Qualcomm Vs. Arm: Pre-Earnings Semiconductor Showdown

Qualcomm Vs. Arm: Pre-Earnings Semiconductor Showdown

As Qualcomm Inc (NASDAQ:QCOM) and Arm Holdings PLC (NASDAQ:ARM) gear up to release their earnings Wednesday, the two semiconductor giants face bearish technical pressures but diverge in their growth paths.

隨着高通公司(納斯達克:QCOM)和Arm Holdings PLC (納斯達克:ARM)準備在週三發佈他們的收益報告,這兩家半導體巨頭面臨着消極的技術壓力,但在其成長路徑上有所分歧。

Qualcomm: Navigating Challenges Amid Bearish Technicals

高通:在消極技術面臨挑戰中航行

Qualcomm, a mainstay in mobile chipsets, faces strong bearish signals.

高通,作爲移動芯片組的主力,面臨着強烈的看淡信號。

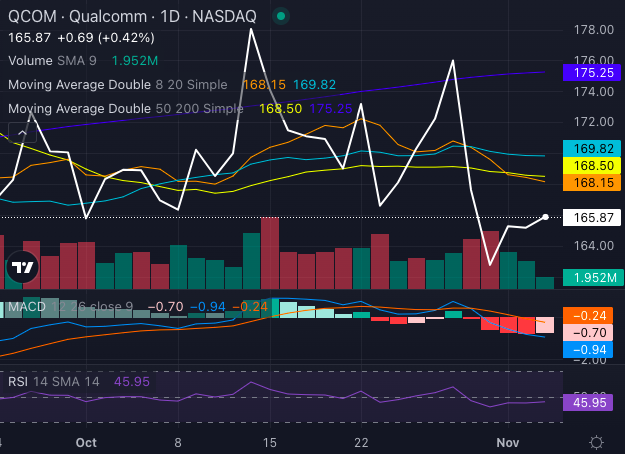

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

QCOM stock is trading at $165.87, well below its eight, 20, and 50-day simple moving averages. Analysts expect fourth quarter EPS of $2.56 on revenue of $9.91 billion, but the stock's recent bearish signals from technical indicators suggest caution.

QCOM股票價格爲165.87美元,遠低於其8、20和50天簡單移動平均線。分析師預期第四季度每股收益爲2.56美元,營業收入爲99.1億美元,但股價最近受到技術指標的看淡信號警示,建議謹慎。

QCOM's MACD (Moving Average Convergence/Divergence) is -0.94, and its RSI (Relative Strength Index) is 45.95, indicating a neutral condition with limited immediate upside potential due to bearish momentum.

高通的MACD(移動平均線收斂/發散)爲-0.94,其RSI(相對強弱指標)爲45.95,表明由於看淡動能,處於中立狀態,並且由於看淡的勢頭,立即上升潛力有限。

Qualcomm's expansion into automotive and IoT markets showcases its strategic shift, but near-term pressures from regulatory concerns and competition—particularly from Apple Inc's (NASDAQ:AAPL) modem push—continue to cloud investor sentiment.

高通對汽車和物聯網市場的拓展展示了其戰略轉變,但受到監管擔憂和競爭的近期壓力,特別是來自蘋果公司(NASDAQ:AAPL)調制解調器推動,繼續使投資者情緒蒙上陰影。

Read Also: AMD's AI Data Center Business Booms: CEO Says It's 'Closed A Good Part Of That Gap' With Nvidia

閱讀更多:AMD的AI idc概念業務蓬勃發展:首席執行官稱已與英偉達『縮小了這部分差距』

Arm Holdings: Bullish Hints Despite Near-Term Pressures

Arm控件:儘管近期面臨壓力,但仍持看好態度

Arm, with its IP-licensing model and strong YTD performance, shows resilience amid bearish trends.

憑藉其知識產權許可模式和強勁的全年表現,Arm表現出色,在消極趨勢中表現出韌性。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Trading at $139.89, ARM stock is below short-to medium-term SMAs (eight-day at $145.69, 20-day at 148.79, and 50-day at $141.22), signaling a bearish trend prevailing. Moreover, its MACD is a negative 0.23, which reinforces the bearish trend.

以139.89美元交易,Arm股票低於短期至中期簡單移動平均線(八天爲145.69美元,20天爲148.79美元,50天爲141.22美元),表明當前看淡趨勢。此外,其MACD爲-0.23,進一步強化了看淡趨勢。

However, the 200-day SMA provides support at $131.04, signaling potential long-term strength.

然而,200日簡單移動平均線在131.04美元提供支撐,表明潛在的長期強勢。

Analysts forecast that the second quarter EPS will be 26 cents on revenue of $808.37 million.

分析師預測第二季度每股收益爲26美分,營業收入爲80837萬美元。

Unlike Qualcomm, Arm's royalty-based model shields it from manufacturing woes, positioning it for growth in high-demand areas like AI, data centers, and IoT.

與高通不同,Arm的基於知識產權費用的模式使其免受制造業問題的影響,爲其在人工智能、數據中心和物聯網等高需求領域的增長奠定了基礎。

Different Risks, Different Rewards

風險不同,回報也不同

While both stocks have bearish technical signals, Qualcomm's cyclicality contrasts with Arm's steadier IP-driven model. Investors eyeing Qualcomm may anticipate a comeback in 5G and automotive, while Arm's appeal lies in its growth as a diversified IP giant.

儘管兩家股票都出現了看淡的技術信號,但高通的週期性與Arm更穩定的基於知識產權的模式形成鮮明對比。瞄準高通的投資者可能預期5g和汽車領域的反彈,而Arm的吸引力在於作爲多元化知識產權巨頭的增長。

This earnings season will be pivotal for both, but the charts suggest caution.

這個盈利季對兩者都至關重要,但圖表表明需要謹慎。

- Super Micro Computer Posts Q1 Earnings: Are Delisting Fears Here To Stay Or Can The Stock Rebound?

- 超微電腦發佈第一季度收益:退市恐懼是否會持續下去還是股票可以反彈?

Photo: Shutterstock

Photo: shutterstock

譯文內容由第三人軟體翻譯。

QCOM stock is trading at $165.87, well below its eight, 20, and 50-day simple moving averages. Analysts expect fourth quarter EPS of $2.56 on revenue of $9.91 billion, but the stock's recent bearish signals from technical indicators suggest caution.

QCOM stock is trading at $165.87, well below its eight, 20, and 50-day simple moving averages. Analysts expect fourth quarter EPS of $2.56 on revenue of $9.91 billion, but the stock's recent bearish signals from technical indicators suggest caution.