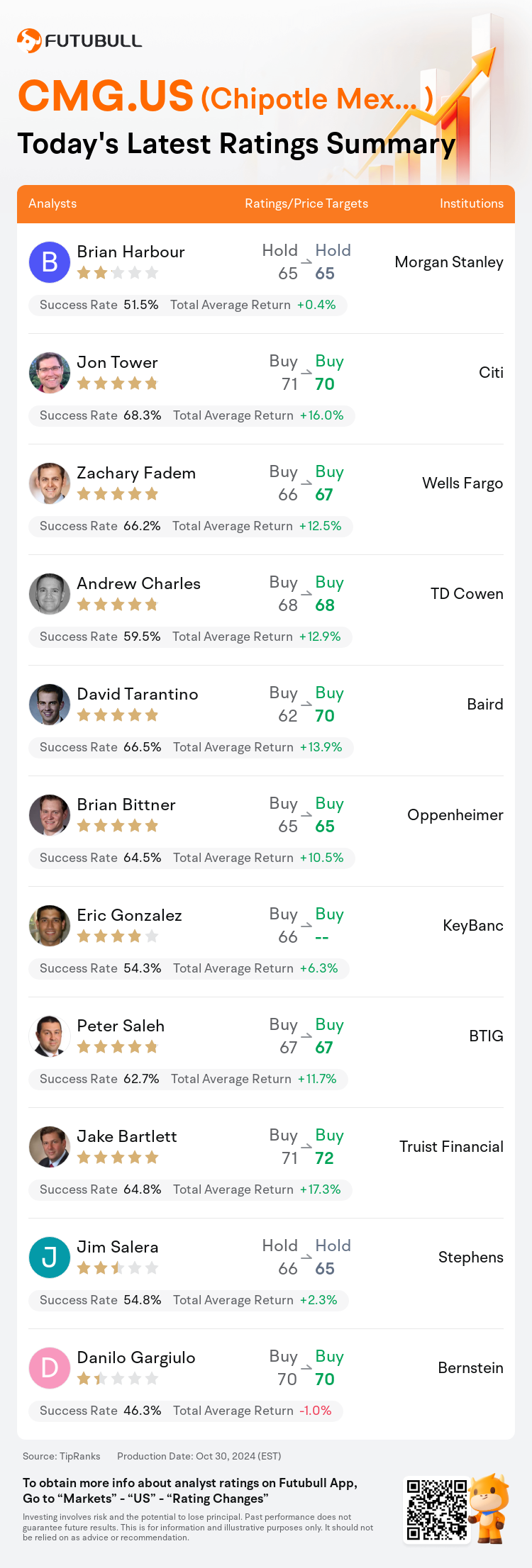

On Oct 30, major Wall Street analysts update their ratings for $Chipotle Mexican Grill (CMG.US)$, with price targets ranging from $65 to $72.

Morgan Stanley analyst Brian Harbour maintains with a hold rating, and maintains the target price at $65.

Citi analyst Jon Tower maintains with a buy rating, and adjusts the target price from $71 to $70.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and adjusts the target price from $66 to $67.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and adjusts the target price from $66 to $67.

TD Cowen analyst Andrew Charles maintains with a buy rating, and maintains the target price at $68.

Baird analyst David Tarantino maintains with a buy rating, and adjusts the target price from $62 to $70.

Furthermore, according to the comprehensive report, the opinions of $Chipotle Mexican Grill (CMG.US)$'s main analysts recently are as follows:

Concerns surrounding Chipotle's Q3 outcomes seem to be minimal. The company's positive remarks on its momentum throughout the quarter and prospects for Q4, along with the anticipated multi-year advantages from efficiency improvements and sustained investment in technology, are expected to contribute to an uptrend in same-store sales and a reduction in long-term cost metrics over time.

Chipotle's Q4 comparable sales matched expectations, and earnings slightly exceeded them. Despite this, concerns have arisen due to the challenging comparison with Q4 and the lapping of prices without a corresponding increase, as well as the restrained growth projections for new units in 2025 compared to the long-term guidance, leading to a cautious stance among investors.

Chipotle's Q3 earnings surpassed estimates with favorable outcomes in general and administrative expenses, restaurant margins, and taxes, which balanced the somewhat weaker growth in same-store sales. Additionally, the company experienced an uptick in traffic trends during September and October. However, the moderation in pricing indicates that the slower trend in comparative store growth observed in Q3 is continuing into Q4.

The firm has increased its estimates and asserts that the fourth quarter same-store sales forecast of 5%-5.5% is attainable, with the possibility of a price hike serving as a backup plan.

Chipotle's third-quarter earnings exceeded the consensus, yet its comparable sales growth of 6% did not meet the anticipated 6.5%. Management anticipates a slight uptick in transaction growth in the fourth quarter compared to the third, with pricing projected to increase just over 1% for the current quarter.

