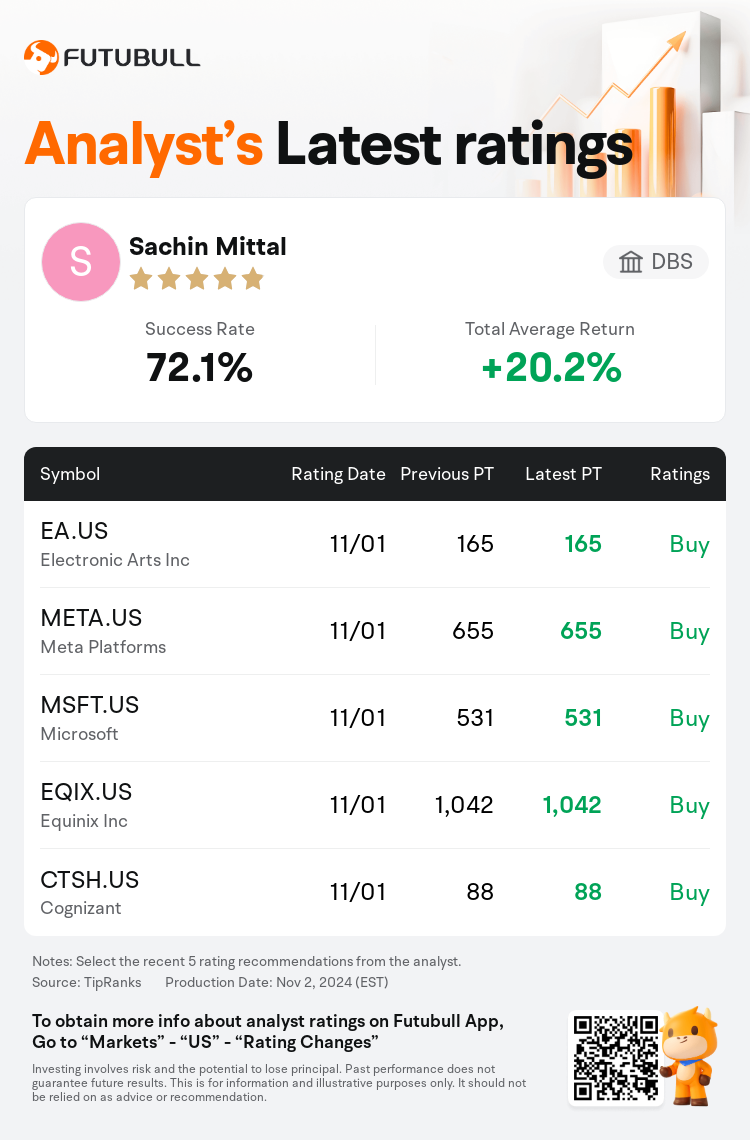

DBS analyst Sachin Mittal maintains $Microsoft (MSFT.US)$ with a buy rating, and maintains the target price at $531.

According to TipRanks data, the analyst has a success rate of 72.1% and a total average return of 20.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Microsoft (MSFT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Microsoft (MSFT.US)$'s main analysts recently are as follows:

Microsoft's Q3 results did not meet expectations, yet there remains a positive stance on the Azure outlook for 2025.

The firm has acknowledged the first-quarter results of Microsoft as 'broadly stable-good,' which aligns with their expectations. Despite the second quarter's total revenue consensus being within a reasonable range and seemingly achievable, Microsoft's guidance fell short, which led to a decline in share prices after hours. The most significant shortfall in guidance was within the More Personal Computing sector. However, this sector is perceived as less critical to Microsoft's core investment thesis due to the higher-margin, more consistent annuity streams that are more central to the company's value. Nevertheless, these recent events are considered to present inconvenient obstacles in the near term.

