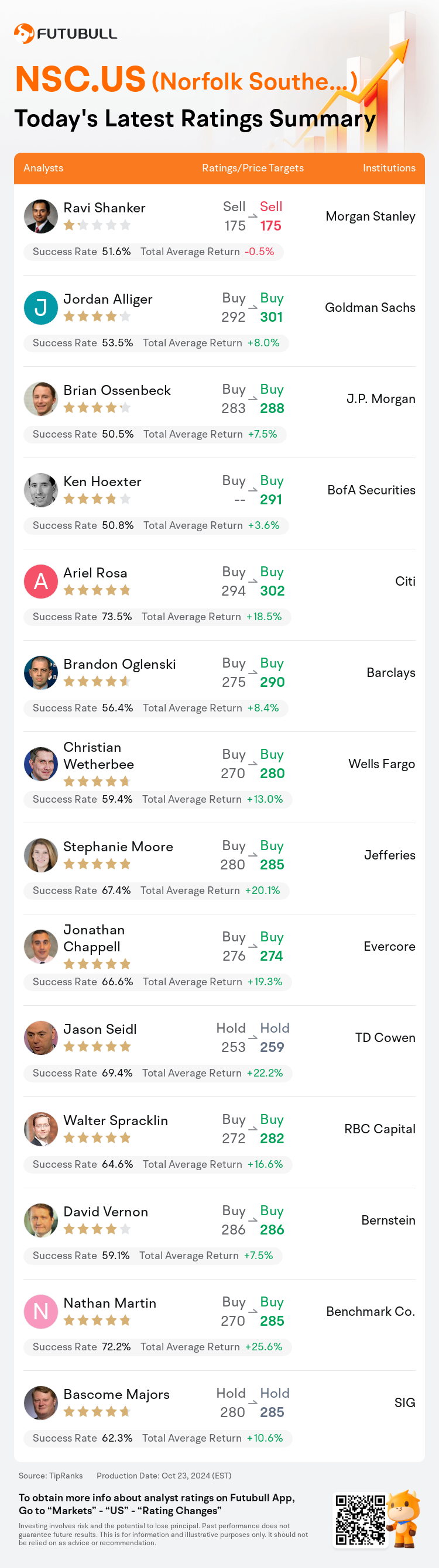

On Oct 23, major Wall Street analysts update their ratings for $Norfolk Southern (NSC.US)$, with price targets ranging from $175 to $302.

Morgan Stanley analyst Ravi Shanker maintains with a sell rating, and maintains the target price at $175.

Goldman Sachs analyst Jordan Alliger maintains with a buy rating, and adjusts the target price from $292 to $301.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $283 to $288.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $283 to $288.

BofA Securities analyst Ken Hoexter maintains with a buy rating, and sets the target price at $291.

Citi analyst Ariel Rosa maintains with a buy rating, and adjusts the target price from $294 to $302.

Furthermore, according to the comprehensive report, the opinions of $Norfolk Southern (NSC.US)$'s main analysts recently are as follows:

The company delivered a comparatively positive earnings report. Despite several challenges expected to affect Q4 margins, there is a vision for significant enhancements in profitability by 2025, which correlates with a compelling equity value.

The company is positioned to enhance margins significantly compared to other Class 1 railways in the near to medium term as it starts from a lower base relative to its peers. The recent sequential margin improvements are indicative of a positive trend. Additionally, the recent increase in carloads and the expected narrowing of the operating ratio gap across its Eastern network geographies signify further operational advancements.

Norfolk Southern's Q3 adjusted EPS observed a 23% increase year over year, surpassing Street estimates. The company also reaffirmed its full year operating ratio goal of 66%, despite a decrease in its 2024 revenue growth forecast to 1% year over year from the previous 3%. It is anticipated that Norfolk Southern will boost earnings through productivity enhancements.

Following the release of quarterly results, there is a positive outlook on Norfolk Southern's operational performance. The company is making notable progress in areas where it had faced challenges, particularly in the implementation of precision scheduled railroading, which is contributing to better efficiency and improved margins. It is observed that achieving an operating ratio under 60 remains a realistic target for the company, assuming macroeconomic support. It's also indicated that the impressive operating ratio this quarter may have been influenced by a combination of volume growth and operational leverage effects.

The company's Q3 earnings surpassed expectations, showcasing its effective cost-saving measures and indicating that Norfolk Southern is experiencing a structural shift in cost management. Relative to its peers, with one having faced a tougher quarter, the company's Q3 performance is particularly commendable.