Here are the latest investment ratings and price targets for $Chipotle Mexican Grill (CMG.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

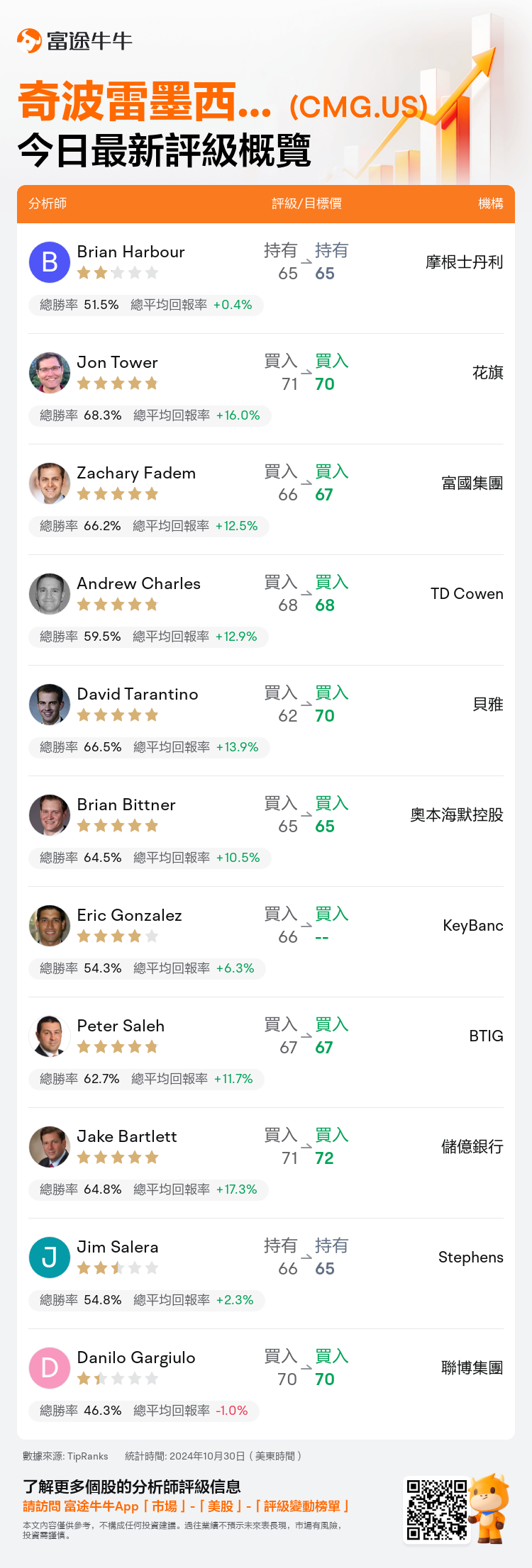

美東時間10月30日,多家華爾街大行更新了$奇波雷墨西哥燒烤 (CMG.US)$的評級,目標價介於65美元至72美元。

摩根士丹利分析師Brian Harbour維持持有評級,維持目標價65美元。

花旗分析師Jon Tower維持買入評級,並將目標價從71美元下調至70美元。

富國集團分析師Zachary Fadem維持買入評級,並將目標價從66美元上調至67美元。

富國集團分析師Zachary Fadem維持買入評級,並將目標價從66美元上調至67美元。

TD Cowen分析師Andrew Charles維持買入評級,維持目標價68美元。

貝雅分析師David Tarantino維持買入評級,並將目標價從62美元上調至70美元。

此外,綜合報道,$奇波雷墨西哥燒烤 (CMG.US)$近期主要分析師觀點如下:

Chipotle第3季度的業績問題似乎很小。公司對整個季度的勢頭以及第4季度的前景發表了積極的看法,預期效率改善和在科技方面的持續投資將帶來多年的優勢,這有望推動同店銷售的上升趨勢,並隨着時間的推移降低成本指標。

Chipotle的第4季度可比銷售達到預期,並且盈利略高於預期。儘管如此,由於與第4季度的比較困難以及價格未同比增加而導致的問題,以及2025年新單位增長預期較長期指導的抑制,引發了投資者的謹慎態度,從而引發了一些擔憂。

Chipotle第3季度的收入超過了預期,總體上在一般和行政費用、餐廳利潤和稅收方面表現良好,這平衡了同店銷售增長略微疲軟的情況。此外,公司在9月和10月交通流量方面經歷了上升趨勢。然而,價格上漲的趨勢適度說明,在第3季度觀察到的比較店面增長速度較慢的情況正在持續到第4季度。

該公司已經提高了其估計,並斷言第四季度同店銷售增長預測的5%-5.5%是可以實現的,有可能通過價格上漲作爲備用計劃。

Chipotle第三季度的盈利超過了共識,但其同店銷售增長率達6%,並未達到預期的6.5%。管理層預計第四季度的交易增長率略高於第三季度,預計本季度的價格將增長超過1%。

以下爲今日11位分析師對$奇波雷墨西哥燒烤 (CMG.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Zachary Fadem維持買入評級,並將目標價從66美元上調至67美元。

富國集團分析師Zachary Fadem維持買入評級,並將目標價從66美元上調至67美元。

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and adjusts the target price from $66 to $67.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and adjusts the target price from $66 to $67.