On Oct 28, major Wall Street analysts update their ratings for $Colgate-Palmolive (CL.US)$, with price targets ranging from $92 to $112.

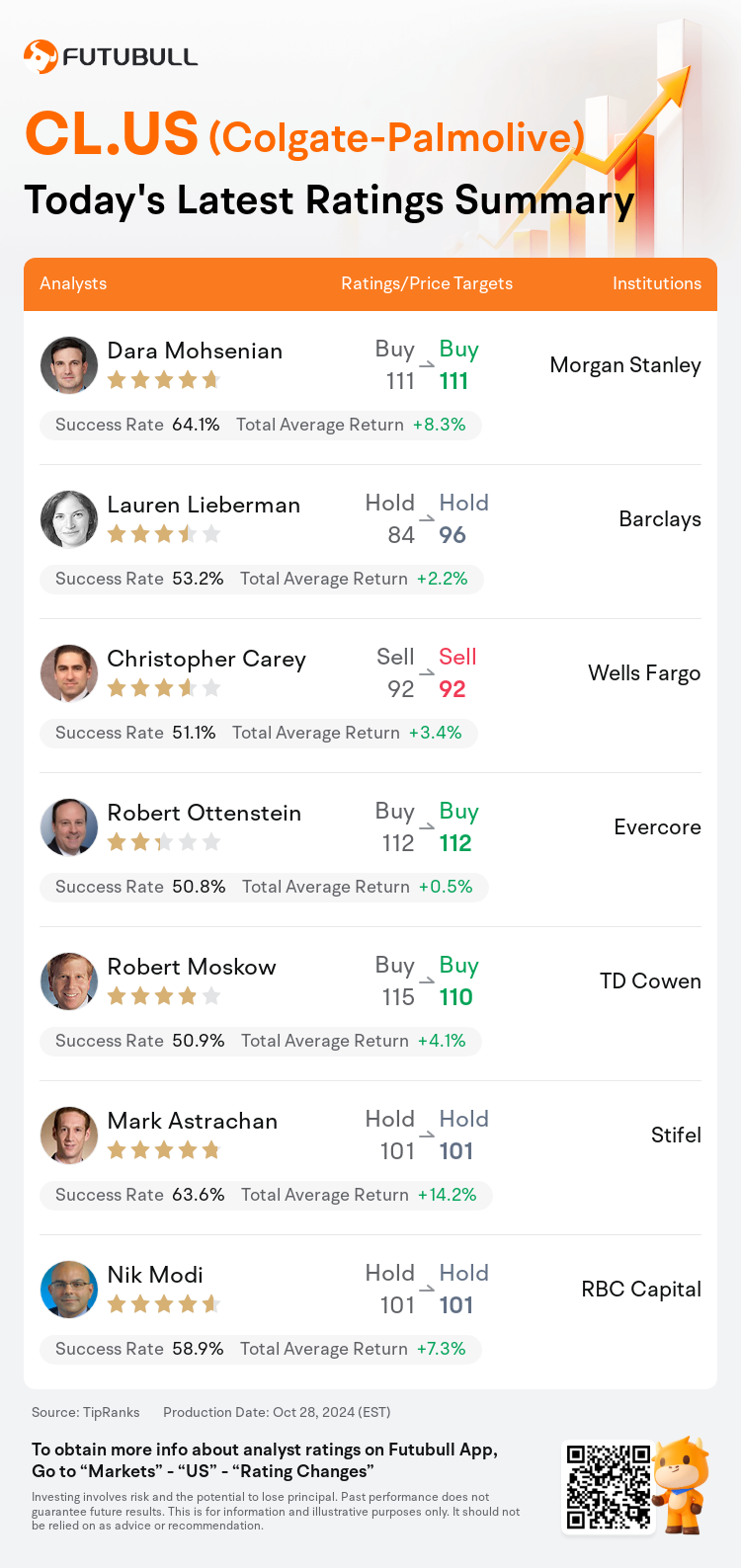

Morgan Stanley analyst Dara Mohsenian maintains with a buy rating, and maintains the target price at $111.

Barclays analyst Lauren Lieberman maintains with a hold rating, and adjusts the target price from $84 to $96.

Wells Fargo analyst Christopher Carey maintains with a sell rating, and maintains the target price at $92.

Wells Fargo analyst Christopher Carey maintains with a sell rating, and maintains the target price at $92.

