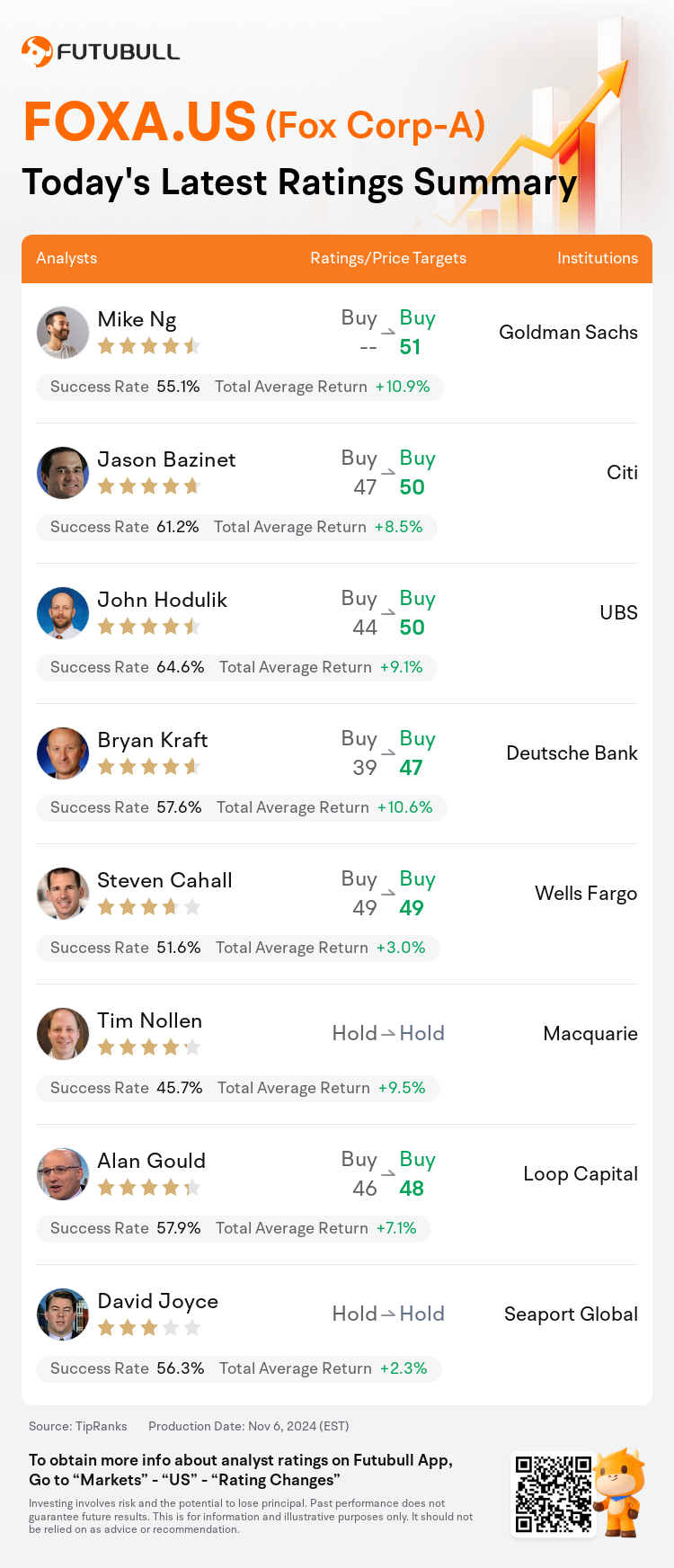

On Nov 06, major Wall Street analysts update their ratings for $Fox Corp-A (FOXA.US)$, with price targets ranging from $47 to $51.

Goldman Sachs analyst Mike Ng maintains with a buy rating, and sets the target price at $51.

Citi analyst Jason Bazinet maintains with a buy rating, and adjusts the target price from $47 to $50.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $44 to $50.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $44 to $50.

Deutsche Bank analyst Bryan Kraft maintains with a buy rating, and adjusts the target price from $39 to $47.

Wells Fargo analyst Steven Cahall maintains with a buy rating, and maintains the target price at $49.

Furthermore, according to the comprehensive report, the opinions of $Fox Corp-A (FOXA.US)$'s main analysts recently are as follows:

Fox Corp. experienced a surge in revenue growth, leading to a substantial increase in segment OIBDA growth for fiscal Q1, bolstered by heightened political ad spending and a resurgence in ratings at Fox News. These factors are anticipated to diminish in the latter half of the year, and the persistent challenges facing linear television are expected to continue.

The recent increase in the sum-of-the-parts valuation for Fox Corp. is attributed to the company's impressive top- and bottom-line results in its fiscal Q1. The company highlighted a robust advertising market, particularly for news and sports, and offered additional insights into upcoming events that are expected to influence EBITDA.

Fox Corp.'s Q1 revenue exceeded consensus estimates, supported by a notable EBITDA beat which was primarily the result of reduced core Cable Networks costs.

Fox Corp. is well-positioned to transition its sports content into the streaming space in a profitable manner, with robust viewership and potential long-term opportunities in both consolidation and sports betting, which could make it a particularly strong candidate within the media sector with favorable risk-adjusted prospects.

Here are the latest investment ratings and price targets for $Fox Corp-A (FOXA.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月6日,多家華爾街大行更新了$福克斯公司-A (FOXA.US)$的評級,目標價介於47美元至51美元。

高盛集團分析師Mike Ng維持買入評級,目標價51美元。

花旗分析師Jason Bazinet維持買入評級,並將目標價從47美元上調至50美元。

瑞士銀行分析師John Hodulik維持買入評級,並將目標價從44美元上調至50美元。

瑞士銀行分析師John Hodulik維持買入評級,並將目標價從44美元上調至50美元。

德意志銀行分析師Bryan Kraft維持買入評級,並將目標價從39美元上調至47美元。

富國集團分析師Steven Cahall維持買入評級,維持目標價49美元。

此外,綜合報道,$福克斯公司-A (FOXA.US)$近期主要分析師觀點如下:

Fox corp在財政第一季度經歷了營業收入激增,導致業務板塊OIBDA增長大幅上升,這主要受益於政治廣告支出增加以及Fox資訊頻道收視率回升。預計這些因素在年後半段會減弱,直播電視面臨的挑戰預計將持續。

最近Fox corp公司的部分估值增長歸因於其財政第一季度出色的營收和利潤表現。公司強調了強勁的廣告市場,尤其是在資訊和體育領域,並提供了對即將影響EBITDA的事件的額外見解。

Fox corp第一季度營收超過共識預期,主要得益於顯著的EBITDA超過預期,這主要是由於核心有線網絡成本的降低。

Fox corp有望以盈利的方式將其體育內容轉向流媒體領域,擁有強大的觀衆群體和潛在的長期機會,在整合和體育博彩方面有利的風險調整前景,這有望使其成爲在媒體板塊中特別強大的候選公司。

以下爲今日8位分析師對$福克斯公司-A (FOXA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師John Hodulik維持買入評級,並將目標價從44美元上調至50美元。

瑞士銀行分析師John Hodulik維持買入評級,並將目標價從44美元上調至50美元。

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $44 to $50.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $44 to $50.