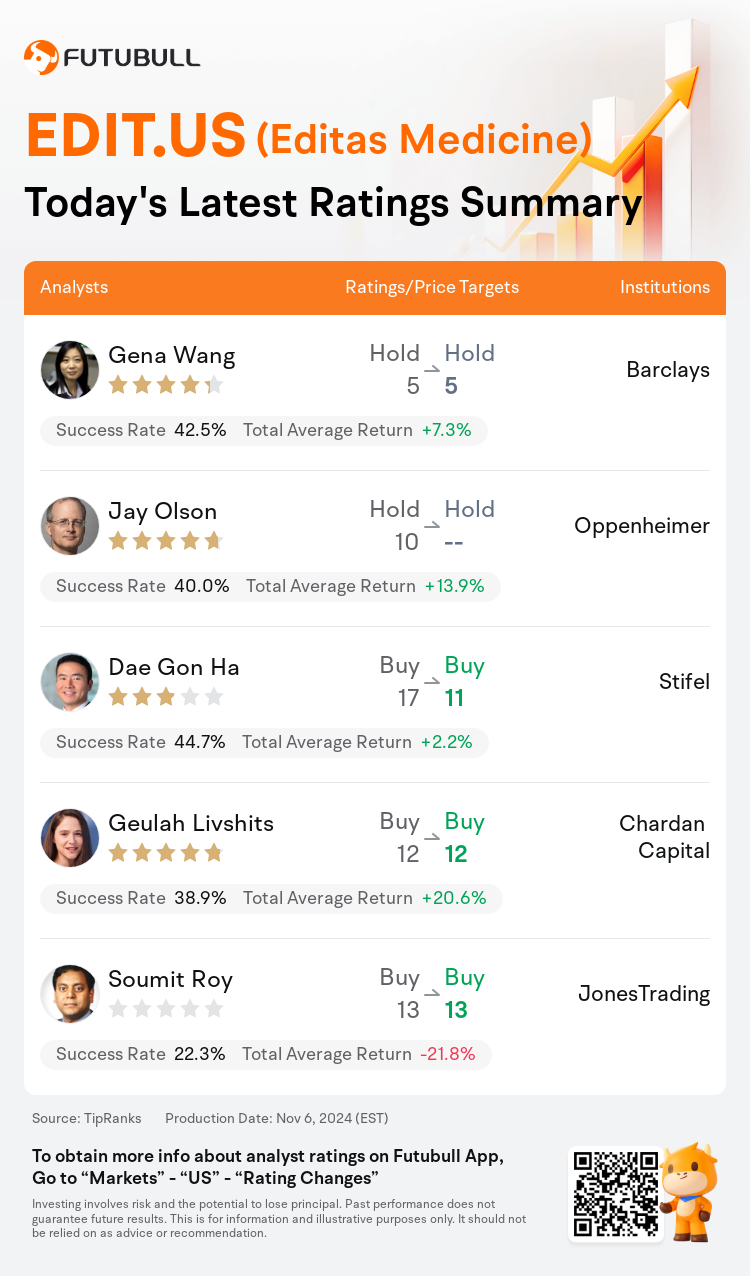

On Nov 06, major Wall Street analysts update their ratings for $Editas Medicine (EDIT.US)$, with price targets ranging from $5 to $13.

Barclays analyst Gena Wang maintains with a hold rating, and maintains the target price at $5.

Oppenheimer analyst Jay Olson maintains with a hold rating.

Stifel analyst Dae Gon Ha maintains with a buy rating, and adjusts the target price from $17 to $11.

Stifel analyst Dae Gon Ha maintains with a buy rating, and adjusts the target price from $17 to $11.

Chardan Capital analyst Geulah Livshits maintains with a buy rating, and maintains the target price at $12.

JonesTrading analyst Soumit Roy maintains with a buy rating, and maintains the target price at $13.

Furthermore, according to the comprehensive report, the opinions of $Editas Medicine (EDIT.US)$'s main analysts recently are as follows:

The company's third quarter presented incremental progress following its strategic update.

The primary discussion among investors regarding Editas Medicine is centered on the debate if the company's new strategy marks progress or regression. The view is that reni-cel for sickle cell disease and transfusion-dependent thalassemia represents an asset with reduced risk that has potential for monetization. This asset also provides essential insights that could be advantageous as the company evaluates future strategies for their in vivo candidate.

The focus of Editas Medicine on in vivo HSPC editing is still viewed as a more efficient allocation of its expertise and resources to generate value. Anticipation is building for the forthcoming in vivo pipeline update in Q1 2025, along with forthcoming updates on reni-cel BD activity.

The recent quarter is viewed as a supplementary period following a strategic change announced earlier. Editas Medicine has shifted focus towards partnering or out-licensing its leading asset for SCD/BT while concentrating on the development of its in vivo pipeline. The decision to partner SCD/BT is considered strategically appropriate given the class's gradual adoption rate. However, a cautious stance is being maintained until more advancement is seen in the in vivo pipeline.

Here are the latest investment ratings and price targets for $Editas Medicine (EDIT.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月6日,多家华尔街大行更新了$Editas Medicine (EDIT.US)$的评级,目标价介于5美元至13美元。

巴克莱银行分析师Gena Wang维持持有评级,维持目标价5美元。

奥本海默控股分析师Jay Olson维持持有评级。

斯迪富分析师Dae Gon Ha维持买入评级,并将目标价从17美元下调至11美元。

斯迪富分析师Dae Gon Ha维持买入评级,并将目标价从17美元下调至11美元。

Chardan Capital分析师Geulah Livshits维持买入评级,维持目标价12美元。

JonesTrading分析师Soumit Roy维持买入评级,维持目标价13美元。

此外,综合报道,$Editas Medicine (EDIT.US)$近期主要分析师观点如下:

该公司的第三季度在战略更新后呈现出增量进展。

投资者讨论editas medicine的主要焦点集中在辩论公司的新策略是否代表进步或退步。认为用于镰状细胞病和依赖输血型地中海贫血的reni-电芯代表着一项风险降低的资产,具有货币化潜力。该资产还提供了至关重要的见解,这些见解在公司评估其体内候选策略时可能会带来优势。

editas medicine专注于体内HSPC编辑仍被视为将其专业知识和资源更有效地配置以创造价值。随着2025年第一季度即将到来的体内管道更新,以及关于reni-电芯BD活性的即将更新,人们期待着发展。

最近一个季度被视为在之前宣布的战略变更后的补充时期。Editas medicine已转向合作或许可其领先资产用于SCD/Bt,同时集中精力开发其体内管道。决定合作SCD/Bt被认为是战略上的适当选择,考虑到这一类别的逐渐接受率。然而,在看到体内管道的进一步进展之前,仍保持谨慎态度。

以下为今日5位分析师对$Editas Medicine (EDIT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

斯迪富分析师Dae Gon Ha维持买入评级,并将目标价从17美元下调至11美元。

斯迪富分析师Dae Gon Ha维持买入评级,并将目标价从17美元下调至11美元。

Stifel analyst Dae Gon Ha maintains with a buy rating, and adjusts the target price from $17 to $11.

Stifel analyst Dae Gon Ha maintains with a buy rating, and adjusts the target price from $17 to $11.