On Oct 23, major Wall Street analysts update their ratings for $Texas Instruments (TXN.US)$, with price targets ranging from $140 to $298.

Morgan Stanley analyst Joseph Moore maintains with a sell rating, and adjusts the target price from $154 to $167.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and maintains the target price at $230.

Barclays analyst Thomas O'Malley maintains with a hold rating, and maintains the target price at $200.

Barclays analyst Thomas O'Malley maintains with a hold rating, and maintains the target price at $200.

UBS analyst Timothy Arcuri maintains with a buy rating, and maintains the target price at $250.

Evercore analyst Mark Lipacis maintains with a buy rating, and adjusts the target price from $268 to $298.

Furthermore, according to the comprehensive report, the opinions of $Texas Instruments (TXN.US)$'s main analysts recently are as follows:

Texas Instruments delivered a performance that exceeded expectations for the September-ending quarter, with a notable strong performance in the automotive sector. However, there is uncertainty about the time frame in which the observed weakness in end demand will reflect on broad market analog suppliers. It has been noted that industrial sectors are exhibiting unexpected weakness, whereas the automotive sector has shown resilience. There is an anticipation that these trends might shift moving forward.

The opinion suggests that Texas Instruments' automotive segment has experienced growth in China, with a 20% increase over the previous two quarters. However, this positive performance is balanced by a weaker Industrial segment, resulting in a perception that the stock remains relatively costly.

The recommendation to increase holdings in Texas Instruments comes with expectations that the company's Q4 revenues will surpass the upper limit of its forecasted range. Analysts suggest that Texas Instruments is positioned to enter a period characterized by surpassing expectations and providing positive forecast adjustments through the year 2025.

Sequential revenue growth is observed in all end-markets except industrial, which company management and their peers are promoting as a sign of a cyclical recovery. It is argued that these sequential comparisons are indicative of shipments aligning more closely with actual end-demand after a period of substantial undershipping.

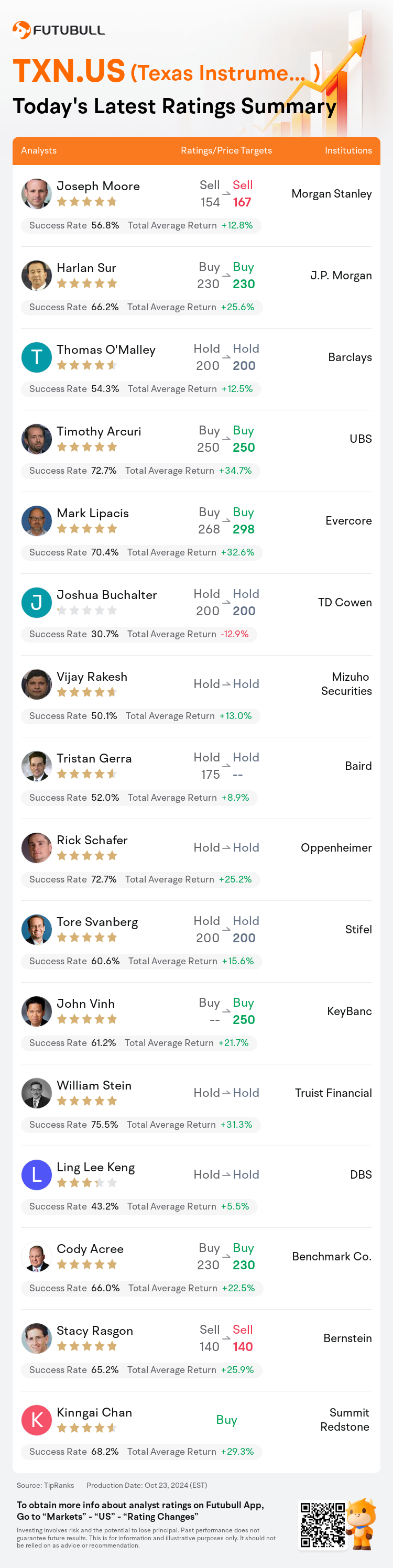

Here are the latest investment ratings and price targets for $Texas Instruments (TXN.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月23日,多家华尔街大行更新了$德州仪器 (TXN.US)$的评级,目标价介于140美元至298美元。

