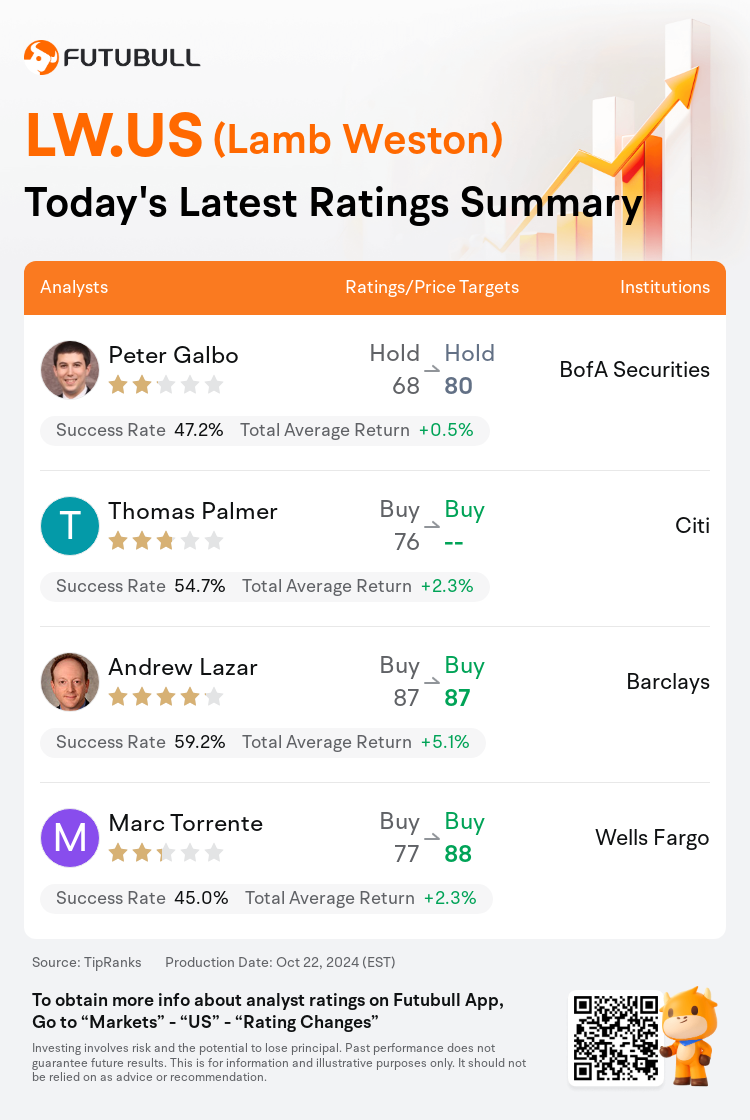

On Oct 22, major Wall Street analysts update their ratings for $Lamb Weston (LW.US)$, with price targets ranging from $80 to $88.

BofA Securities analyst Peter Galbo maintains with a hold rating, and adjusts the target price from $68 to $80.

Citi analyst Thomas Palmer maintains with a buy rating.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Wells Fargo analyst Marc Torrente maintains with a buy rating, and adjusts the target price from $77 to $88.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Expectations for Lamb Weston's shares to appreciate in the coming year are rooted in fundamental enhancements like a rebound in volume, operational leverage, and a more favorable pricing landscape. Additionally, there is anticipation of another possible path to value creation given the track record of successful activism in the food sector.

After an activist investor disclosed a significant stake in Lamb Weston and indicated plans to engage with the board and management about the company's series of self-imposed errors, analysts acknowledge the move. They note that given Lamb Weston's lackluster stock performance since the start of the year, the emergence of activist interest is not unexpected. The involvement of an investor with a background in the agricultural sector alongside the activist is perceived as adding substantial influence.

Following the disclosure of a significant investment by an activist investor in Lamb Weston and their intention to prompt the consideration of a sale, there is added pressure on the management of the company, especially considering the 34% decline in share value year-to-date prior to the announcement. It is considered somewhat unlikely that there will be considerable interest from any of the major branded companies. Lamb Weston experiences greater fluctuations in its financial performance due to its substantial involvement with the foodservice sector and is subject to the influence of overarching market trends and the annual potato crop's quality.

Lamb Weston's shares experienced a significant increase following the announcement that an activist acquired a substantial stake, which may act as a catalyst for hastened strategic initiatives. While there are ongoing discussions regarding short-term outcomes, there is optimism surrounding the company's prospects for recovery.

The revelation that an activist entity disclosed a significant stake in Lamb Weston is perceived positively, as it is expected to catalyze a heightened sense of urgency within the company to enhance its performance. Discussions regarding strategic alternatives with the board are anticipated.

Here are the latest investment ratings and price targets for $Lamb Weston (LW.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月22日,多家華爾街大行更新了$Lamb Weston (LW.US)$的評級,目標價介於80美元至88美元。

美銀證券分析師Peter Galbo維持持有評級,並將目標價從68美元上調至80美元。

花旗分析師Thomas Palmer維持買入評級。

巴克萊銀行分析師Andrew Lazar維持買入評級,維持目標價87美元。

巴克萊銀行分析師Andrew Lazar維持買入評級,維持目標價87美元。

富國集團分析師Marc Torrente維持買入評級,並將目標價從77美元上調至88美元。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

預計 Lamb Weston 的股票在未來一年有望升值,根植於像成交量的回升、運營槓桿和更爲有利的定價環境這樣的基本改進。此外,鑑於食品板塊成功激勵活動的成功記錄,還有另一種增值可能路徑的預期。

一名激進投資者披露在 Lamb Weston 持有重要股份,並表明計劃與董事會和管理層討論公司一系列自我施加的錯誤後,分析師們對此舉表示認可。他們指出,考慮到 Lamb Weston 自年初以來股價表現平平,激進投資興趣的出現並不意外。與激進者一起的具有農產品領域背景的投資者的參與被視爲增加了實質性影響力。

在一名激進投資者披露在 Lamb Weston 擁有重要股份並打算促使考慮出售後,公司管理層面臨着更大壓力,尤其是考慮到在宣佈之前其股價年度累計下跌34%。比起出售有名品牌公司,衆多公司對此將產生相當大的興趣的可能性被認爲有點小。由於與餐飲服務板塊的廣泛聯繫,Lamb Weston 的財務表現更容易出現較大波動,受制於全面性市場趨勢和年度馬鈴薯產量的質量。

在激進投資者獲得大量股份的披露後,Lamb Weston 的股價經歷了顯著增長,這可能成爲推動加速戰略舉措的催化劑。儘管關於短期結果仍在討論中,但對公司復甦前景仍持樂觀態度。

激進實體披露在 Lamb Weston 擁有重要股份的消息被視爲積極的,因爲預計這將加速公司內部改善績效的緊迫感。與董事會關於戰略替代方案的討論備受期待。

以下爲今日4位分析師對$Lamb Weston (LW.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Andrew Lazar維持買入評級,維持目標價87美元。

巴克萊銀行分析師Andrew Lazar維持買入評級,維持目標價87美元。

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.