This Is What Whales Are Betting On Occidental Petroleum

This Is What Whales Are Betting On Occidental Petroleum

Whales with a lot of money to spend have taken a noticeably bullish stance on Occidental Petroleum.

擁有大量資金的鯨魚明顯看好西方石油。

Looking at options history for Occidental Petroleum (NYSE:OXY) we detected 19 trades.

查看西方石油(紐交所:OXY)的期權歷史,我們發現了19次交易。

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 42% with bearish.

如果我們考慮每筆交易的具體情況,有47%的投資者持有看漲期望開立交易,42%持有看跌。

From the overall spotted trades, 11 are puts, for a total amount of $1,131,775 and 8, calls, for a total amount of $355,717.

從所有交易中發現,有11次看跌,總金額爲$1,131,775,而有8次看漲,總金額爲$355,717。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $37.5 and $70.0 for Occidental Petroleum, spanning the last three months.

通過評估交易量和持倉量,明顯地可以看出,主要市場操盤者正專注於西方石油的價格區間在$37.5和$70.0之間,跨過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

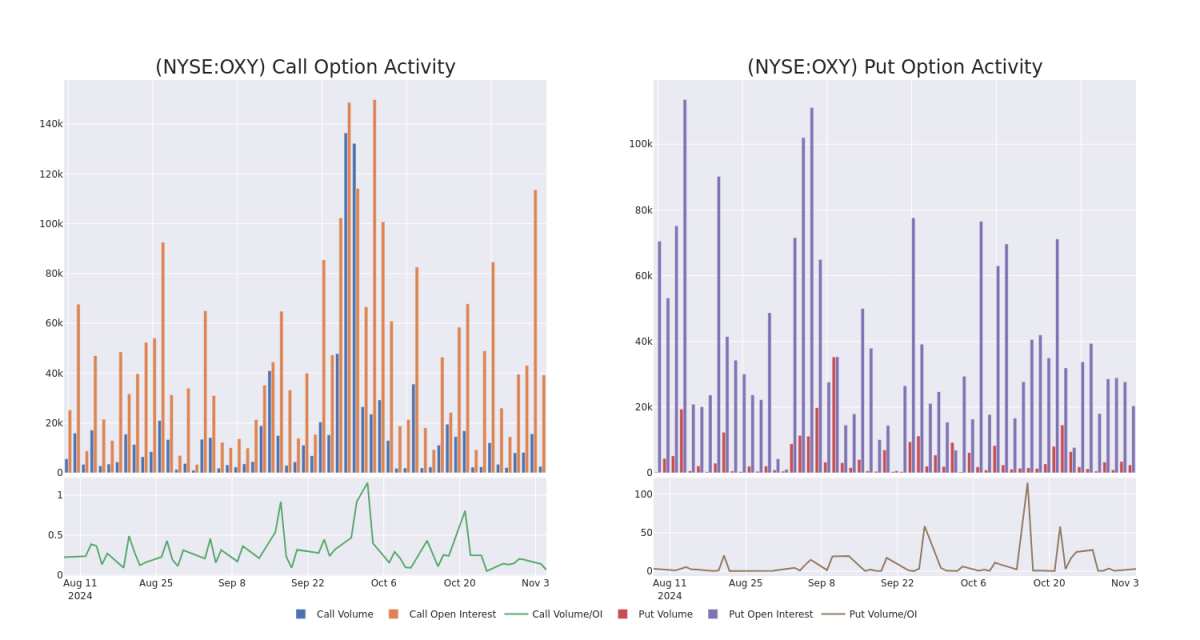

In terms of liquidity and interest, the mean open interest for Occidental Petroleum options trades today is 4260.43 with a total volume of 4,410.00.