摩根士丹利分析师Joseph Moore维持卖出评级,并将目标价从154美元上调至167美元。

摩根大通分析师Harlan Sur维持买入评级,维持目标价230美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,维持目标价200美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,维持目标价200美元。

瑞士银行分析师Timothy Arcuri维持买入评级,维持目标价250美元。

Evercore分析师Mark Lipacis维持买入评级,并将目标价从268美元上调至298美元。

此外,综合报道,$德州仪器 (TXN.US)$近期主要分析师观点如下:

德州仪器在截至九月的季度交付了超出预期的表现,汽车板块表现强劲。然而,关于观察到的终端需求疲软何时会反映在广泛市场模拟供应商身上存在不确定性。人们注意到工业板块表现出意外薄弱,而汽车板块表现出弹性。有人预计这些趋势可能会在未来发生转变。

有观点认为,德州仪器的汽车板块在中国经历了增长,与前两个季度相比增长了20%。然而,这种积极表现被工业板块的疲软所平衡,导致人们认为股票仍然相对昂贵。

建议增加对德州仪器的持股,在预期公司第四季度的营业收入将超过预测区间的上限。分析师们认为,德州仪器正处于超越预期并通过2025年提供积极的预测调整的时期。

在所有终端市场中,除了工业板块外,都观察到了环比营收增长,公司管理层及其同行将其宣传为周期性复苏的迹象。有人认为,这些环比比较显示了在重大低出货期后,出货更加接近实际需求。

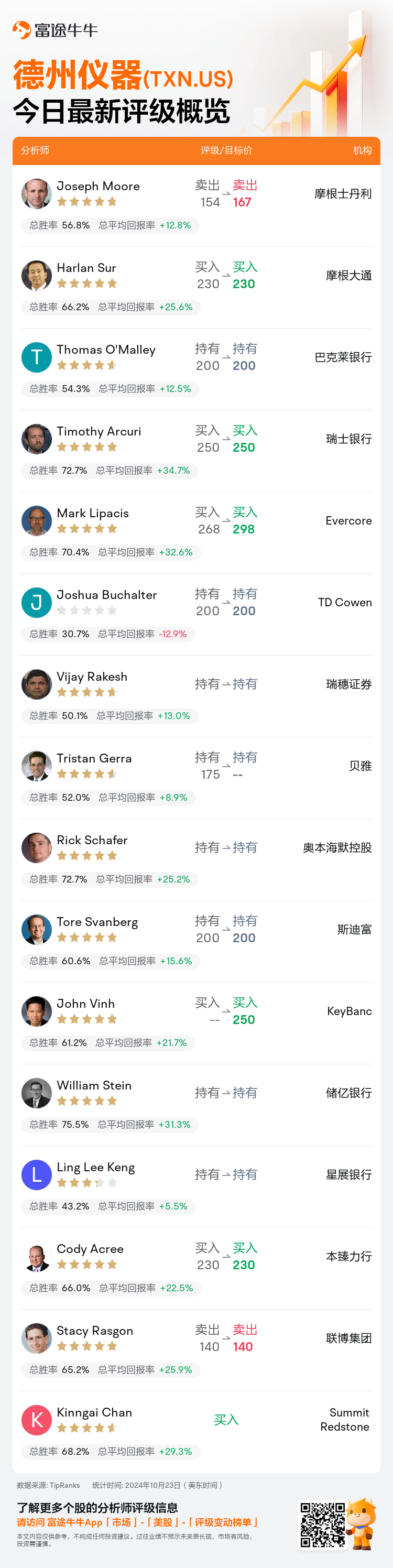

以下为今日16位分析师对$德州仪器 (TXN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Thomas O'Malley维持持有评级,维持目标价200美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,维持目标价200美元。

Barclays analyst Thomas O'Malley maintains with a hold rating, and maintains the target price at $200.

Barclays analyst Thomas O'Malley maintains with a hold rating, and maintains the target price at $200.