Source: Wall Street See

"AI laggards" $Intel (INTC.US)$ The stock price soared into double digits after the earnings report, as Q3 financials and performance guidance, while not particularly good, were not as bad as feared, impressing Wall Street.

On October 31st, after the US market closed, Intel announced its Q3 2024 performance.

1) Key Financial Figures:

1) Key Financial Figures:

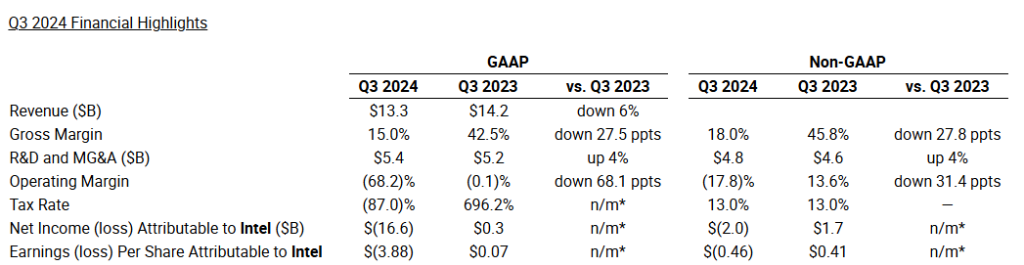

Revenue: In Q3, revenue was $13.3 billion, higher than analysts' expectations of $13.02 billion. Breaking it down, customer computing revenue in Q3 was $7.33 billion, while analysts expected $7.46 billion. Intel Foundry revenue in Q3 was $4.35 billion, slightly less than analysts' $4.44 billion expectation. Datacenter and artificial intelligence (AI) revenue in Q3 was $3.35 billion, higher than the $3.15 billion expected by analysts.

EPS: Adjusted EPS in Q3 was a loss of 46 cents per share, while analysts had expected a loss of 2 cents, compared to a profit of 41 cents per share in the same period last year. The adjusted EPS of $0.63 per share in Q3 included a provision for losses, which was not reflected in the previous performance guidance provided.

Gross margin: The gross profit margin in the third quarter is 18%, lower than analysts' expectations.

Operating margin: The operating profit margin in the third quarter was -17.8%, compared to 13.6% in the same period last year.

Expected Q3 revenue growth of 3.25%-4.25% and adjusted earnings per share of 0.51-0.52 US dollars, below the market estimate of 0.55 US dollars.

Revenue: Expected revenue for the fourth quarter is $13.3 billion to $-14.3 billion, while analysts expect $13.63 billion.

EPS: Expected adjusted EPS for the fourth quarter is $0.12, compared to analysts' expectation of $0.063.

Gross margin: Expected adjusted gross profit margin for the fourth quarter is 39.5%, while analysts expect 38.7%.

After the financial report was released, Intel's stock surged more than 15% in post-market trading. Year to date, the stock price has dropped by over 57%.

Intel CEO Gelsinger stated during the earnings conference call that we have made significant changes towards cost reduction. The company incurred significant expenses in the third quarter for long-term cost savings, including approximately $19 billion related to restructuring business, causing a loss of 63 cents per share in earnings, affecting the company's financial performance during this period.

Intel was once the leader in the personal computer processor field. Starting in 1980, it dominated and drove the global PC market, becoming the world's largest semiconductor supplier in 1992. Over the next 25 years, Intel has maintained its position as the leader in the semiconductor sector.

However, in recent years, with intensifying competition in the semiconductor sector, Intel's market position has been challenged. Now Intel has to save money to implement a major revival plan, which CEO Gelsinger describes as the 'boldest rebuilding plan' in company history.

In the previous quarter, Intel conducted a large layoff, reduced various expenses, and suspended dividends to investors. Gelsinger stated: 'This is a crucial period for the company, and we have completed a lot of work.'

Gelsinger also mentioned that the orders for the company's AI acceleration chip Gaudi did not meet expectations, resulting in the inability to achieve the $0.5 billion revenue target this year. Meanwhile, competitor AMD raised sales expectations for its competitive products, expecting sales to exceed $5 billion. Analysts also project that Nvidia's AI chip business revenue is likely to exceed the $100 billion mark this year.

Editor / jayden