Evercore analyst Robert Ottenstein maintains with a buy rating, and maintains the target price at $112.

TD Cowen analyst Robert Moskow maintains with a buy rating, and adjusts the target price from $115 to $110.

Furthermore, according to the comprehensive report, the opinions of $Colgate-Palmolive (CL.US)$'s main analysts recently are as follows:

Colgate-Palmolive's shares experienced a sell-off even though third-quarter estimates were surpassed, which is attributed more to profit-taking than underlying fundamental issues. Despite North American sales not meeting expectations, which was probably a key factor in the stock's underperformance, the anticipated positive turn in the North America division in the fourth quarter is likely due to a mix of shipment timing, innovative efforts, and overcoming previous allocation challenges.

The recent decline in Colgate-Palmolive's stock, despite surpassing third-quarter expectations and raising future projections, is believed to be due to market worries over peak valuations and doubts regarding the enduring nature of their current performance. The adjustment of the target reflects a broader trend of lower multiples throughout the sector. Nevertheless, this is seen as a favorable opportunity for investors seeking stable consumer packaged goods companies with a view through 2025.

Colgate-Palmolive's third quarter showed solid performance, yet the company's stock has witnessed a decline. The expectation is for market trends to continue normalizing, which contrasts with a valuation that remains somewhat elevated, particularly when considering a slight adjustment to earnings per share projections for 2025.

Colgate-Palmolive's fundamentals remain robust, demonstrated by a 4% increase in volume in the third quarter, following a 3% rise in the first half of 2024, positioning it as one of the top performers among large-cap consumer staples entities. Despite this, there is an expectation for a deceleration in Colgate's organic sales growth, transitioning from the high single-digits of recent years to a forecasted 4%-5% over the upcoming four quarters. This projected slowdown suggests that the stock's current valuation may not experience an upward re-rating.

Here are the latest investment ratings and price targets for $Colgate-Palmolive (CL.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月28日,多家華爾街大行更新了$高露潔 (CL.US)$的評級,目標價介於92美元至112美元。

摩根士丹利分析師Dara Mohsenian維持買入評級,維持目標價111美元。

巴克萊銀行分析師Lauren Lieberman維持持有評級,並將目標價從84美元上調至96美元。

富國集團分析師Christopher Carey維持賣出評級,維持目標價92美元。

富國集團分析師Christopher Carey維持賣出評級,維持目標價92美元。

Evercore分析師Robert Ottenstein維持買入評級,維持目標價112美元。

TD Cowen分析師Robert Moskow維持買入評級,並將目標價從115美元下調至110美元。

此外,綜合報道,$高露潔 (CL.US)$近期主要分析師觀點如下:

高露潔的股票經歷了拋售,儘管第三季度的預期被超越,但更多歸因於獲利回吐而非基本問題。儘管北美銷售未達預期,這可能是股票表現不佳的關鍵因素,但預計第四季度北美業務的積極轉變很可能是因爲出貨時間、創新努力和克服以前的配置挑戰之間的混合作用。

儘管超過第三季度的預期並提高未來預期,但高露潔股票最近出現下滑,被認爲是市場對最高估值和對當前業績持續性的懷疑所致。目標的調整反映了整個板塊估值更低的更廣泛趨勢。儘管如此,對於尋求穩定的包裝消費品公司的投資者來說,此舉被認爲是一個有利機會,展望到2025年。

高露潔的第三季度表現出色,但該公司的股票卻出現了下滑。預期市場趨勢將繼續正常化,這與估值略高仍然相反,特別是考慮到2025年每股收益預測的輕微調整。

高露潔的基本面依然強勁,第三季度銷售額增長4%,緊隨2024年上半年3%的增長,使其成爲大市值日用消費品實體中表現最佳之一。儘管如此,有人預計高露潔的有機銷售增長將放緩,從近年的高單位數轉變爲接下來四個季度的預測4%-5%。這一預期的放緩暗示着股票當前的估值可能不會再度上漲。

以下爲今日7位分析師對$高露潔 (CL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Christopher Carey維持賣出評級,維持目標價92美元。

富國集團分析師Christopher Carey維持賣出評級,維持目標價92美元。

Wells Fargo analyst Christopher Carey maintains with a sell rating, and maintains the target price at $92.

Wells Fargo analyst Christopher Carey maintains with a sell rating, and maintains the target price at $92.