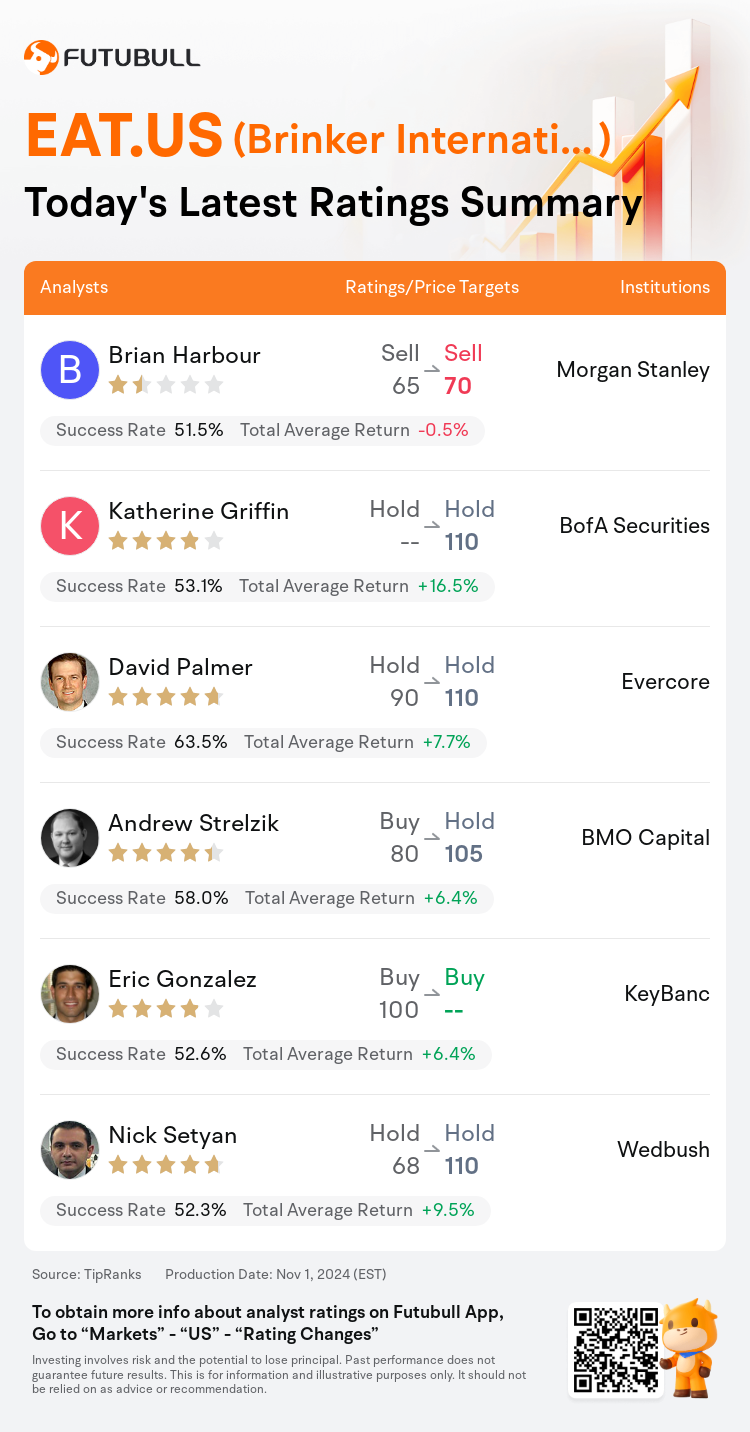

On Nov 01, major Wall Street analysts update their ratings for $Brinker International (EAT.US)$, with price targets ranging from $70 to $110.

Morgan Stanley analyst Brian Harbour maintains with a sell rating, and adjusts the target price from $65 to $70.

BofA Securities analyst Katherine Griffin maintains with a hold rating, and sets the target price at $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

BMO Capital analyst Andrew Strelzik downgrades to a hold rating, and adjusts the target price from $80 to $105.

