Tesla Bull Says Elon Musk-Led EV Giant Is No Longer Seen As An Auto Company By Investors, Explains Why Its Stock Trades At A Hefty Premium To Legacy Rivals

Tesla Bull Says Elon Musk-Led EV Giant Is No Longer Seen As An Auto Company By Investors, Explains Why Its Stock Trades At A Hefty Premium To Legacy Rivals

Tesla Inc. (NASDAQ:TSLA) is no longer viewed as a car company by most investors, The Future Fund Managing Partner Gary Black said on Tuesday, reflecting on the company's high price-earnings ratio.

特斯拉公司(納斯達克:TSLA)在大多數投資者眼中不再被視爲一家汽車公司,未來基金管理合夥人加里·布萊克(Gary Black)週二表示,這反映了該公司高的市盈率。

What Happened: "With future expected EPS growth of 25-30%, TSLA trades at 84x FY'25 Adj EPS vs 5-6x for legacy auto companies," Black said in a post on social media platform X.

「未來預期每股收益增長率爲25-30%, 特斯拉 在社交媒體平台X上的發帖中表示,特斯拉的市盈率爲84倍FY'25調整每股收益,而傳統汽車公司的市盈率爲5-6倍。」

A company's price-earnings ratio, he noted, is based on future expected growth rate and not the company's current business and Tesla has its feet into EVs and autonomous driving – two of the highest growth aspects of the auto business.

他指出,公司的市盈率是基於未來預期增長率而不是公司當前的業務, 特斯拉 介入電動車和自動駕駛領域 - 這是汽車業務增長最快的兩個方面。

Once Tesla's profits from its auto business fall below 50% of its overall profit, Wall Street will no longer compare it to other car companies, Black said, while also noting that in the last quarter, the company's auto business profit accounted for just 80% of its overall profit.

一旦 特斯拉 的汽車業務利潤下降到其整體利潤的50%以下,華爾街將不再將其與其他汽車公司進行比較,Black表示,並指出在上一季度,公司的汽車業務利潤僅佔其整體利潤的80%。

$TSLA is no longer viewed as a car company by most investors. With future expected EPS growth of 25-30%, TSLA trades at 84x FY'25 Adj EPS vs 5-6x for legacy auto companies. A company's P/E is based on its future expected growth rate, not the business in which it competes. TSLA... pic.twitter.com/5VBEpp7957

— Gary Black (@garyblack00) October 29, 2024

$TSLA 不再被大多數投資者視爲一家汽車公司。未來預期每股收益增長率爲25-30%, 特斯拉的市盈率爲84倍FY'25調整每股收益,而傳統汽車公司的市盈率爲5-6倍。公司的市盈率基於其未來預期增長率,而不是其競爭領域。 特斯拉... pic.twitter.com/5VBEpp7957

Gary Black(@garyblack00)於2024年10月29日發推文

Black on Monday raised his 6-12 month price target on Tesla from $270 to $300 citing improved earnings projections and market indicators. Black's adjusted earnings per share estimates now stand at $2.40 for FY'24 and $3.60 for FY'25, slightly above Wall Street consensus.

週一,Black將 特斯拉 的6-12個月目標股價從270美元上調至300美元,其理由是公司盈利預期和市場因子的改善。Black調整後的每股收益預估現在爲FY'24的2.40美元和FY'25的3.60美元,略高於華爾街的一致預期。

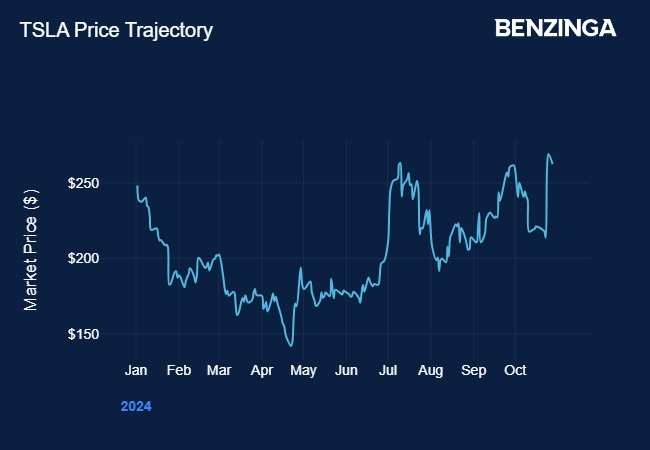

Why It Matters: Tesla's stock was on a more-or-less downward trajectory since the start of the year until the company reported its third-quarter earnings last week on Oct. 23 and gave upbeat forecasts.

爲什麼重要: 自年初以來,特斯拉的股價一直處於更或多或少的下降軌道,直到公司在10月23日報告了其第三季度業績並給出樂觀的預測。

The company reported third-quarter earnings per share of 72 cents, beating a Street consensus estimate of 58 cents per share.

公司報告第三季度每股收益爲72美分,超過了華爾街的預期每股58美分。

Musk also said that he expects vehicle sales to grow 20% to 30% next year, addressing investor concerns of falling EV demand. For 2024 too, the company is looking to exceed its delivery numbers from last year.

馬斯克還表示,他預計明年的車輛銷量將增長20%至30%,從而解決投資者對電動車需求下降的擔憂。而對於2024年,該公司也希望超過去年的交付數量。

Price Action: Tesla shares closed down 2.5% at $262.51 on Monday. The stock is up 5.7% year-to-date and up by nearly 21% over the past five days, according to data from Benzinga Pro.

股價走勢:特斯拉股價週一收盤下跌2.5%,報262.51美元。根據Benzinga Pro的數據,該股年初至今上漲了5.7%,過去五天更是上漲了近21%。

Check out more of Benzinga's Future Of Mobility coverage by following this link.

通過以下鏈接查看更多財經新聞《Benzinga智庫:移動出行未來》

- US Auto Sales To Pick Up Pace In October With EVs Crossing 9% Market Share, Says S&P Global Mobility

- 美國汽車銷售將在十月加快步伐,電動汽車市場份額將超過9%,標普全球出行表示

Photo courtesy: Tesla

圖片提供:特斯拉

譯文內容由第三人軟體翻譯。

Once Tesla's profits from its auto business fall below 50% of its overall profit, Wall Street will no longer compare it to other car companies, Black said, while also noting that in the last quarter, the company's auto business profit accounted for just 80% of its overall profit.

Once Tesla's profits from its auto business fall below 50% of its overall profit, Wall Street will no longer compare it to other car companies, Black said, while also noting that in the last quarter, the company's auto business profit accounted for just 80% of its overall profit.