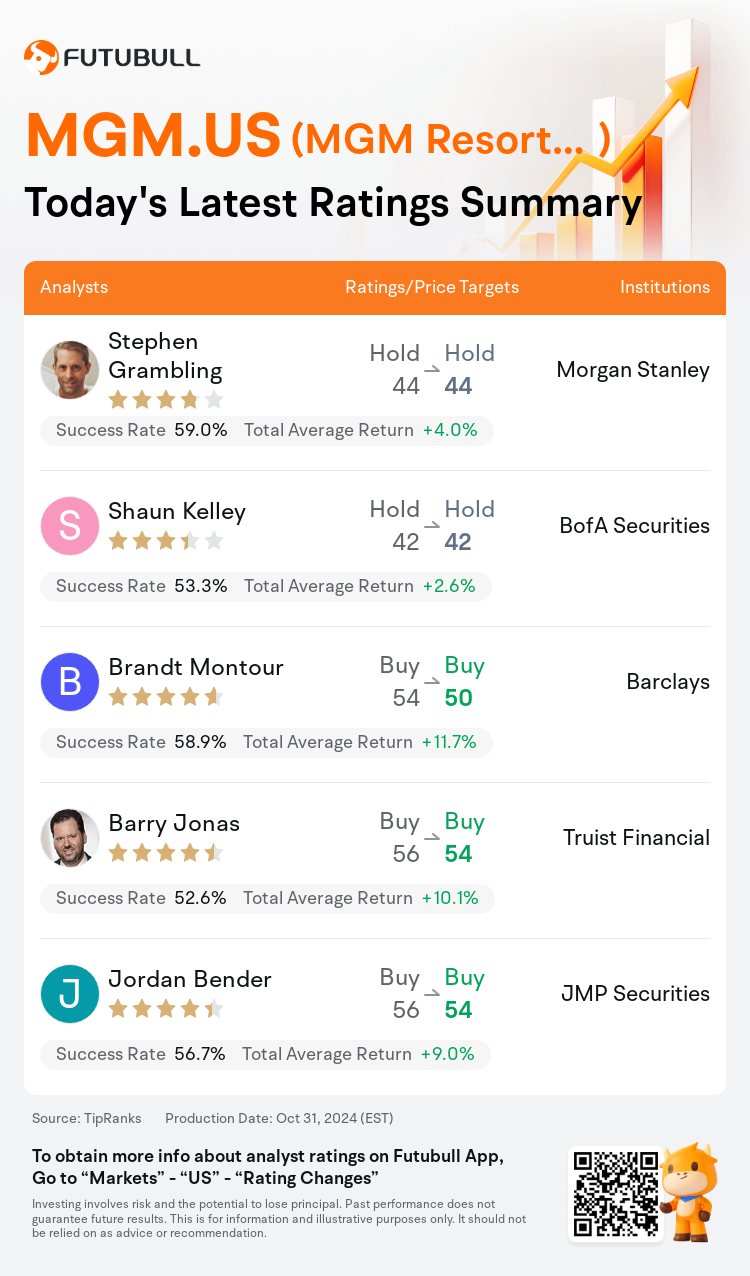

On Oct 31, major Wall Street analysts update their ratings for $MGM Resorts International (MGM.US)$, with price targets ranging from $42 to $54.

Morgan Stanley analyst Stephen Grambling maintains with a hold rating, and maintains the target price at $44.

BofA Securities analyst Shaun Kelley maintains with a hold rating, and maintains the target price at $42.

Barclays analyst Brandt Montour maintains with a buy rating, and adjusts the target price from $54 to $50.

Barclays analyst Brandt Montour maintains with a buy rating, and adjusts the target price from $54 to $50.

Truist Financial analyst Barry Jonas maintains with a buy rating, and adjusts the target price from $56 to $54.

JMP Securities analyst Jordan Bender maintains with a buy rating, and adjusts the target price from $56 to $54.

Furthermore, according to the comprehensive report, the opinions of $MGM Resorts International (MGM.US)$'s main analysts recently are as follows:

The volatility seen in Las Vegas gaming coupled with a significant margin miss in Macau contributed to a challenging third quarter for MGM Resorts.

MGM Resorts' third quarter is expected to be perceived as underwhelming, mainly due to subdued performance in Las Vegas. It is anticipated that the company will encounter several challenges in the Vegas market, which are likely to prompt a revision of Street estimates.

