Behind the Scenes of Dell Technologies's Latest Options Trends

Behind the Scenes of Dell Technologies's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Dell Technologies.

擁有大量資金的鯨魚顯然持看淡態度,對戴爾科技不看好。

Looking at options history for Dell Technologies (NYSE:DELL) we detected 46 trades.

查看戴爾科技(紐交所:DELL)期權歷史,我們檢測到46筆交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 47% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,41%的投資者以牛市預期開倉,47%的投資者以熊市預期開倉。

From the overall spotted trades, 10 are puts, for a total amount of $497,867 and 36, calls, for a total amount of $2,433,557.

在整體被發現的交易中,有10筆看跌,總金額$497,867,而36筆看漲,總金額$2,433,557。

Expected Price Movements

預期價格波動

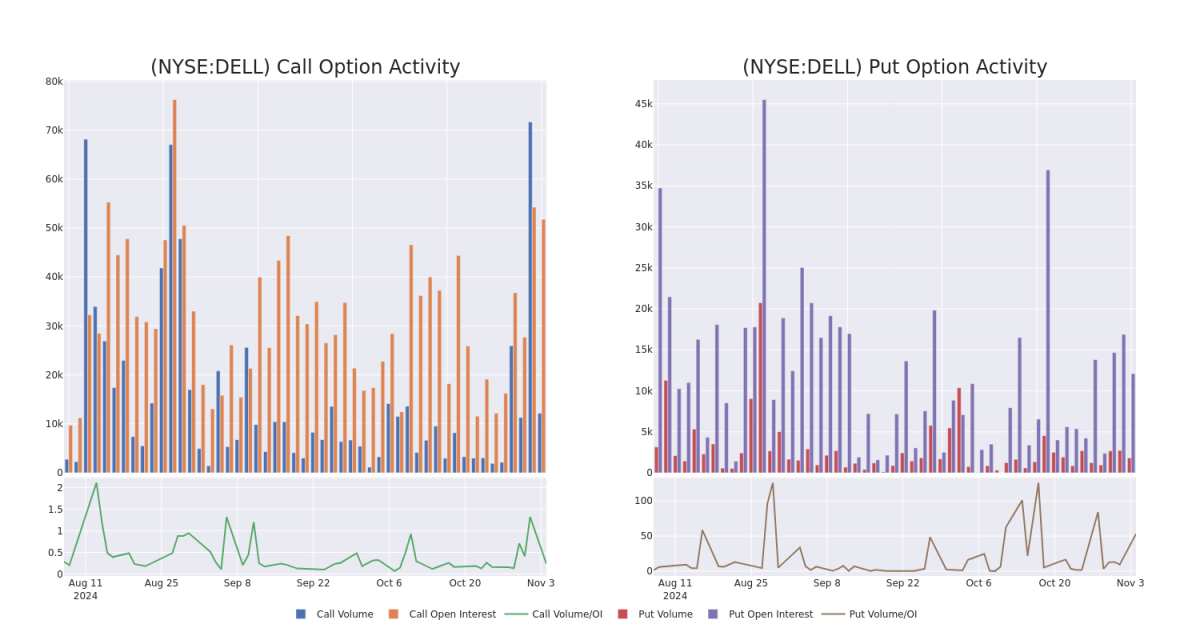

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $170.0 for Dell Technologies during the past quarter.

分析這些合約的成交量和未平倉合約量,似乎大戶已經在過去的一個季度裏盯上了戴爾科技從$100.0到$170.0的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Dell Technologies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Dell Technologies's substantial trades, within a strike price spectrum from $100.0 to $170.0 over the preceding 30 days.

評估成交量和未平倉利息是期權交易中的戰略步驟。這些指標揭示了戴爾科技期權在特定行權價上的流動性和投資者興趣。即將發佈的數據可視化呈現了在過去30天內,戴爾科技的成交量和未平倉利息的波動,涉及從$100.0到$170.0的行權價範圍內的看漲和看跌,與戴爾科技的重要交易相關。

Dell Technologies Option Volume And Open Interest Over Last 30 Days

戴爾科技期權成交量和持倉量在過去30天內

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | SWEEP | BULLISH | 01/17/25 | $6.9 | $6.65 | $6.9 | $150.00 | $344.5K | 6.0K | 508 |

| DELL | CALL | TRADE | BULLISH | 01/16/26 | $20.0 | $19.7 | $20.0 | $165.00 | $238.0K | 537 | 119 |

| DELL | CALL | SWEEP | BEARISH | 11/29/24 | $9.6 | $9.0 | $9.04 | $135.00 | $180.2K | 784 | 239 |

| DELL | PUT | TRADE | BEARISH | 01/15/27 | $31.9 | $31.55 | $31.9 | $135.00 | $159.5K | 1 | 50 |

| DELL | CALL | TRADE | BULLISH | 01/16/26 | $30.55 | $30.1 | $30.55 | $135.00 | $113.0K | 1.5K | 68 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | 看漲 | SWEEP | 看好 | 01/17/25 | $6.9 | $6.65 | $6.9 | $150.00 | $344.5K | 6.0K | 508 |

| DELL | 看漲 | 交易 | 看好 | 01/16/26 | $20.0 | $19.7 | $20.0 | 165.00美元 | 238.0千美元 | 537 | 119 |

| DELL | 看漲 | SWEEP | 看淡 | 11/29/24 | 9.6 | 9.0美元 | 9.04美元 | $135.00 | $180.2K | 784 | 239 |

| DELL | 看跌 | 交易 | 看淡 | 01/15/27 | $31.9應該是指目標價$31.9。 | $31.55 | $31.9應該是指目標價$31.9。 | $135.00 | $159.5K | 1 | 50 |

| DELL | 看漲 | 交易 | 看好 | 01/16/26 | $30.55 | 30.1美元 | $30.55 | $135.00 | $113.0K | 1.5K | 68 |

About Dell Technologies

關於戴爾科技

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

戴爾科技是一家廣泛提供信息技術的供應商,主要爲企業提供硬件。其專注於高端商用個人電腦和企業本地數據中心硬件。在個人電腦、外圍顯示器、主流服務器和外部存儲等核心市場上擁有前三的市場份額。戴爾擁有一個強大的部件和組裝夥伴生態系統,並且也嚴重依賴渠道合作伙伴來滿足銷售需求。

Where Is Dell Technologies Standing Right Now?

Dell Technologies現在處於什麼位置?

- Trading volume stands at 7,376,901, with DELL's price up by 0.57%, positioned at $131.62.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 22 days.

- 交易量爲7,376,901,戴爾的價格上漲0.57%,位於131.62美元。

- RSI指標顯示該股票可能接近超買。

- 預計在22天內公佈收益報告。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 10 are puts, for a total amount of $497,867 and 36, calls, for a total amount of $2,433,557.

From the overall spotted trades, 10 are puts, for a total amount of $497,867 and 36, calls, for a total amount of $2,433,557.