Here are the latest investment ratings and price targets for $Norfolk Southern (NSC.US)$ from 14 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

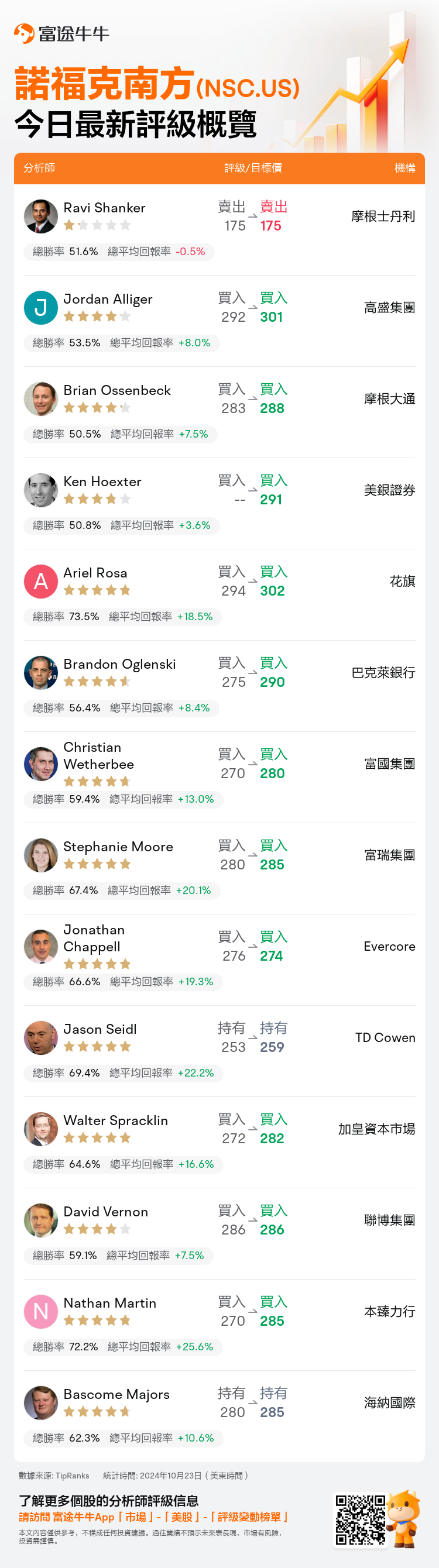

美東時間10月23日,多家華爾街大行更新了$諾福克南方 (NSC.US)$的評級,目標價介於175美元至302美元。

摩根士丹利分析師Ravi Shanker維持賣出評級,維持目標價175美元。

高盛集團分析師Jordan Alliger維持買入評級,並將目標價從292美元上調至301美元。

摩根大通分析師Brian Ossenbeck維持買入評級,並將目標價從283美元上調至288美元。

摩根大通分析師Brian Ossenbeck維持買入評級,並將目標價從283美元上調至288美元。

美銀證券分析師Ken Hoexter維持買入評級,目標價291美元。

花旗分析師Ariel Rosa維持買入評級,並將目標價從294美元上調至302美元。

此外,綜合報道,$諾福克南方 (NSC.US)$近期主要分析師觀點如下:

公司發佈了相對積極的收益報告。儘管預計會面臨一些挑戰影響到第四季度的利潤率,但到2025年,將有顯著利潤增長的願景,這與股權價值的潛力相關。

該公司定位在未來中短期內將顯着增加利潤率,與其他一級鐵路相比其起點較低,顯示了積極的趨勢。近期的連續利潤率改善表明了積極的趨勢。此外,最近承載量的增加以及預期在其東部地區地理位置上縮小的運營比率差距顯示了更多的運營進步。

諾福克南方的第三季度調整後每股收益同比增長了23%,超過了市場預期。儘管2024年營收增長預期從之前的3%同比年增長下調至1%,該公司也重申了全年66%的運營比率目標。預計諾福克南方將通過提升生產力增加收益。

在季度業績發佈後,對於諾福克南方的運營績效持樂觀態度。該公司在曾經面臨挑戰的領域取得了顯著進展,特別是在實施精準調度鐵路方面,有助於提高效率和改善利潤率。可以看到,假設宏觀經濟支撐,實現60以下的運營比率仍然是該公司的一個現實目標。還有跡象表明,本季度出色的運營比率可能受到成交量增長和運營槓桿效應的影響。

該公司第三季度收益超出預期,展示了其有效的節約成本措施,並表明諾福克南方正經歷成本管理方面的結構性轉變。與其中一家經歷更爲艱難季度的同行相比,該公司第三季度的表現特別值得讚賞。

以下爲今日14位分析師對$諾福克南方 (NSC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Brian Ossenbeck維持買入評級,並將目標價從283美元上調至288美元。

摩根大通分析師Brian Ossenbeck維持買入評級,並將目標價從283美元上調至288美元。

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $283 to $288.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $283 to $288.