來源:晚點Auto

作者:趙宇

海外市場壁壘提升,國內市場競爭加劇。

去年 11 月,我們曾率先介紹, $理想汽車 (LI.US)$ 計劃在 2024 年進入沙特、阿聯酋等中東國家市場,前期把在國內生產的汽車直接運輸到海外市場售賣,遠期則計劃在海外建立直營門店網絡、整車工廠。

但據我們了解,理想汽車的出海步伐較一年前的規劃明顯放緩。

但據我們了解,理想汽車的出海步伐較一年前的規劃明顯放緩。

一位知情人士告訴我們,理想管理層認爲出海需要做更充分的準備,比如希望出海車型爲當地消費者專屬設計,會與國內市場在售車型版本存在一定區別。

「理想不會簡單地只是把理想車機系統語言從中文改成英文,而是會在車輛外觀、智駕功能以及其他配置方面實現差異化,然後用一個合適的品牌推向海外市場。」 這位人士說。

中東市場的複雜程度也超出理想最初的預估。另一位接近理想汽車出海團隊的人士對我們分析稱,理想出海的步伐之所以放緩,並不是因爲出現了新的負面因素,而是時機還不夠成熟。

「中東地處歐亞非的十字路口,歷史又非常複雜,不能把任何事情簡單化。」 他說,並且,他還以阿聯酋人工智能和雲計算公司 G42 近期和中國拉開距離、轉而和美國走得更近爲例,表示中東國家確實對華友好,但並不是只對華友好,歐美一直對中東有很強影響力。

據我們了解,理想管理層認爲短期內中國新勢力車企較難進入美國和西歐主要國家市場,而中國、美國和西歐合計佔據全球 85%-90% 的豪華車市場份額,理想作爲車型售價較高的汽車品牌,進入其他國家或地區汽車市場的戰略意義也不大。

我們就上述信息與理想汽車官方確認,截至發稿,未獲回覆。

中東市場沒有想象中美好

在理想 2020 年四季度業績會上,理想汽車董事長兼 CEO 李想曾說,海外市場是理想必然要進入的市場。

理想實際的出海動作可以追溯至三年前。一位知情人士告訴我們,2021 年下半年,理想就準備進入美國市場,併爲此搭建起約 30 人的團隊。這個團隊當時負責的工作主要包括海外市場推廣、品牌策略、戰略分析、數據分析等。

2022 年初,由於出海暫緩,該團隊的部分成員被調整到國內業務,另有部分成員離職。

到了 2023 年,理想重新將出海提上議事日程。當年 5 月,理想高級副總裁範皓宇曾在美國硅谷的一場宣講會上說:「出海是我們公司(管理層)每年都會聊好幾次的問題……至少在中國市場做到 30% 的市佔率之前就要出海,因爲如果直到國內市佔率達到 30% 才開始做這件事,會有點晚。」

今年 2 月,在理想 2023 年四季度業績會上,鄒良軍重申海外市場對理想汽車來說非常重要,正在加快開拓海外市場進度。

他還說,理想希望在海外做直營,並在迪拜啓動了當地銷售和服務團隊的招聘工作。2024 年上半年,理想計劃在中亞和中東建立專門的售後服務網絡;四季度,理想將開始海外交付,首先在當地推出理想 L9、L7 兩款車型。

今年 5 月,鄒良軍在 2024 年一季度業績會上確認理想出海放緩、銷售模式也由全直營改爲部分與經銷商合作。

據我們了解,理想之所以暫緩出海中東,有多方面的原因。

首先,中東地區的新能源車市場發展還處於起步階段,現階段的市場規模較小。

中東國家多數盛產石油、油價低廉,這在一定程度上阻礙了電動車在當地的普及。即便是普及率最高的阿聯酋,當前其新能源滲透率也僅爲 3% 左右,遠低於全球平均水平的 20%。

