US oil and Brent oil both closed down more than 6%. Citi said the market is unlikely to view Israel's recent military actions as escalating oil supply issues. However, some industry insiders also pointed out that it cannot be ruled out that Iran will retaliate in the coming weeks, causing the risk premium in the crude oil market to rise again. On Monday, according to Xinhua News Agency, Iran said it would not give up the right to respond to Israel's 'aggression'.

On Monday, US WTI crude oil plummeted more than 6%, marking the largest single-day drop in over two years. Prior to this, concerns of further escalation in the Middle East situation eased as Iranian energy facilities were not damaged in the attacks launched by Israel over the weekend.

As of Monday's close, WTI December crude oil futures fell by $4.48, a decrease of 6.13%, to $67.38 per barrel, approaching the closing prices of $67.19 on September 26 and $64.69 on September 10, the latter being the lowest closing price since June 12, 2023. Monday saw the largest single-day drop in US oil prices since July 12, 2022, when prices plummeted by 7.93% in a day.

Brent December crude oil futures fell by $4.63, a decrease of 6.09%, to $71.42 per barrel, approaching the closing prices of $71.09 on September 26 and $68.83 on September 10.

Brent December crude oil futures fell by $4.63, a decrease of 6.09%, to $71.42 per barrel, approaching the closing prices of $71.09 on September 26 and $68.83 on September 10.

According to Xinhua News Agency, the Israeli Defense Forces stated on the 26th that the Israeli military had completed "precise and targeted strikes" on multiple military targets in Iran, and the Israeli Air Force jets had safely returned to Israel. The Iranian military also stated on the same day that they successfully defended against the Israeli attack, with the Israeli operation causing "limited damage".

For the crude oil market, the main focus is on whether Iran's oil facilities will be attacked. The latest Israeli attacks did not hit key oil and nuclear facilities, avoiding locations of oil, nuclear energy, and civilian infrastructure. Iran's oil industry operations are running normally without interruptions, according to Iran's oil news website Shana. Iran accounts for about 4% of global oil supply.

Citi analysts said in their latest report on Monday that the market is unlikely to believe that Israel's recent military actions will escalate oil supply issues. Citi has lowered its price forecast for Brent crude oil in the next three months by $4 to $70 per barrel.

Currently, the prevailing view among most industry insiders is that oil prices will continue to be under pressure for the remainder of the year, making it unlikely for Brent crude oil prices to reach $80 in the foreseeable future. Some industry experts point out that due to Israel's deliberate avoidance, perhaps under the persuasion of the United States, Iranian oil facilities were spared as targets, with limited attacks easing market hopes for Middle East tensions, thus reducing the risk premium by a few dollars per barrel. The oil market has returned to focusing on oversupply concerns.

Currently, the oil production of major oil-producing countries such as the USA, Canada, and Brazil has been increasing, while the crude oil production of smaller countries like Argentina and Senegal is also on the rise.

However, some industry insiders point out that it cannot be ruled out that Iran will retaliate in the coming weeks, which will lead to another increase in the risk premium in the crude oil market. Some experts predict that the direct conflict between Israel and Iran may continue. Israel has stated that it has the capability and willingness to target Iran's energy and nuclear targets in future strikes.

On Monday, according to Xinhua News Agency, Iran stated that it will not abandon its right to respond to Israel's "aggression":

Iranian Foreign Ministry spokesman Bagaei said at a press conference on the 28th that Iran will not abandon its right to respond to what it perceives as Israel's "aggression" on its territory. Bagaei emphasized that responding to Israeli attacks is the right and responsibility of the Iranian government. According to international law, any country that is subjected to aggression and unlawful force has this right. Regardless of the outcome of negotiations, Iran will respond to Israel "resolutely in an appropriate manner," which will be determined by the national armed forces and relevant authorities.

Bagaei also said that the unlimited support from the USA has emboldened Israel to continue committing "crimes" in the Middle East region. He called on US officials to stop providing weapons, intelligence, and political support to Israel, instead of encouraging other countries to exercise restraint.

In addition, some industry insiders point out that the market will also focus on the Hamas-Israel and Israel-Hezbollah ceasefire negotiations that resumed over the weekend. Despite Israel's less aggressive response towards Iran, doubts remain on whether Israel can achieve a lasting ceasefire with Hamas and Hezbollah.

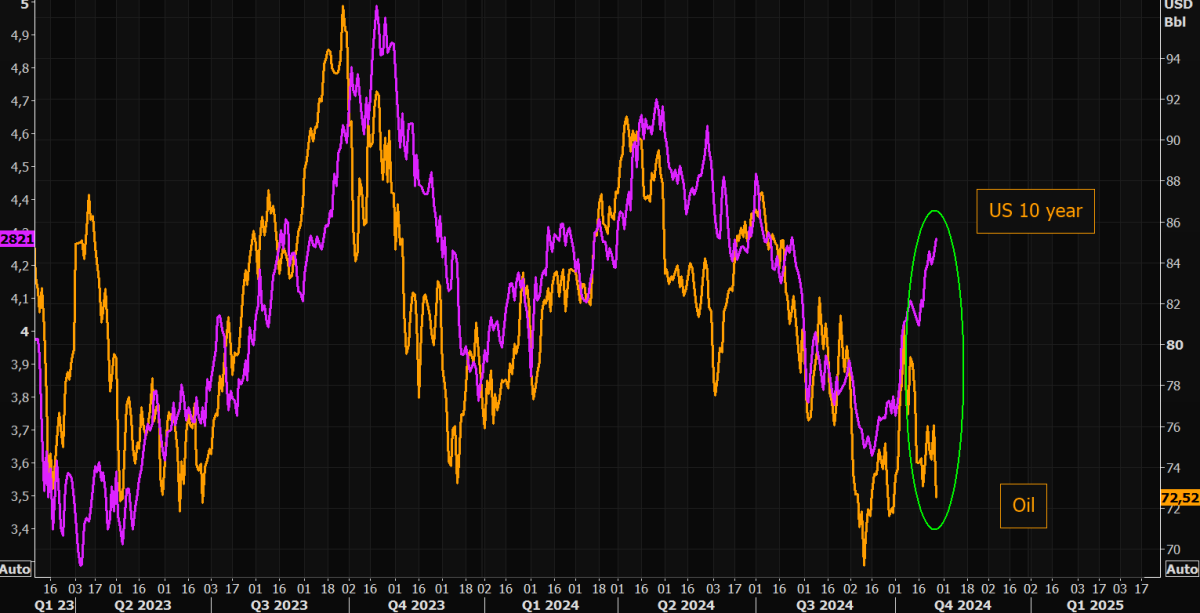

On the same day, the financial blog Zerohedge shared a chart comparing crude oil with US bond yields. For a long time, the two have been highly correlated, but recently there has been a deviation: US bond yields have risen, while oil prices have fallen.

Editor/Lambor

布伦特12月原油期货收跌4.63美元,跌幅6.09%,报71.42美元/桶,逼近9月26日的收盘位71.09美元和9月10日的收盘位68.83美元。

布伦特12月原油期货收跌4.63美元,跌幅6.09%,报71.42美元/桶,逼近9月26日的收盘位71.09美元和9月10日的收盘位68.83美元。