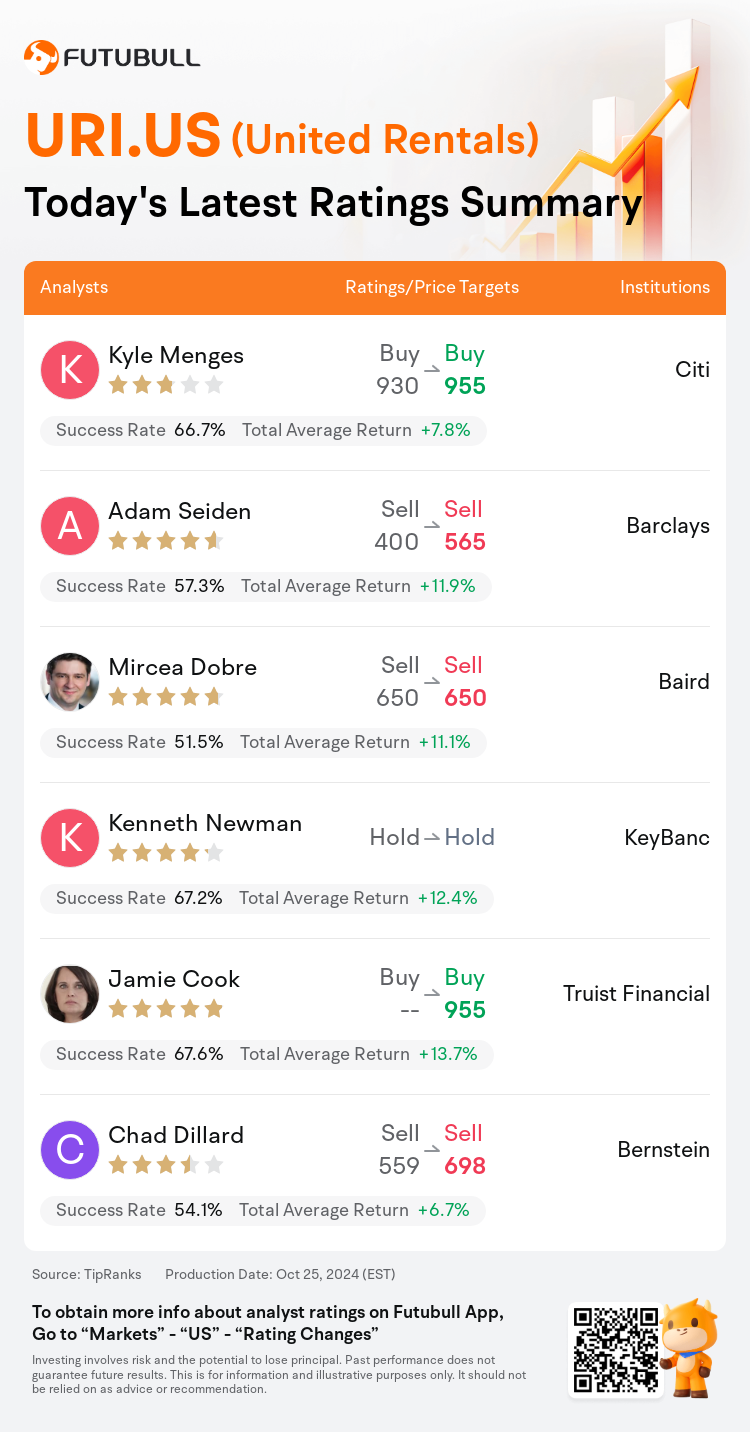

On Oct 25, major Wall Street analysts update their ratings for $United Rentals (URI.US)$, with price targets ranging from $565 to $955.

Citi analyst Kyle Menges maintains with a buy rating, and adjusts the target price from $930 to $955.

Barclays analyst Adam Seiden maintains with a sell rating, and adjusts the target price from $400 to $565.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

KeyBanc analyst Kenneth Newman maintains with a hold rating.

Truist Financial analyst Jamie Cook maintains with a buy rating, and sets the target price at $955.

Furthermore, according to the comprehensive report, the opinions of $United Rentals (URI.US)$'s main analysts recently are as follows:

Post the Q3 report, it's noted that United Rentals' key performance indicators are exhibiting a downward trend, and the unit economics have been experiencing a decline since the latter part of 2022.

United Rentals is expected to experience growth by 2025, which is anticipated to be driven by mega projects. This outlook persists despite the potential for ongoing softness in local markets, as noted by an analyst.

The company's Q3 outcomes were marginally below expectations, with certain aspects not meeting forecasts. Despite this, the projection for Q4 isn't assured, yet growth is anticipated to continue into 2025 even against a subdued industrial environment. It is believed that the company merits a higher valuation multiple as easing monetary policies begin to take effect. The business model and financial structure are considered to be robust, with the flexibility to adjust to the changes in the economic cycle.

The company noted a minor discrepancy in earnings while maintaining its future projections. Analysts observe indications that are in line with the peak of demand, which is also reflected in the commencement of construction activities and the slowing pace of non-residential expenditure commitments.