汽車市場研究機構 Mordor Intelligence 數據顯示,2023 年中東新能源車的市場規模約爲 27 億美元。這一數字相當於同期中國新能源車市場規模的百分之一。

其次,理想管理層對於當前平行出口帶來的新車銷量比較滿意,因此不急於出海。

近兩年,理想旗下 L 系列車型主要以平行出口的方式售賣到海外市場。去年 7 月,李想曾在微博上發文稱:「7 月前兩週,私人平行出口了 200 多輛車,詳細調查後發現以出口中亞和中東爲主。」 他還在回覆網友評論時稱,「我們沒有權利限制私人平行出口的需求」。

汽車的平行出口,是指貿易商將在國內完成生產的汽車運輸到海外國家或地區售賣,並從中賺取差價。但由於貿易商未經汽車品牌授權,海外消費者購車後,在車輛維修、保養等方面缺乏保障。

據我們了解,2023 年,理想共以平行出口的方式在海外市場銷售了 3 萬多輛車,銷量佔比約爲 10%。今年,理想以平行出口方式銷往海外的新車預計也將佔到全年總銷量的 10% 左右。

最後,國內的激烈競爭也在一定程度上影響了理想的出海決策。

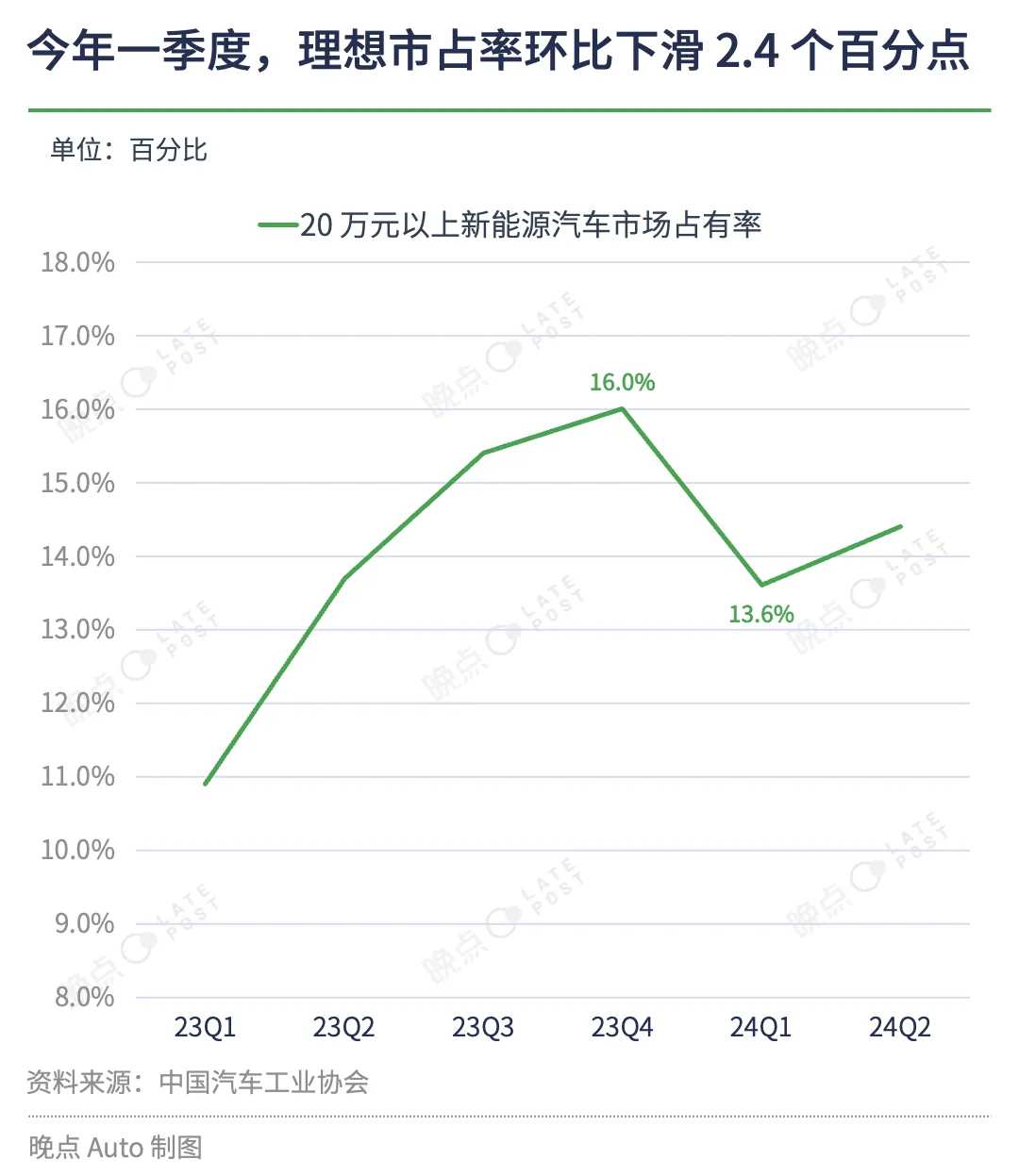

今年前兩個季度,理想在中國售價 20 萬元以上新能源市場的份額分別爲 13.6% 和 14.4%,均低於去年四季度的 16%。一位接近理想銷售體系的人士告訴我們,理想管理層認爲,在宏觀經濟環境趨緊、市場競爭加劇的情況下,理想需要聚焦資源、主攻國內市場。

出口和出海是兩件事,後者更長期、難度更大

中國汽車銷售正呈現出 「內冷外熱」 的局面。中汽協統計數據顯示,今年 1-9 月,汽車國內銷量 1725.9 萬輛,同比下降 2.4%;汽車出口 431.2 萬輛,同比增長 27.3%。

