SelectQuote, Inc.'s (NYSE:SLQT) CEO Will Probably Find It Hard To See A Huge Raise This Year

SelectQuote, Inc.'s (NYSE:SLQT) CEO Will Probably Find It Hard To See A Huge Raise This Year

Key Insights

主要見解

- SelectQuote to hold its Annual General Meeting on 12th of November

- Total pay for CEO Tim Danker includes US$540.8k salary

- Total compensation is similar to the industry average

- SelectQuote's EPS grew by 32% over the past three years while total shareholder loss over the past three years was 82%

- selectquote將於11月12日舉行年度股東大會

- 董事長Tim Danker的總薪酬包括54.08萬美元的薪資

- 總補償與行業平均水平相似

- selectquote的每股收益在過去三年增長了32%,而股東在過去三年的總損失爲82%

Shareholders of SelectQuote, Inc. (NYSE:SLQT) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 12th of November. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

SelectQuote股東(紐交所:SLQT)對過去三年的股價表現不佳感到沮喪。然而,不尋常的是,每股收益增長是正的,這表明股價已偏離基本面。這些都是股東可能希望在下次於11月12日舉行的股東大會上提出的一些關注點。他們還可以通過投票影響管理層和公司方向,例如執行薪酬和其他公司事務的決議。根據我們以下的分析,我們認爲股東可能暫時不願增加CEO的薪酬。

How Does Total Compensation For Tim Danker Compare With Other Companies In The Industry?

Tim Danker的總薪酬與行業內其他公司相比如何?

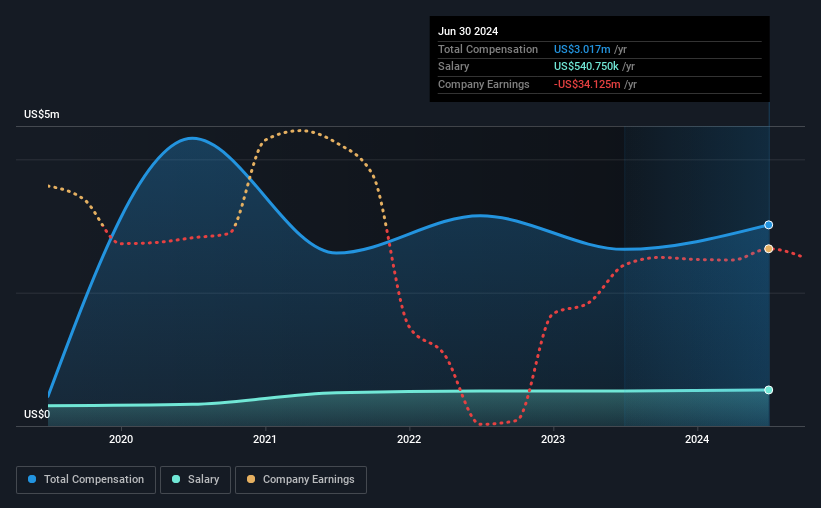

According to our data, SelectQuote, Inc. has a market capitalization of US$350m, and paid its CEO total annual compensation worth US$3.0m over the year to June 2024. That's a notable increase of 14% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$541k.

根據我們的數據,SelectQuote公司的市值爲35000萬美元,並在2024年6月的一年內支付給其CEO總年度薪酬價值300萬美元。這比去年增長了14%。儘管本分析側重於總薪酬,但值得注意的是,薪資部分較低,價值爲54.1萬美元。

For comparison, other companies in the American Insurance industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$2.8m. So it looks like SelectQuote compensates Tim Danker in line with the median for the industry. What's more, Tim Danker holds US$4.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

相比之下,美國保險行業其他市值在20000萬至80000萬美元之間的公司,其CEO的中位總薪酬爲280萬美元。因此,看起來SelectQuote公司的薪酬與行業中位數相符。此外,Tim Danker以個人名義持有公司價值420萬美元的股份,表明他們對公司有大量利害關係。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$541k | US$525k | 18% |

| Other | US$2.5m | US$2.1m | 82% |

| Total Compensation | US$3.0m | US$2.6m | 100% |

| 組成部分 | 2024 | 2023 | 比例(2024年) |

| 薪資 | 541,000美元 | 525,000美元 | 18% |

| 其他 | 2.5百萬美元 | 210萬美元 | 82% |

| 總補償 | 300萬美元 | 2.6百萬美元 | 100% |

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. It's interesting to note that SelectQuote pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

就行業來說,薪水在我們分析的所有公司中大約佔總薪酬的14%,而其他補償佔據了86%。值得注意的是,與行業相比,SelectQuote通過薪水支出了更大比例的補償。重要的是要注意,對非薪酬補償的傾斜表明總薪酬與公司的績效掛鉤。

A Look at SelectQuote, Inc.'s Growth Numbers

查看selectquote公司的增長數字

SelectQuote, Inc. has seen its earnings per share (EPS) increase by 32% a year over the past three years. It achieved revenue growth of 29% over the last year.

selectquote公司在過去三年中,每股收益(EPS)增長了32%。在過去一年實現了29%的營業收入增長。

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

這表明該公司最近一直在進步,對股東來說是個好消息。大多數股東會很高興看到營業收入和每股收益增長強勁。這種組合表明業務在快速增長。展望未來,您可能希望查看該公司未來收益的分析師預測的免費可視化報告。

Has SelectQuote, Inc. Been A Good Investment?

selectquote公司是否是一項不錯的投資?

With a total shareholder return of -82% over three years, SelectQuote, Inc. shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

在過去三年中,selectquote公司的股東總回報率爲-82%,股東基本上會感到失望。因此,如果CEO得到高額報酬,股東可能會感到不安。

In Summary...

總之……

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

儘管營收增長,但過去三年股價的下跌確實令人擔憂。股價未隨着收益增長可能表明其他問題可能正在影響該股。股東們可能會渴望找出可能拖累該股的其他因素。在即將到來的股東大會上,股東們將有機會討論任何與董事會相關的問題,包括與CEO薪酬有關的問題,並評估董事會的計劃是否可能在未來提高業績。

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which doesn't sit too well with us) in SelectQuote we think you should know about.

分析CEO薪酬總是明智之舉,同時對公司的關鍵績效領域進行徹底分析也很重要。我們進行了研究,在selectquote中發現了3個警示信號(還有一個信號讓我們感到不太舒服),我們認爲你應該知道。

Switching gears from SelectQuote, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

如果你正在尋找一份完美的資產負債表和出衆回報,這份免費的高回報、低債務公司清單是一個很好的參考。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. It's interesting to note that SelectQuote pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. It's interesting to note that SelectQuote pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.