Here are the latest investment ratings and price targets for $United Rentals (URI.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

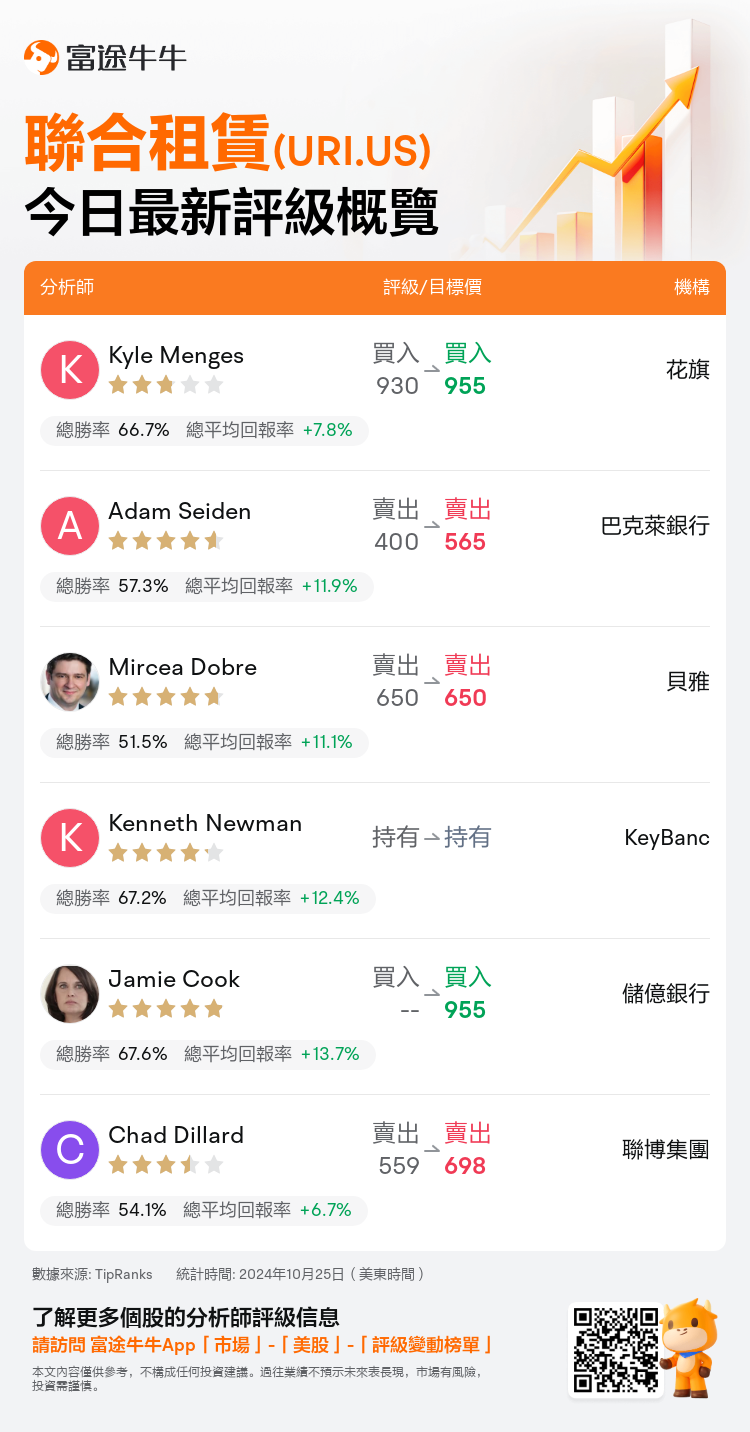

美東時間10月25日,多家華爾街大行更新了$聯合租賃 (URI.US)$的評級,目標價介於565美元至955美元。

花旗分析師Kyle Menges維持買入評級,並將目標價從930美元上調至955美元。

巴克萊銀行分析師Adam Seiden維持賣出評級,並將目標價從400美元上調至565美元。

貝雅分析師Mircea Dobre維持賣出評級,維持目標價650美元。

貝雅分析師Mircea Dobre維持賣出評級,維持目標價650美元。

KeyBanc分析師Kenneth Newman維持持有評級。

儲億銀行分析師Jamie Cook維持買入評級,目標價955美元。

此外,綜合報道,$聯合租賃 (URI.US)$近期主要分析師觀點如下:

發帖第三季度報告顯示,聯合租賃的關鍵績效因子正在呈現下降趨勢,自2022年下半年以來,單位經濟出現下滑。

聯合租賃預計到2025年將經歷增長,預計將受到大型項目的推動。儘管分析師指出當地市場可能持續疲軟,這一展望仍然存在。

公司第三季度業績略低於預期,某些方面未達到預測。儘管如此,對第四季度的預測並不確定,但預計增長將持續到2025年,即使在工業環境疲軟的情況下。

公司注意到收益存在輕微差異,同時保持未來預測。分析師觀察到符合需求高峰的跡象,這也反映在施工活動的開始和非住宅支出承諾放緩的步伐中。

以下爲今日6位分析師對$聯合租賃 (URI.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

貝雅分析師Mircea Dobre維持賣出評級,維持目標價650美元。

貝雅分析師Mircea Dobre維持賣出評級,維持目標價650美元。

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.