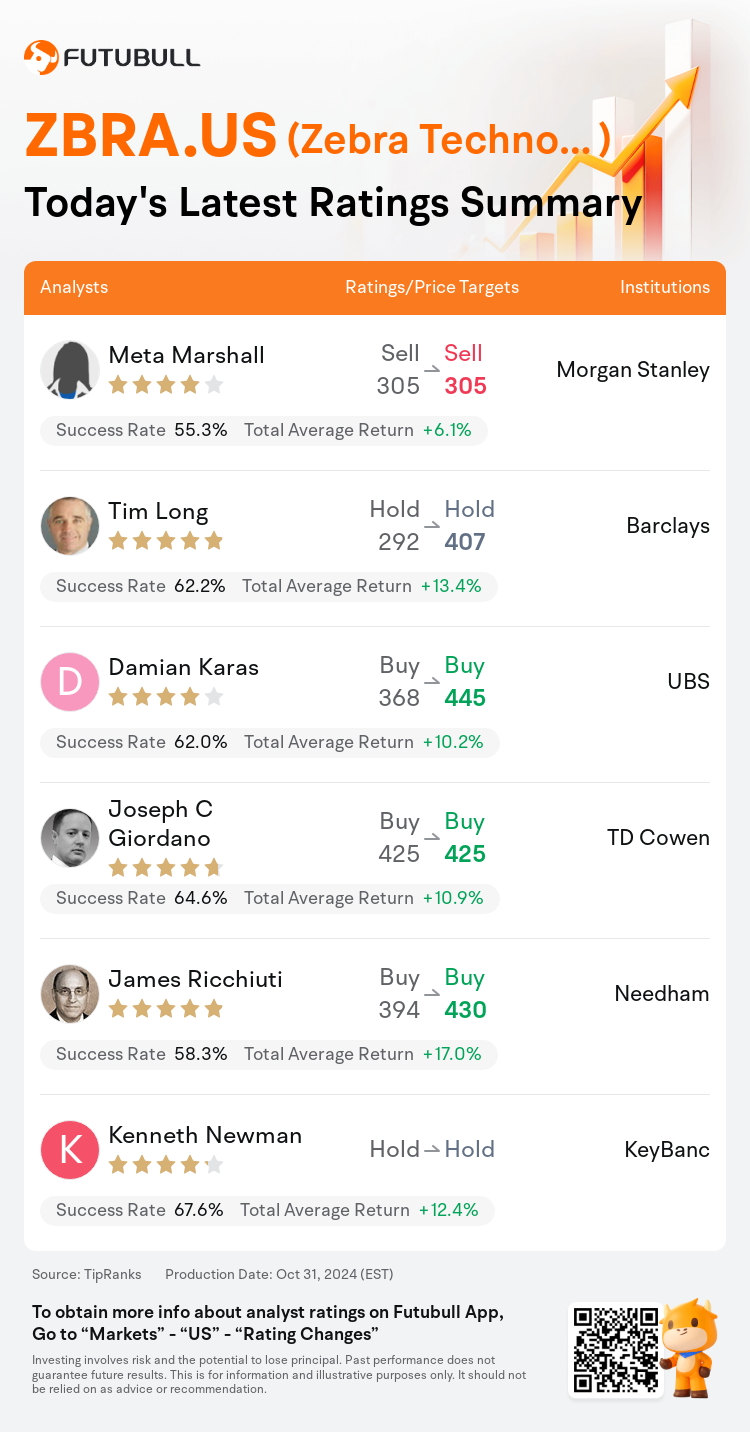

On Oct 31, major Wall Street analysts update their ratings for $Zebra Technologies (ZBRA.US)$, with price targets ranging from $305 to $445.

Morgan Stanley analyst Meta Marshall maintains with a sell rating, and maintains the target price at $305.

Barclays analyst Tim Long maintains with a hold rating, and adjusts the target price from $292 to $407.

UBS analyst Damian Karas maintains with a buy rating, and adjusts the target price from $368 to $445.

UBS analyst Damian Karas maintains with a buy rating, and adjusts the target price from $368 to $445.

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $425.

Needham analyst James Ricchiuti maintains with a buy rating, and adjusts the target price from $394 to $430.

Furthermore, according to the comprehensive report, the opinions of $Zebra Technologies (ZBRA.US)$'s main analysts recently are as follows:

The company's third-quarter performance exceeded expectations, along with a further increase in guidance for the fiscal year, as demand improvements persistently exceed projections. Nonetheless, the uncertain macroeconomic conditions are impacting the visibility into the company's financial outlook for fiscal year 2025.

Zebra Technologies demonstrated a stronger than expected performance with a more widespread recovery and larger deal momentum in Q3, which is seen as encouraging. Nonetheless, there is a belief that the present valuation already reflects the anticipated recovery and that there are more appealing risk-reward opportunities to be found elsewhere.

The firm expressed increased confidence in the FY25 estimates as more normalized activity is beginning to emerge, although they note that decision timelines for large projects remain extended.

Zebra Technologies has been recognized for delivering another quarter that exceeded expectations, with demand showing signs of increasing strength and diversity, although still limited by the broader economic environment. Expectations for the fourth quarter are more aligned with usual seasonal patterns, which could include larger transactions and year-end budget spending.