在國內汽車市場價格戰持續、競爭壓力有增無減的情況下,多家自主品牌車企加快出海步伐。例如,奇瑞在今年前三季度出口 82.9 萬輛,超過上汽排名中國車企第一;比亞迪在今年前三季度出口 30.2 萬輛,同比增長 96.3%。

2023 年,中國已經超過日本,成爲年度汽車出口量最多的國家。只不過根據 World's Top Exports 的整理,中國在以美元計價的汽車出口價值榜上暫排第三(777 億美元),落後於德國(1772 億美元)和日本(1109 億美元)。而且,在汽車出口總體趨勢向好的同時,中國車企也在面臨更高的政策壁壘。

10 月 4 日,歐洲委員會宣佈,已經通過了對於從中國進口的電動汽車加徵反補貼關稅的投票表決,將於 10 月 30 日前公佈反補貼調查的最終結果和具體實施措施。更早前的 5 月 14 日,美國政府宣佈,將對從中國進口的電動汽車加徵 100% 的關稅。美國汽車關稅稅率原本爲 2.5%,此次加徵關稅落地後,中國車企面臨的美國關稅稅率合計高達 102.5%。

一位服務多家中國自主品牌車企的人士告訴我們,汽車是歐洲的支柱型產業,除了關稅之外,國內車企還在觀察歐美后續是否還有其他限制性政策。

10 月 5 日,小鵬汽車聯席總裁顧宏地在德國柏林舉辦的一場會議上稱,小鵬正在積極評估在歐洲建立本地工廠的可行性。比亞迪則預備選用更多歐洲供應商、並在其匈牙利和土耳其的工廠組裝電池組。奇瑞、極氪等品牌也有類似計劃。

目前,理想官網的海外招聘主要是海外服務中心店長、海外小組高級維修專家,工作地點均在哈薩克斯坦第一大城市阿拉木圖。

編輯/Jeffy

但据我们了解,理想汽车的出海步伐较一年前的规划明显放缓。

但据我们了解,理想汽车的出海步伐较一年前的规划明显放缓。