Senior Vice President of HR & Corporate Relations Of Winnebago Industries Sold 42% Of Their Shares

Senior Vice President of HR & Corporate Relations Of Winnebago Industries Sold 42% Of Their Shares

Some Winnebago Industries, Inc. (NYSE:WGO) shareholders may be a little concerned to see that the Senior Vice President of HR & Corporate Relations, Bret Woodson, recently sold a substantial US$690k worth of stock at a price of US$56.64 per share. That sale reduced their total holding by 42% which is hardly insignificant, but far from the worst we've seen.

一些温尼巴格实业(NYSE: WGO)的股东可能会有些担心,因为人力资源和公司关系高级副总裁布雷特·伍德森最近以每股56.64美元的价格抛售了价值69万美元的大量股票。这笔交易使他们的持股总数减少了42%,这并不算微不足道,但也远非我们见过的最糟糕的情况。

The Last 12 Months Of Insider Transactions At Winnebago Industries

温尼巴格实业近12个月内的内部交易

The Senior Vice President of Business Development, Ashis Bhattacharya, made the biggest insider sale in the last 12 months. That single transaction was for US$701k worth of shares at a price of US$61.48 each. So what is clear is that an insider saw fit to sell at around the current price of US$57.11. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

业务发展高级副总裁阿西斯·巴塔查亚在过去12个月中进行了最大规模的内部交易。那笔交易金额为70.1万美元,以每股61.48美元的价格进行。明显的是,内部人士认为以目前的57.11美元价格出售是合适的。虽然内部人士的抛售是一个负面因素,但对我们而言,如果股票以较低价格出售,那就更为负面。我们注意到这笔交易是以目前的价格进行的,所以这并不是一个主要问题,尽管这并不是一个好迹象。

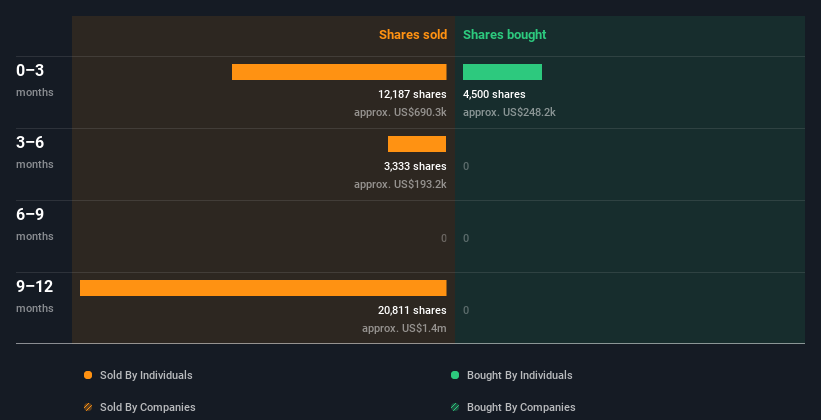

Happily, we note that in the last year insiders paid US$248k for 4.50k shares. But insiders sold 36.33k shares worth US$2.2m. All up, insiders sold more shares in Winnebago Industries than they bought, over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

令人高兴的是,我们注意到在过去一年内,内部人员以24.8万美元购买了0.45万股。但内部人员却抛售了220万美元价值的3.633万股。总体来看,过去一年中,内部人员在温尼巴格实业中抛售的股票比购买的股票多。您可以在以下图表中看到过去一年内公司和个人的内部交易情况。如果您想确切了解谁以多少价格何时出售了股票,只需点击下方的图表即可!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

对于那些喜欢发现潜力股票的人,可以免费查看最新内部交易股票的小盘公司名单,这可能正是您要找的机会。

Insider Ownership

内部人员持股情况

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Winnebago Industries insiders own about US$58m worth of shares. That equates to 3.5% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

很多投资者喜欢查看公司内部持有的股份比例。 高持股比例通常使公司领导更加重视股东利益。 温尼巴格实业内部持有约5,800万美元的股份。 这相当于公司的3.5%。 我们当然在其他地方看到过更高的内部持股比例,但这些持股足以表明内部人员与其他股东之间的一致性。

So What Does This Data Suggest About Winnebago Industries Insiders?

那么,这些数据对于温尼巴格实业的内部人员意味着什么?

The stark truth for Winnebago Industries is that there has been more insider selling than insider buying in the last three months. Despite some insider buying, the longer term picture doesn't make us feel much more positive. While insiders do own shares, they don't own a heap, and they have been selling. So we'd only buy after careful consideration. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Winnebago Industries. While conducting our analysis, we found that Winnebago Industries has 4 warning signs and it would be unwise to ignore them.

对于温尼巴格实业来说,残酷的事实是在过去三个月内部人员卖出的股票比买入的要多。 尽管有一些内部买入,长期来看,我们并不感到更加积极。 大股东虽然持有股份,但并不是很多,并且一直在卖出。 因此,我们只会在经过深思熟虑后再买入。 除了关注内部交易的情况外,还有利于识别温尼巴格实业面临的风险。 在开展分析时,我们发现温尼巴格实业有4个警示信号,忽视它们将是不明智的。

Of course Winnebago Industries may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

当然,温尼巴格实业可能不是最好的股票可供购买。 因此,您可能希望查看这些高质量公司的免费收藏。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

对于本文而言,内部人是指向相关监管机构报告其交易的个人。我们目前仅考虑公开市场交易和直接利益的私人处置,但不包括衍生交易或间接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

译文内容由第三方软件翻译。

For those who like to find

For those who like to find