Here are the latest investment ratings and price targets for $Zebra Technologies (ZBRA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

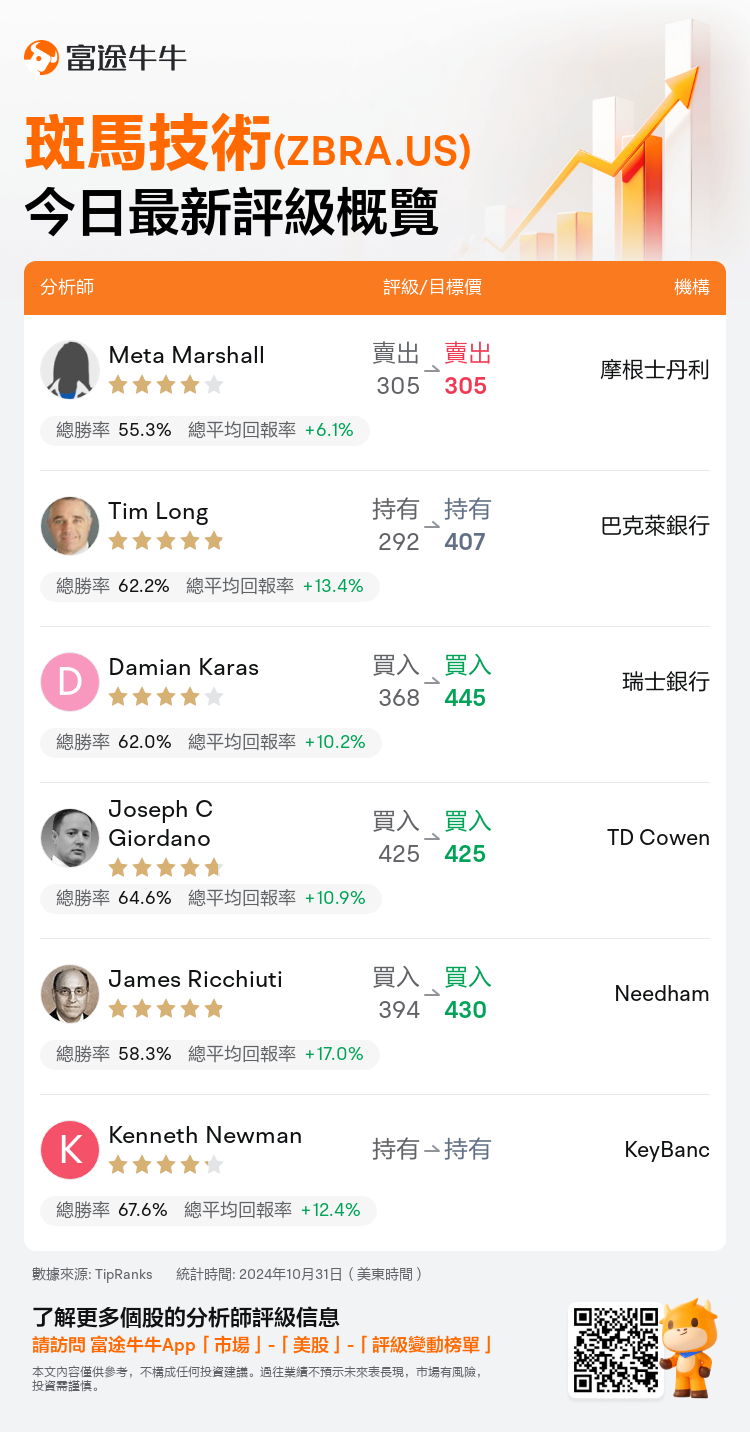

美東時間10月31日,多家華爾街大行更新了$斑馬技術 (ZBRA.US)$的評級,目標價介於305美元至445美元。

摩根士丹利分析師Meta Marshall維持賣出評級,維持目標價305美元。

巴克萊銀行分析師Tim Long維持持有評級,並將目標價從292美元上調至407美元。

瑞士銀行分析師Damian Karas維持買入評級,並將目標價從368美元上調至445美元。

瑞士銀行分析師Damian Karas維持買入評級,並將目標價從368美元上調至445美元。

TD Cowen分析師Joseph C Giordano維持買入評級,維持目標價425美元。

Needham分析師James Ricchiuti維持買入評級,並將目標價從394美元上調至430美元。

此外,綜合報道,$斑馬技術 (ZBRA.US)$近期主要分析師觀點如下:

公司第三季度業績超出預期,財年的指引進一步增長,需求改善持續超過預期。然而,不確定的宏觀經濟條件影響了對財年2025年的財務前景的可見性。

斑馬技術公司展示出比預期更強勁的表現,在第三季度有更廣泛的復甦和更多的交易勢頭,這被視爲令人鼓舞的。然而,有一種觀點認爲,目前的估值已經反映了預期的復甦,而且在其他地方可能會找到更有吸引力的風險回報機會。

該公司對FY25的估算表現出增強的信懇智能,因爲更多正常化的活動開始出現,儘管他們指出,大型項目的決策時間表仍然延長。

斑馬技術已經因交付超出預期的另一個季度而得到認可,需求顯示出增強的力量和多樣性,儘管仍受到更廣泛經濟環境的限制。對第四季度的預期更符合通常的季節性模式,可能包括更大的交易和年底預算支出。

以下爲今日6位分析師對$斑馬技術 (ZBRA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Damian Karas維持買入評級,並將目標價從368美元上調至445美元。

瑞士銀行分析師Damian Karas維持買入評級,並將目標價從368美元上調至445美元。

UBS analyst Damian Karas maintains with a buy rating, and adjusts the target price from $368 to $445.

UBS analyst Damian Karas maintains with a buy rating, and adjusts the target price from $368 to $445.