KeyBanc analyst Eric Gonzalez maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Brinker International (EAT.US)$'s main analysts recently are as follows:

The company's focus on value offerings and a strong marketing mix, which includes both conventional media advertisements and social media interactions, has been instrumental in advancing traffic growth that surpasses industry standards. There is potential to boost recognition via television promotions, and it is anticipated that the company can sustain the upward trajectory of its top line for Chili's during the second fiscal quarter by continuing to effectively utilize advertising.

The firm anticipates that the company's share strength post-earnings will continue in the near term, supported by the company's commentary on trends and industry outperformance that improved throughout the quarter and into October. This is expected to position the company for a potentially higher guidance update in fiscal Q2.

The company's fiscal Q1 results surpassed expectations across the board, and its positive momentum persisted into October. Nonetheless, the current stock valuation is considered to reflect its full potential.

The stock is perceived as having reached its full potential in terms of valuation. CEO Kevin Hochman has been commended for his impressive efforts in revitalizing and sharpening the focus of a brand that, arguably, experienced its lowest point in the unprofitable quarter of Q1 of fiscal 2023.

The firm believes that a robust first quarter and raised guidance for fiscal year 2025 suggest continued momentum in the near term. It is perceived that the current valuation of Brinker adequately reflects the enhanced near-term clarity into same-store growth and margin trends, balanced by a still-obscured outlook on medium- and long-term revenue and profit factors, notwithstanding a significant increase in near-term marketing expenditures.

Here are the latest investment ratings and price targets for $Brinker International (EAT.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月1日,多家華爾街大行更新了$布林克國際 (EAT.US)$的評級,目標價介於70美元至110美元。

摩根士丹利分析師Brian Harbour維持賣出評級,並將目標價從65美元上調至70美元。

美銀證券分析師Katherine Griffin維持持有評級,目標價110美元。

Evercore分析師David Palmer維持持有評級,並將目標價從90美元上調至110美元。

Evercore分析師David Palmer維持持有評級,並將目標價從90美元上調至110美元。

BMO資本市場分析師Andrew Strelzik下調至持有評級,並將目標價從80美元上調至105美元。

KeyBanc分析師Eric Gonzalez維持買入評級。

此外,綜合報道,$布林克國際 (EAT.US)$近期主要分析師觀點如下:

公司專注於價值提供和強大的營銷組合,包括傳統媒體廣告和社交媒體互動,已成爲推動超越行業標準的流量增長的關鍵。通過電視推廣有潛力提升知名度,並預計公司可以繼續有效利用廣告來在Chili's的第二財季內保持其營業收入的上升軌跡。

公司預計公司在近期會繼續保持盈利後的股份實力,這得到了公司對趨勢和行業表現的評論的支持,這些評論在季度內好轉並延續到了十月。預計這將使公司能夠在財政第二季度進行潛在的更高指引更新。

公司在財政第一季度的業績在各方面都超出了預期,並且其積極勢頭持續到了十月。儘管如此,當前股價被認爲已反映了其全部潛力。

從估值角度來看,這隻股票被認爲已經達到了其全部潛力。首席執行官Kevin Hochman在重新振興和聚焦品牌方面做出了令人印象深刻的努力,可以說,該品牌在2023財政第一季度的虧損低谷。

公司認爲,在強勁的第一季度和提高2025財政年度指引的情況下,近期勢頭將持續。人們認爲Brinker目前的估值已充分反映了對同店增長和邊際趨勢的近期增強的清晰認識,儘管在中長期營收和利潤因素方面的前景仍不明朗,而在顯著增加近期市場支出的情況下,中長期收益因素仍不明朗。

以下爲今日6位分析師對$布林克國際 (EAT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師David Palmer維持持有評級,並將目標價從90美元上調至110美元。

Evercore分析師David Palmer維持持有評級,並將目標價從90美元上調至110美元。

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.