Here are the latest investment ratings and price targets for $MGM Resorts International (MGM.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

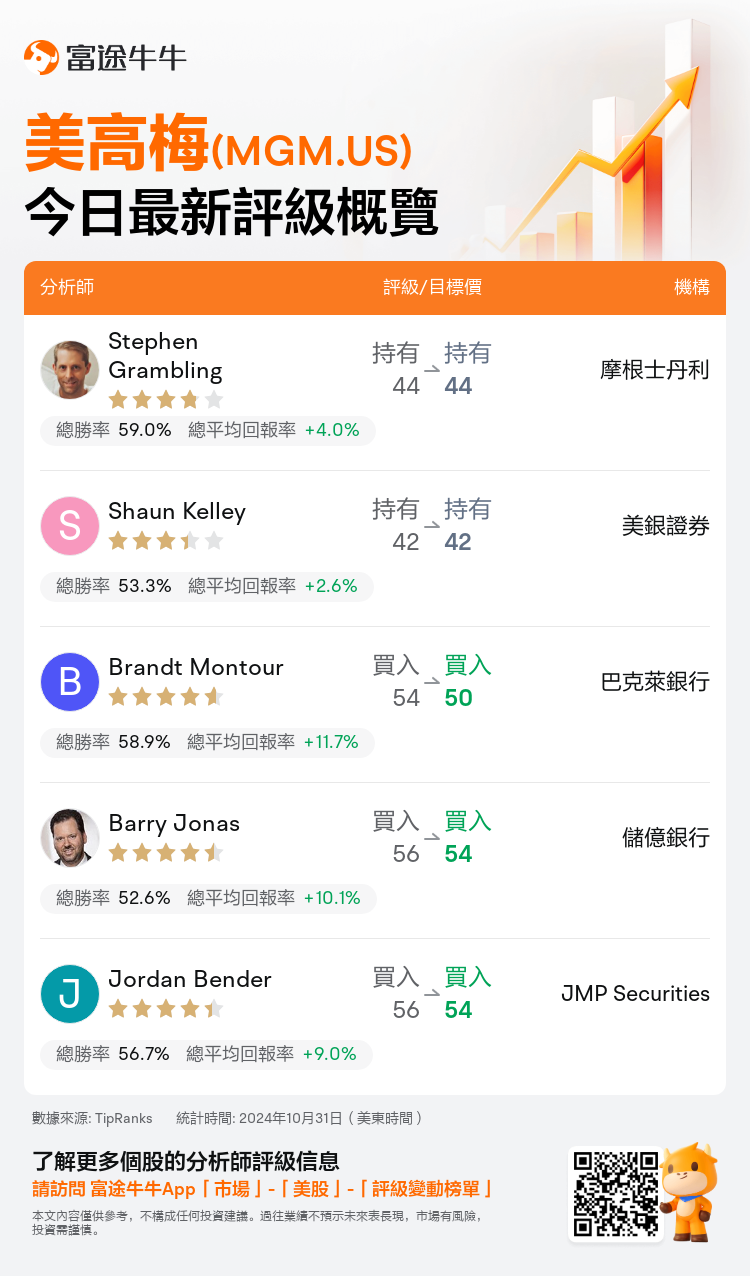

美東時間10月31日,多家華爾街大行更新了$美高梅 (MGM.US)$的評級,目標價介於42美元至54美元。

摩根士丹利分析師Stephen Grambling維持持有評級,維持目標價44美元。

美銀證券分析師Shaun Kelley維持持有評級,維持目標價42美元。

巴克萊銀行分析師Brandt Montour維持買入評級,並將目標價從54美元下調至50美元。

巴克萊銀行分析師Brandt Montour維持買入評級,並將目標價從54美元下調至50美元。

儲億銀行分析師Barry Jonas維持買入評級,並將目標價從56美元下調至54美元。

JMP Securities分析師Jordan Bender維持買入評級,並將目標價從56美元下調至54美元。

此外,綜合報道,$美高梅 (MGM.US)$近期主要分析師觀點如下:

以下爲今日5位分析師對$美高梅 (MGM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Brandt Montour維持買入評級,並將目標價從54美元下調至50美元。

巴克萊銀行分析師Brandt Montour維持買入評級,並將目標價從54美元下調至50美元。

Barclays analyst Brandt Montour maintains with a buy rating, and adjusts the target price from $54 to $50.

Barclays analyst Brandt Montour maintains with a buy rating, and adjusts the target price from $54 to $50.