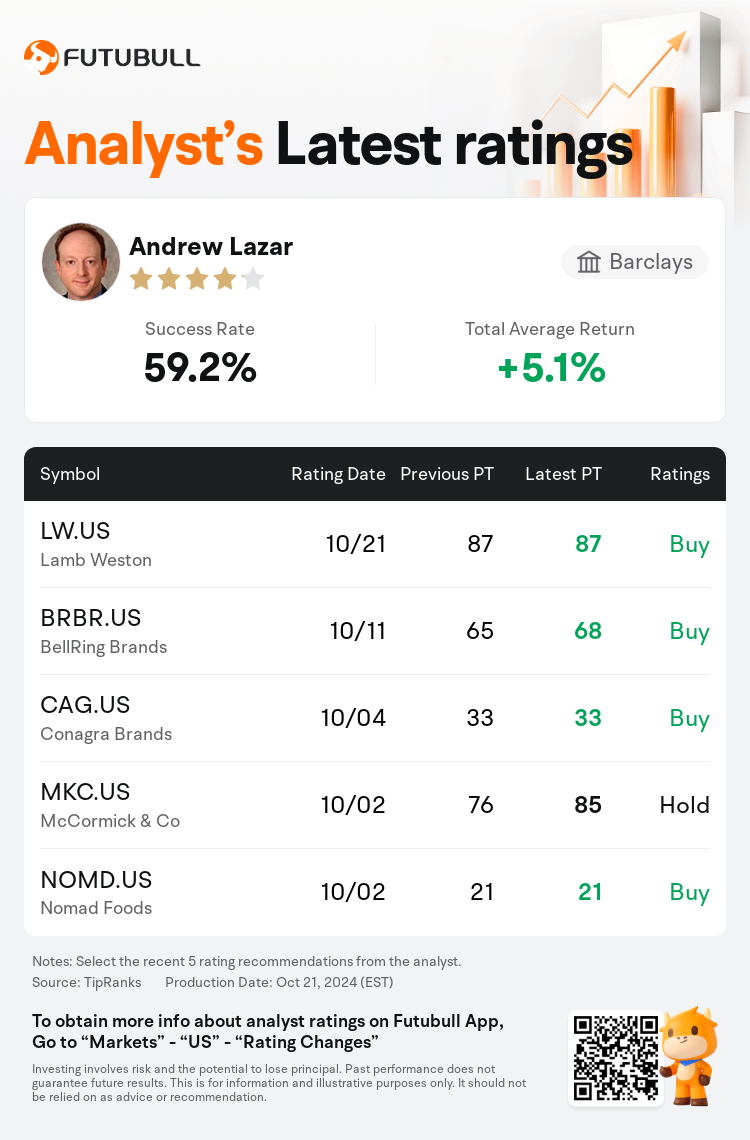

Barclays analyst Andrew Lazar maintains $Lamb Weston (LW.US)$ with a buy rating, and maintains the target price at $87.

According to TipRanks data, the analyst has a success rate of 59.2% and a total average return of 5.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

There is an increase in pressure on Lamb Weston management as shares have fallen significantly since the start of the year. This sentiment follows the disclosure of a notable investment by an activist investor, which also brings speculation about the company's potential exploration of a sale. It's considered somewhat improbable that there would be considerable interest from any major branded firms. Lamb Weston has substantial exposure to the foodservice sector and typically experiences more variability in its financial performance compared to established packaged food producers, due to the significant influence of both broader economic trends and the variability in the annual potato crop.

Following the disclosure of an activist investor acquiring a 5% stake, there is anticipation of potential discussions regarding strategic alternatives with the company's board. This development is perceived positively, as it may at least intensify the company's commitment to enhancing its performance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

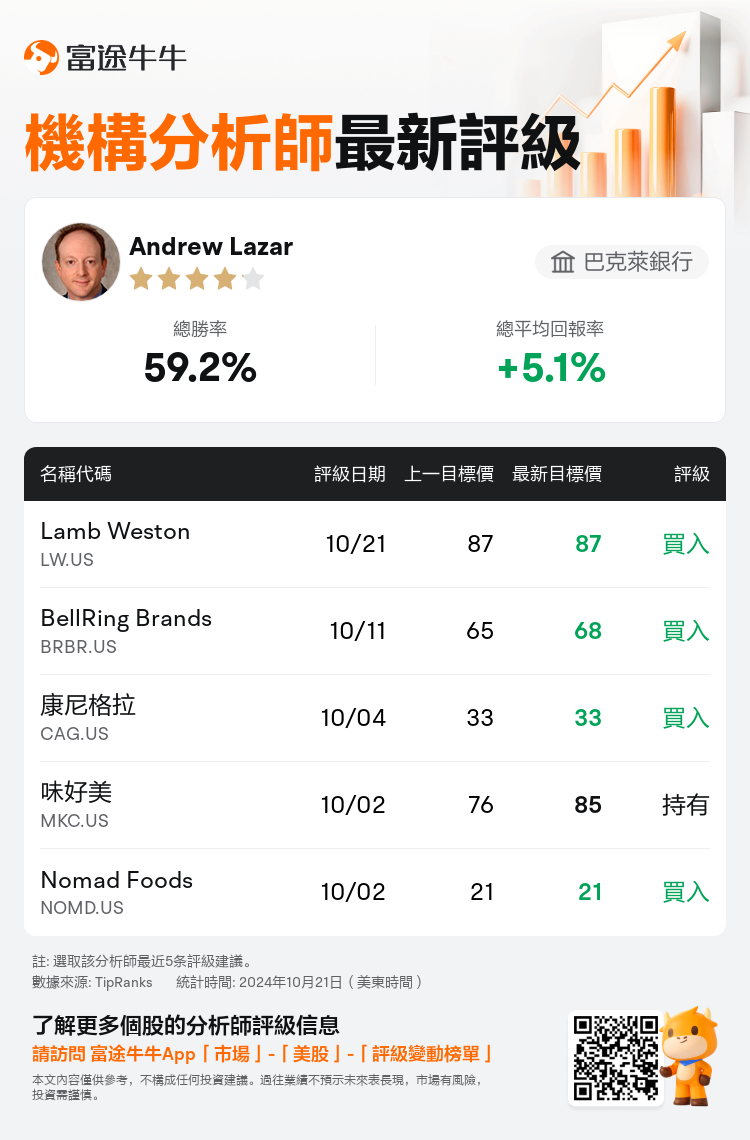

巴克萊銀行分析師Andrew Lazar維持$Lamb Weston (LW.US)$買入評級,維持目標價87美元。

根據TipRanks數據顯示,該分析師近一年總勝率為59.2%,總平均回報率為5.1%。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

自今年年初以來,Lamb Weston管理層面臨壓力增加,股價大幅下跌。這種情緒是由一位激進投資者披露的投資引發的,也引起了關於公司潛在出售的猜測。一些人認爲,任何主要知名公司對其可能會有相當感興趣,這在一定程度上是不太可能的。Lamb Weston在餐飲板塊有着重要的暴露,並且與傳統包裝食品生產商相比,通常會更多地經歷財務績效上的波動,這是由於更廣泛的經濟趨勢和年度土豆產量的變化所產生的重要影響。

在激進投資者收購5%股份的披露之後,人們預計可能會就戰略選擇與公司董事會進行討論。這一進展被認爲是積極的,因爲它至少可能會加強公司對提升業績的承諾。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of