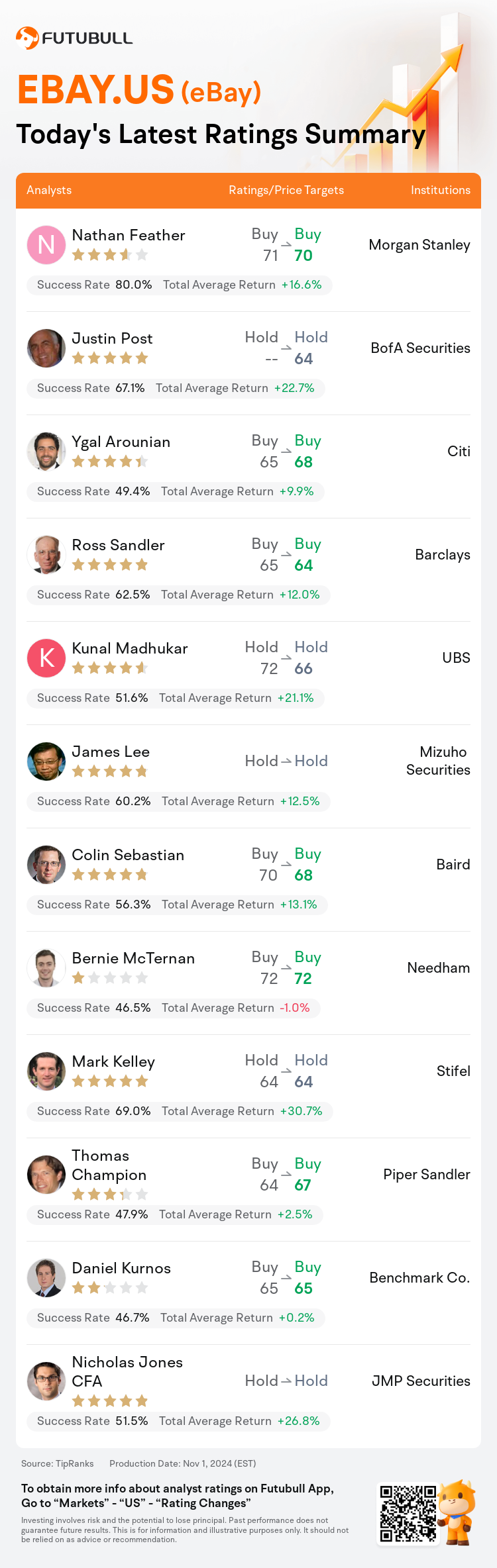

On Nov 01, major Wall Street analysts update their ratings for $eBay (EBAY.US)$, with price targets ranging from $64 to $72.

Morgan Stanley analyst Nathan Feather maintains with a buy rating, and adjusts the target price from $71 to $70.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $64.

Citi analyst Ygal Arounian maintains with a buy rating, and adjusts the target price from $65 to $68.

Citi analyst Ygal Arounian maintains with a buy rating, and adjusts the target price from $65 to $68.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $65 to $64.

UBS analyst Kunal Madhukar maintains with a hold rating, and adjusts the target price from $72 to $66.

Furthermore, according to the comprehensive report, the opinions of $eBay (EBAY.US)$'s main analysts recently are as follows:

eBay's recent quarterly results exhibited revenue and gross merchandise volume that slightly surpassed the guidance, with margins aligning with expectations. Despite this, the shares experienced a downturn as the outlook for Q4 did not meet the consensus expectations. Analysts are anticipating further evidence of robust and lasting sales growth.

eBay's third-quarter results were largely consistent with expectations, and the forecast for Q4 Gross Merchandise Volume aligns with current market projections.

eBay's third-quarter results surpassed expectations, although the outlook for the fourth quarter was somewhat varied, primarily due to a strategic investment in the UK. This investment, focused on consumer-to-consumer commerce, is expected to influence revenue and take rate in the short term. Nevertheless, it is anticipated to balance out in early 2025 and has the potential to contribute positively to gross merchandise volume and revenue over time.

Post eBay's financial disclosures and future projections, there is an adjustment in the Q4 and 2025 Gross Merchandise Volume (GMV) estimations, with a minor increase. Conversely, there's a slight decrease in the anticipated revenue and non-GAAP earnings per share, adjusting figures to $10.6 billion and $5.21 from previous estimates of $10.7 billion and $5.28, respectively, due to possible challenges in monetization.

eBay reported revenue and earnings that largely met expectations, but provided guidance for Q4 that fell short of consensus. Analysts note that the overarching narrative remains the same, with eBay's shares appearing undervalued and share repurchases offering a buffer to investors against this transitory setback.

Here are the latest investment ratings and price targets for $eBay (EBAY.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$eBay (EBAY.US)$的评级,目标价介于64美元至72美元。

摩根士丹利分析师Nathan Feather维持买入评级,并将目标价从71美元下调至70美元。

美银证券分析师Justin Post维持持有评级,目标价64美元。

花旗分析师Ygal Arounian维持买入评级,并将目标价从65美元上调至68美元。

花旗分析师Ygal Arounian维持买入评级,并将目标价从65美元上调至68美元。

巴克莱银行分析师Ross Sandler维持买入评级,并将目标价从65美元下调至64美元。

瑞士银行分析师Kunal Madhukar维持持有评级,并将目标价从72美元下调至66美元。

此外,综合报道,$eBay (EBAY.US)$近期主要分析师观点如下:

ebay最近的季度业绩表现出营业收入和总商品成交量略高于预期,利润率符合预期。尽管如此,由于第四季度的展望未达到共识预期,股价出现下跌。分析师预计会进一步看到强劲和持久的销售增长证据。

ebay第三季度的业绩基本符合预期,第四季度总商品成交量的预测与当前市场预期一致。

ebay第三季度的业绩超出预期,尽管第四季度展望有所不同,主要是由于对英国的战略投资。这项投资侧重于消费者间的商业,预计将在短期内影响营业收入和费率。然而,预计将在2025年初达到平衡,并有可能随着时间的推移对总商品成交量和营业收入产生积极影响。

发布ebay的财务披露和未来预测后,第四季度和2025年总商品成交量(GMV)估计有所调整,略有增加。相比之下,预期营业收入和非GAAP每股收益出现轻微下降,调整至106亿美元和5.21美元,分别比之前的107亿美元和5.28美元估计略低,这主要是由于可能在货币化方面遇到挑战。

ebay报告的营业收入和盈利基本符合预期,但对第四季度的指引未能达到共识。分析师指出,总体叙述仍然相同,ebay的股票似乎被低估,并且回购股份为投资者提供了抵御这种暂时挫折的保障。

以下为今日12位分析师对$eBay (EBAY.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Ygal Arounian维持买入评级,并将目标价从65美元上调至68美元。

花旗分析师Ygal Arounian维持买入评级,并将目标价从65美元上调至68美元。

Citi analyst Ygal Arounian maintains with a buy rating, and adjusts the target price from $65 to $68.

Citi analyst Ygal Arounian maintains with a buy rating, and adjusts the target price from $65 to $68.