Palantir Technologies Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Top Analysts

Palantir Technologies Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Top Analysts

Palantir Technologies Inc. (NYSE:PLTR) will release earnings results for its third quarter, after the closing bell on Monday, Nov. 4.

Palantir科技公司(紐交所: PLTR)將在11月4日星期一收盤後發佈第三季度收益結果。

Analysts expect the Denver, Colorado-based company to report quarterly earnings at 9 cents per share, up from 7 cents per share in the year-ago period. Palantir Technologies projects to report revenue of $701.13 million for the quarter, according to data from Benzinga Pro.

分析師預計總部位於科羅拉多州丹佛的該公司將報告每股9美分的季度收益,高於去年同期的7美分。Palantir科技公司計劃在本季度報告70113萬美元的營業收入,據彭博專業版數據顯示。

The company recently announced a strategic partnership with L3Harris Technologies Inc. (NYSE:LHX) to combine Palantir's Artificial Intelligence Platform with L3Harris' sensor and software-defined systems. The collaboration aims to support U.S. Army programs and expand capabilities in AI-driven defense technology, enhancing situational awareness and target identification.

該公司最近宣佈與L3賀錦麗科技公司(紐交所:LHX)達成戰略合作伙伴關係,將Palantir的人工智能平台與L3賀錦麗的傳感器和軟件定義系統結合。此次合作旨在支持美國軍方項目,並擴展人工智能驅動的軍工科技能力,增強態勢感知和目標識別。

Palantir Technologies shares gained 0.9% to close at $41.92 on Friday.

Palantir科技股票週五上漲0.9%,收盤價爲41.92美元。

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Benzinga的讀者可以在分析師股票評級頁面上獲取最新的分析師評級。讀者可以按股票代號、公司名稱、分析師公司、評級變化或其他變量排序。

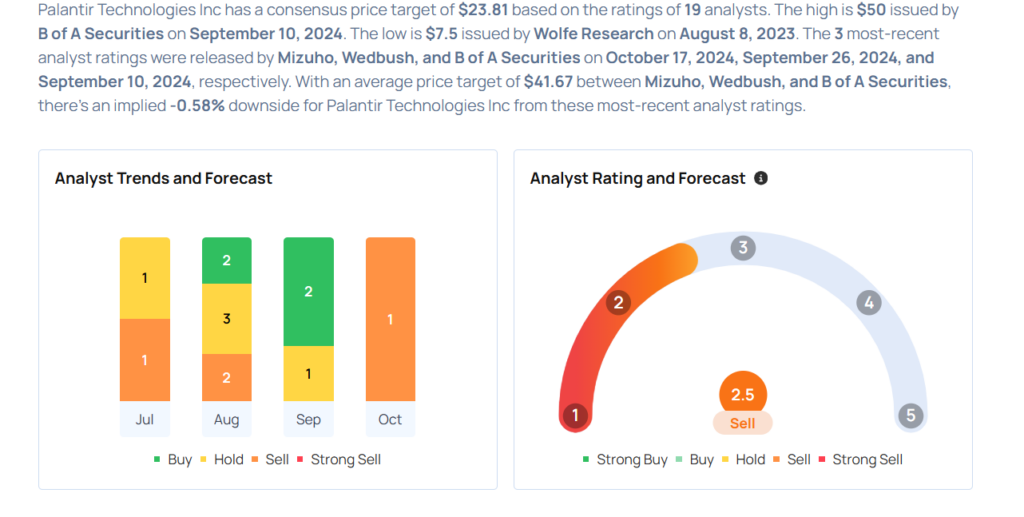

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

讓我們來看看Benzinga最準確的分析師是如何評價公司的。

- Mizuho analyst Matthew Broome maintained an Underperform rating and raised the price target from $24 to $30 on Oct. 17.

- Wedbush analyst Daniel Ives maintained an Outperform rating and increased the price target from $38 to $45 on Sept. 26.

- Raymond James analyst Brian Gesuale downgraded the stock from Outperform to Market Perform on Sept. 23.

- B of A Securities analyst Mariana Perez maintained a Buy rating and raised the price target from $30 to $50 on Sept. 10.

- Northland Capital Markets analyst Michael Latimore initiated coverage on the stock with a Market Perform rating and a price target of $35 on Aug. 22.

- 瑞穗分析師馬修·布魯姆維持了$24萬億的表現評級,並於10月17日將價格目標上調至30美元。

- Wedbush分析師丹尼爾·艾夫斯保持了$38萬億的表現評級,並於9月26日將價格目標上調至45美元。

- 雷蒙德詹姆斯分析師Brian Gesuale在9月23日將該股票的評級從Outperform降級爲Market Perform。

- 美國銀行證券分析師瑪麗安娜·佩雷斯在9月10日維持買入評級,並將目標價從$30萬億上調至$50。

- Northland Capital Markets分析師邁克爾·拉蒂莫於8月22日對該股進行了覆蓋,並給予了市場表現評級和35美元的目標價。

Considering buying PLTR stock? Here's what analysts think:

考慮購買PLTR股票嗎?這是分析師的看法:

Read This Next:

閱讀以下內容:

- Jim Cramer Likes Cava Group, Calls This Utilities Stock 'Terrific'

- 吉姆·克雷默喜歡Cava集團,稱這家公用事業股票「了不起」

譯文內容由第三人軟體翻譯。

Palantir Technologies shares gained 0.9% to close at $41.92 on Friday.

Palantir Technologies shares gained 0.9% to close at $41.92 on Friday.