在流動性和利率方面,今天西方石油期權交易的平均持倉量爲4260.43,總成交量爲4410.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Occidental Petroleum's big money trades within a strike price range of $37.5 to $70.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內西方石油股票期權成交量和持倉量的發展,涵蓋了目標價區間在37.5美元至70.0美元之間的看漲和看跌期權交易。

Occidental Petroleum Option Volume And Open Interest Over Last 30 Days

西方石油期權在過去30天的成交量和未平倉合約情況

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $11.7 | $11.6 | $11.75 | $60.00 | $409.6K | 6.2K | 1 |

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $13.6 | $13.5 | $13.6 | $62.50 | $255.6K | 1.1K | 177 |

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $11.75 | $11.6 | $11.75 | $60.00 | $116.3K | 6.2K | 353 |

| OXY | CALL | SWEEP | BULLISH | 06/20/25 | $3.4 | $3.35 | $3.4 | $55.00 | $102.0K | 2.2K | 583 |

| OXY | PUT | SWEEP | BEARISH | 01/16/26 | $11.75 | $11.6 | $11.75 | $60.00 | $75.2K | 6.2K | 516 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | 看跌 | SWEEP | 看淡 | 01/16/26 | $11.7 | $11.6 | 11.75美元 | $60.00 | $409.6K | 6.2K | 1 |

| OXY | 看跌 | SWEEP | 看淡 | 01/16/26 | 13.6美元 | $13.5 | 13.6美元 | $62.50 | 255.6千美元 | 1.1千 | 177 |

| OXY | 看跌 | SWEEP | 看淡 | 01/16/26 | 11.75美元 | $11.6 | 11.75美元 | $60.00 | $116.3K | 6.2K | 353 |

| OXY | 看漲 | SWEEP | 看好 | 06/20/25 | $3.4 | $3.35 | $3.4 | $55.00 | $102.0K | 2.2K | 583 |

| OXY | 看跌 | SWEEP | 看淡 | 01/16/26 | 11.75美元 | $11.6 | 11.75美元 | $60.00 | $75.2K | 6.2K | 516 |

About Occidental Petroleum

關於西方石油

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

西方石油是一家獨立的勘探和生產公司,其業務遍佈美國、拉丁美洲和中東。截至2023年底,該公司報告的淨探明儲量近40億桶油當量。2023年,淨產量平均每天爲123.4萬桶油當量,油和天然氣液體之比約爲50%,天然氣比例約爲50%。

Having examined the options trading patterns of Occidental Petroleum, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了西方石油的期權交易模式後,我們的關注點現在直接轉向該公司。這樣的轉變可以讓我們深入了解其目前的市場位置和表現。

Where Is Occidental Petroleum Standing Right Now?

西方石油現在處於什麼地位?

- Trading volume stands at 3,284,117, with OXY's price down by -0.21%, positioned at $50.46.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 7 days.

- 交易量爲3,284,117,OXY的價格下跌-0.21%,位於$50.46。

- RSI指標顯示該股票可能正接近超賣。

- 7天內預計發佈收益公告。

Professional Analyst Ratings for Occidental Petroleum

西方石油的專業分析師評級

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $66.33333333333333.

在過去的一個月裏,有3位行業分析師分享了對這支股票的見解,提出了66.33333333333333美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $57.* An analyst from Susquehanna has decided to maintain their Positive rating on Occidental Petroleum, which currently sits at a price target of $77. * Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Occidental Petroleum, targeting a price of $65.

Benzinga Edge的期權異動板塊會在市場發生變化前發現潛在的市場推動因素。了解大型資金主要關注的股票持倉情況。點擊這裏進行訪問。*受到擔憂的影響,B of A Securities的分析師將評級下調至中立,新的目標價爲57美元。*Susquehanna的分析師決定維持對西方石油的積極評級,目前的目標價爲77美元。*Scotiabank的分析師繼續保持持有態度,對西方石油給予板塊表現評級,目標價爲65美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Occidental Petroleum with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易員通過持續的教育、戰略性的交易調整、利用各種因子以及保持對市場動態的敏感來減少這些風險。通過Benzinga Pro實時警報,了解最新的西方石油期權交易。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 11 are puts, for a total amount of $1,131,775 and 8, calls, for a total amount of $355,717.

From the overall spotted trades, 11 are puts, for a total amount of $1,131,775 and 8, calls, for a total amount of $355,717.