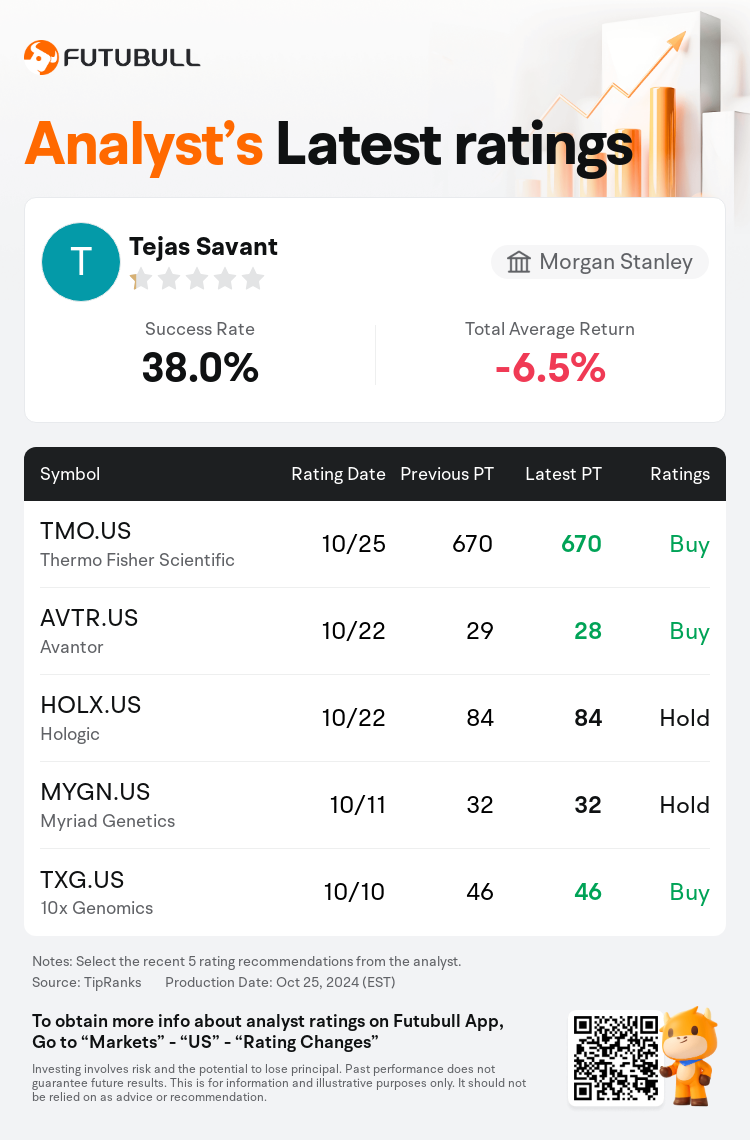

Morgan Stanley analyst Tejas Savant maintains $Thermo Fisher Scientific (TMO.US)$ with a buy rating, and maintains the target price at $670.

According to TipRanks data, the analyst has a success rate of 38.0% and a total average return of -6.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Thermo Fisher Scientific (TMO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Thermo Fisher Scientific (TMO.US)$'s main analysts recently are as follows:

Thermo Fisher's recent financial performance met expectations in a context of high anticipation. Solid execution was noted in a challenging demand climate for tools, with uncertainty remaining regarding the timing of demand improvement.

The company's third-quarter earnings presentation was deemed more encouraging than the actual results, and the analyst continues to hold a positive outlook on the stock. The Life Sciences Solutions segment is experiencing bioproduction momentum, and the Laboratory Products and Biopharma Services segment appears to be unaffected by a biotech slowdown.

