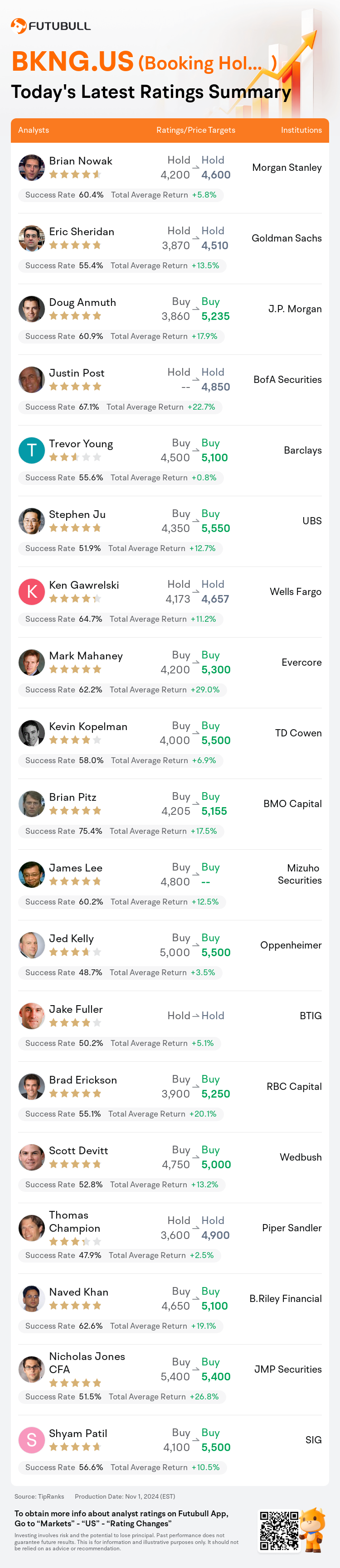

On Nov 01, major Wall Street analysts update their ratings for $Booking Holdings (BKNG.US)$, with price targets ranging from $4,510 to $5,550.

Morgan Stanley analyst Brian Nowak maintains with a hold rating, and adjusts the target price from $4,200 to $4,600.

Goldman Sachs analyst Eric Sheridan maintains with a hold rating, and adjusts the target price from $3,870 to $4,510.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $3,860 to $5,235.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $3,860 to $5,235.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $4,850.

Barclays analyst Trevor Young maintains with a buy rating, and adjusts the target price from $4,500 to $5,100.

Furthermore, according to the comprehensive report, the opinions of $Booking Holdings (BKNG.US)$'s main analysts recently are as follows:

Booking Holdings is experiencing significant global expansion.

Booking Holdings' Q3 outcomes and Q4 projections reflect a more robust European leisure travel market and the profit scalability of the company's platform than was earlier anticipated. As the industry shifts its attention to the investment intensity for Booking and other travel companies by 2025, the analyst maintains a balanced perspective on the stock.

Booking Holdings reported results that exceeded expectations in terms of Room Nights, Revenue, and adjusted EBITDA, while EPS fell short only due to a significant one-time expense. The resilience in alternative accommodations growth and acceleration in airline tickets and rental car days indicate that Booking's Connected Trip initiative is gaining traction with consumers.

Booking Holdings recorded a 'broad-based beat' with guidance surpassing estimates. This performance is anticipated to be positively received, despite previously high expectations. The company's sales and margin are progressing favorably for Q4, which is likely to sustain the stock's near-term momentum.

Here are the latest investment ratings and price targets for $Booking Holdings (BKNG.US)$ from 19 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

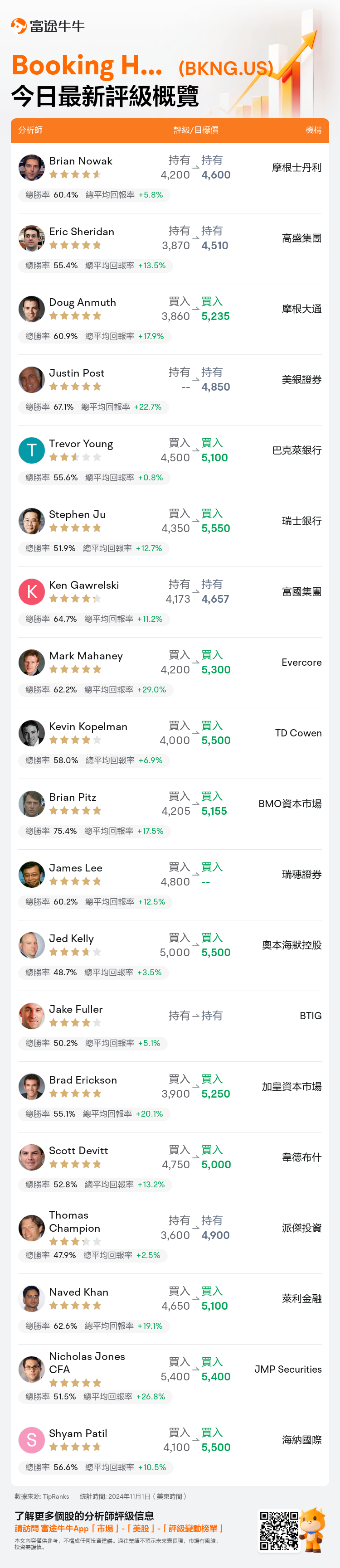

美東時間11月1日,多家華爾街大行更新了$Booking Holdings (BKNG.US)$的評級,目標價介於4,510美元至5,550美元。

摩根士丹利分析師Brian Nowak維持持有評級,並將目標價從4,200美元上調至4,600美元。

高盛集團分析師Eric Sheridan維持持有評級,並將目標價從3,870美元上調至4,510美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從3,860美元上調至5,235美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從3,860美元上調至5,235美元。

美銀證券分析師Justin Post維持持有評級,目標價4,850美元。

巴克萊銀行分析師Trevor Young維持買入評級,並將目標價從4,500美元上調至5,100美元。

此外,綜合報道,$Booking Holdings (BKNG.US)$近期主要分析師觀點如下:

booking holdings正在經歷全球貨幣顯著擴張。

Booking Holdings的Q3業績和Q4預測反映了歐洲休閒旅遊市場更強勁的增長,以及公司平台的利潤可擴展性高於之前預期。隨着行業將注意力轉向2025年Booking和其他旅行公司的投資強度,分析師對該股保持着平衡的觀點。

Booking Holdings報告的結果在房間夜晚、營業收入和調整後的稅前息稅折舊攤銷前利潤方面超出預期,而每股收益之所以僅因一次重大開支而不及預期。替代性住宿增長的抗風險性和航空公司機票以及租車天數的加速增長表明Booking的Connected Trip計劃正受到消費者的青睞。

Booking Holdings取得了超出預期的業績,其業績指引超出市場預期。儘管之前的預期較高,但預計市場對這一表現會做出積極回應。該公司的銷售額和利潤率對Q4業績的進展持續向好,這可能會維持該股票的短期勢頭。

以下爲今日19位分析師對$Booking Holdings (BKNG.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從3,860美元上調至5,235美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從3,860美元上調至5,235美元。

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $3,860 to $5,235.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $3,860 to $5,235.