Microsoft's Azure platform exhibited a 34% growth in constant currency during Q1, slightly surpassing expectations, attributed in part to the GenAI contribution, which accounted for up to 12 percentage points as demand continues to exceed supply. It is anticipated that Azure's growth will decelerate to 31%-32% in the upcoming quarter before picking up pace in the second half of FY25. Additionally, management anticipates that total GenAI revenue will surpass a $10B run-rate in Q2 of FY25.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

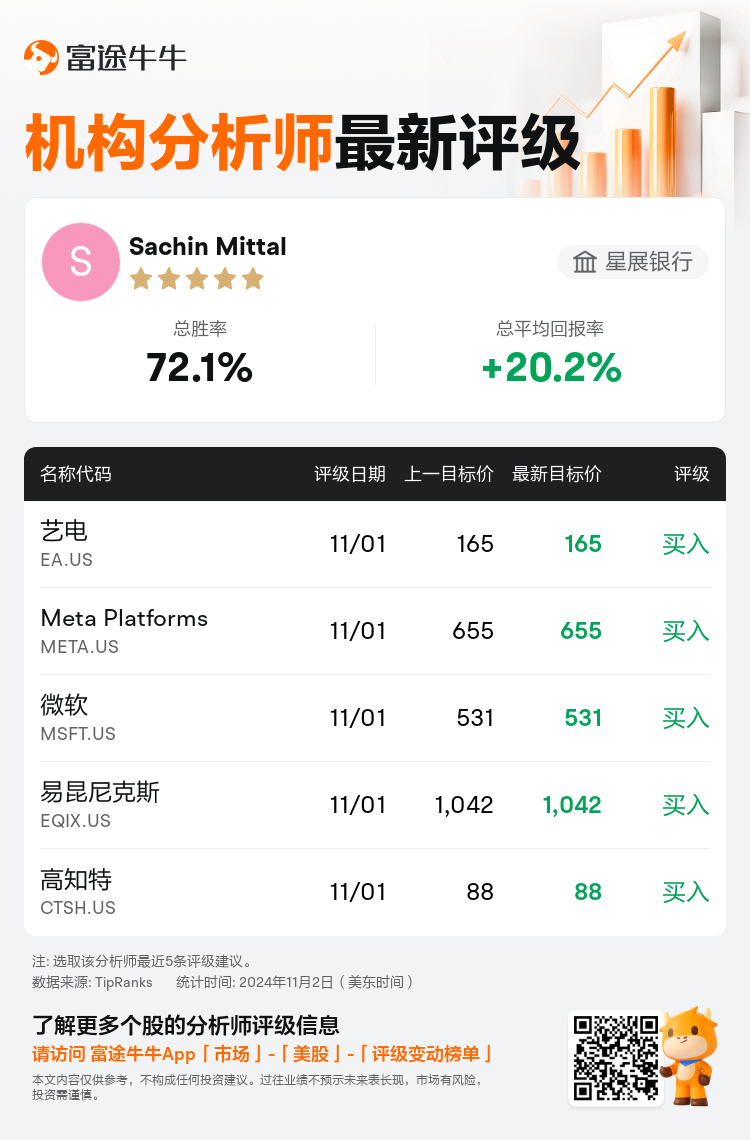

星展银行分析师Sachin Mittal维持$微软 (MSFT.US)$买入评级,维持目标价531美元。

根据TipRanks数据显示,该分析师近一年总胜率为72.1%,总平均回报率为20.2%。

此外,综合报道,$微软 (MSFT.US)$近期主要分析师观点如下:

此外,综合报道,$微软 (MSFT.US)$近期主要分析师观点如下:

微软Q3的成绩没有达到预期,但对2025年Azure的前景仍然持积极态度。

公司已经认可微软第一季度的成绩为“大致稳定-良好”,这与他们的预期一致。尽管第二季度的总营业收入一致性处于一个合理的范围内,看起来是可以实现的,微软的指导却不足,导致盘后股价下跌。在指导方面最显著的缺口出现在更个人计算板块内。然而,这个板块被认为对微软的核心投资主题的重要性较低,因为更高利润率、更一致的年金流更贴近于公司的价值。尽管如此,最近发生的这些事件被认为在短期内会带来不便的障碍。

微软的Azure平台在Q1期间以恒定货币计算增长了34%,略高于预期,部分归因于GenAI贡献,这一贡献占到了需求持续超过供应的部分12个百分点。预计Azure的增长将在接下来的一个季度放缓至31%-32%,然后在FY25的下半年加快步伐。此外,管理层预计总GenAI营收将在FY25年Q2超过100亿美元的运行率。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$微软 (MSFT.US)$近期主要分析师观点如下:

此外,综合报道,$微软 (MSFT.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of