The firm observes that Thermo Fisher's core growth is showing a consistent improvement on a quarter-over-quarter basis, with forecasts suggesting a slight increase to approximately 2.5% in Q4. Expectations from the market for a 5% core growth by 2025 are also perceived as reasonable and justifiable. The firm maintains its appreciation for Thermo Fisher's resilient business model and the flexibility provided by its balance sheet.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

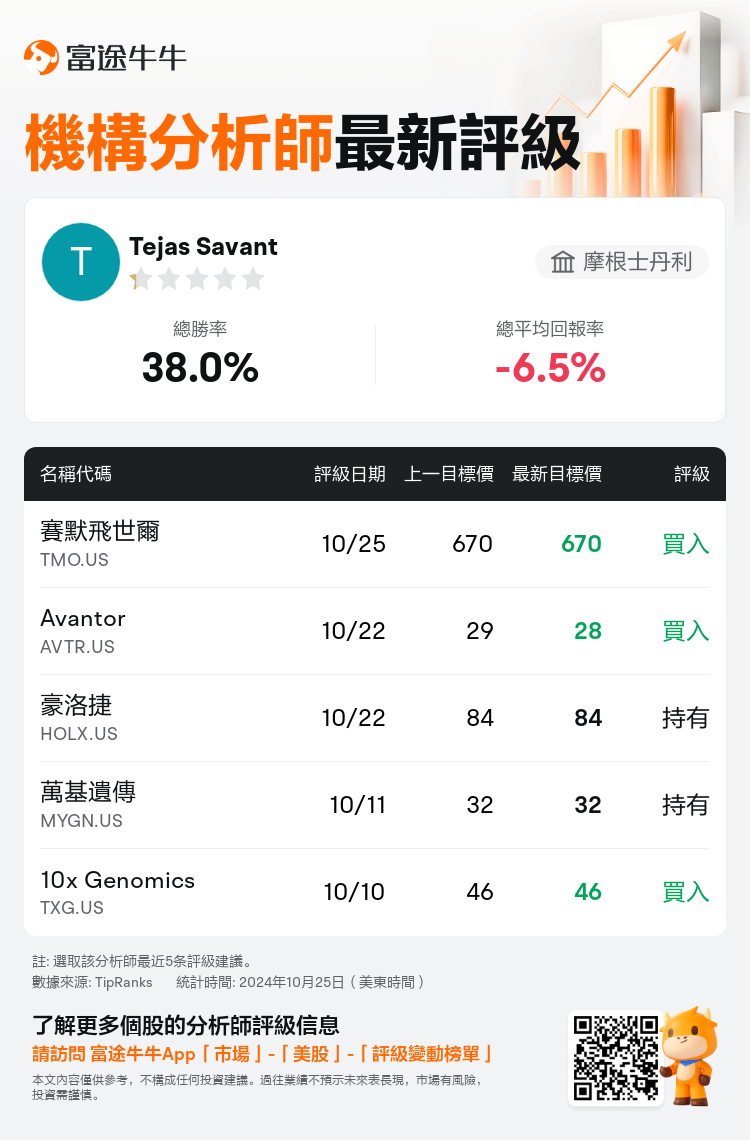

摩根士丹利分析師Tejas Savant維持$賽默飛世爾 (TMO.US)$買入評級,維持目標價670美元。

根據TipRanks數據顯示,該分析師近一年總勝率為38.0%,總平均回報率為-6.5%。

此外,綜合報道,$賽默飛世爾 (TMO.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽默飛世爾 (TMO.US)$近期主要分析師觀點如下:

賽默飛世爾最近的財務表現符合預期,高度期待的背景下表現穩健。儘管工具需求環境具有挑戰性,但實現了良好的執行,對需求改善的時機仍存在不確定性。

公司第三季度收益報告被認爲比實際結果更令人鼓舞,分析師繼續持有積極的股票展望。生命科學解決方案部門正在經歷生物生產動力,實驗室產品和生物製藥服務部門似乎不受生物技術放緩的影響。

該公司觀察到賽默飛世爾的核心增長呈現季度持續改善,預測顯示四季度核心增長率略有增長,達到約2.5%。市場對2025年5%的核心增長預期也被認爲是合理且有根據的。該公司對賽默飛世爾彈性業務模式和資產負債表提供的靈活性的讚賞仍然保持。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$賽默飛世爾 (TMO.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽默飛世爾 (TMO.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of