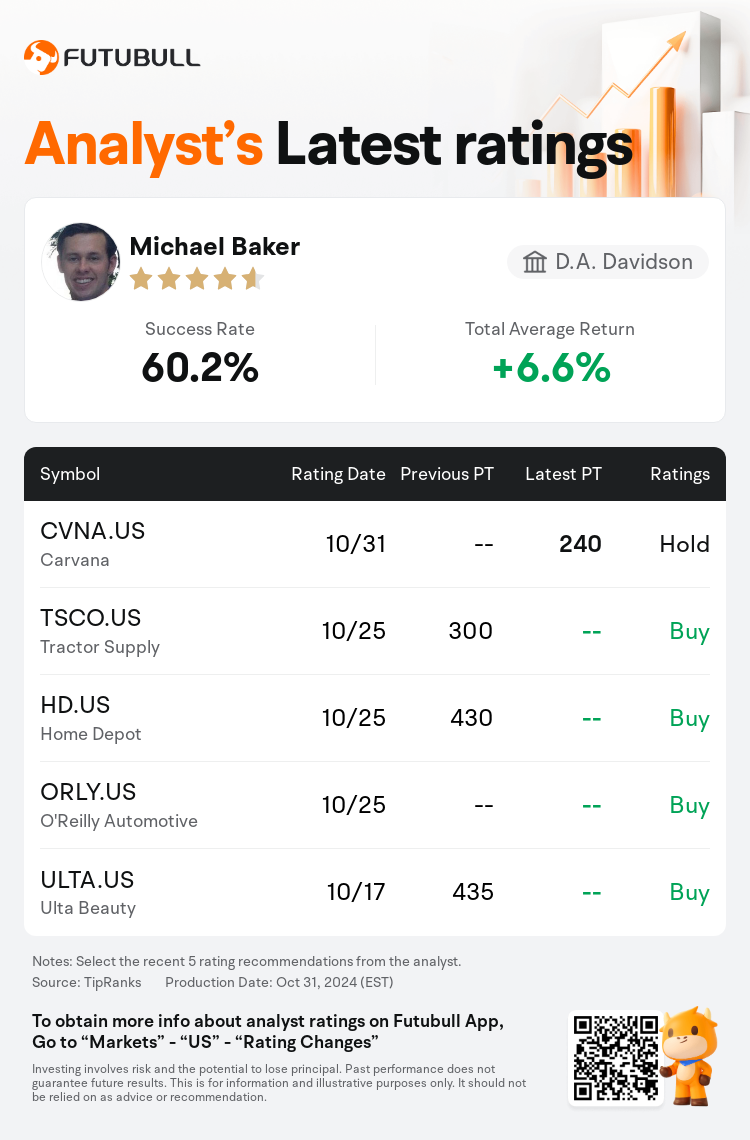

D.A. Davidson analyst Michael Baker maintains $Carvana (CVNA.US)$ with a hold rating, and sets the target price at $240.

According to TipRanks data, the analyst has a success rate of 60.2% and a total average return of 6.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Carvana's core business operations persist in surpassing expectations, with the company's re-entry into the marketplace showcasing its significant 'infrastructure moat'. The enhancement of EBIDTA estimates reflects the company's strong positioning as a leading choice within the auto retail ecosystem.

Carvana has once more surpassed the expected Gross Profit per Unit estimates, which has led to an increase in gross profit dollars, coinciding with a predicted retail unit sales exceed. This occurred while maintaining a stable operating expenditure, resulting in an EBITDA that exceeded expectations by 30%. Forecasts for retail unit sales in the fourth quarter and thereafter are being adjusted upwards, guided by company insights and excess physical capacity. Carvana is focusing on expanding its inventory to enhance conversion rates and unit growth.

The firm acknowledges Carvana's third-quarter results, especially noting the gross profit per unit of $7,685, which surpassed the Street's estimated $6,599 as a highlight of the quarter.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

戴維森信託分析師Michael Baker維持$Carvana (CVNA.US)$持有評級,目標價240美元。

根據TipRanks數據顯示,該分析師近一年總勝率為60.2%,總平均回報率為6.6%。

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

carvana的核心業務運營仍在超越預期,公司重新進入市場展示了其重要的'製造行業壕溝'。EBIDTA估計值的提高反映了該公司作爲汽車零售生態系統中領先選擇的強勢定位。

Carvana再次超過了預期的每單位毛利潤估計,導致毛利潤金額增加,與預測的零售單位銷售額增加相一致。這發生在保持穩定運營支出的同時,導致EBITDA超出預期30%。第四季度及以後零售單位銷售預測正在上調,由公司見解和過剩的實際產能指導。Carvana專注於擴大庫存以提高轉化率和單位增長。

公司承認Carvana的第三季度業績,特別是註明每單位毛利潤爲$7,685,超過了街頭估計的$6,599,成爲當季的亮點。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Carvana (CVNA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of